Why Choose Sage Intacct ERP for SaaS Industry?

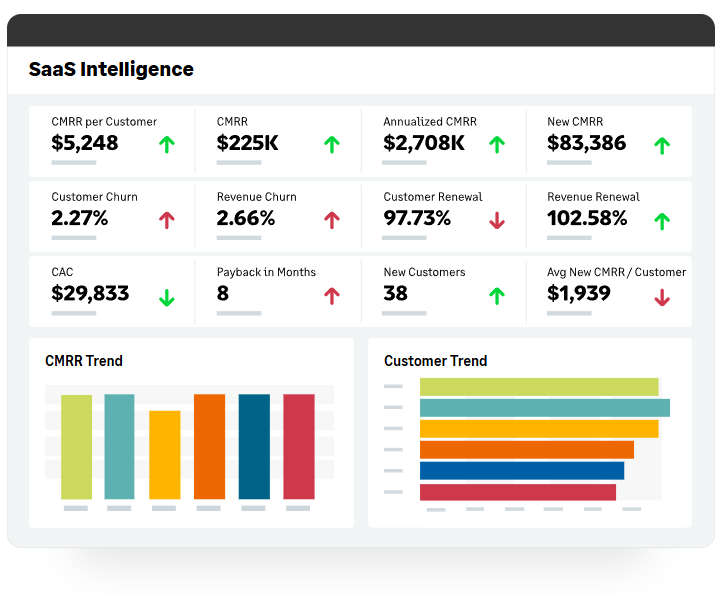

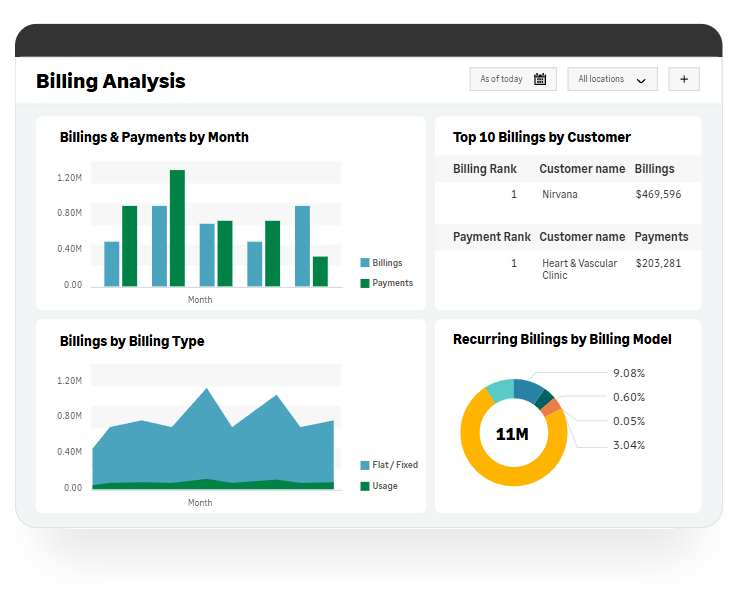

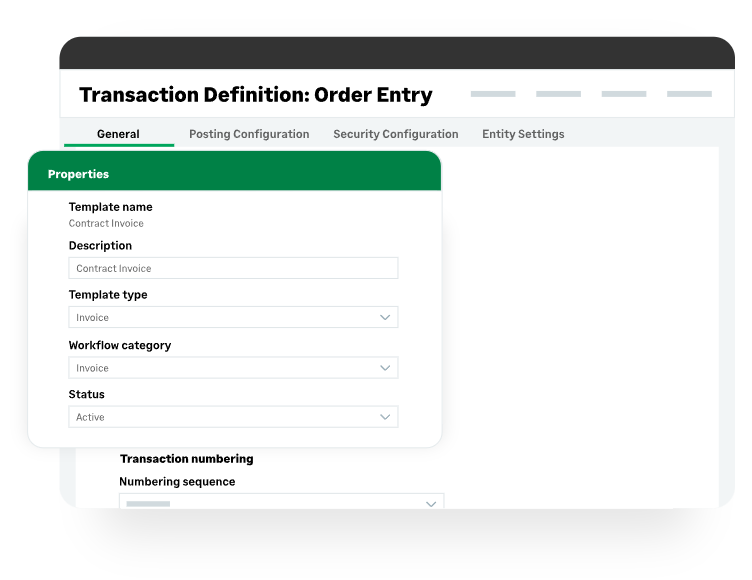

Sage Intacct SaaS Enterprise Resource Planning software is the number #1 usage billing and revenue management solution for SaaS and subscription-based companies.

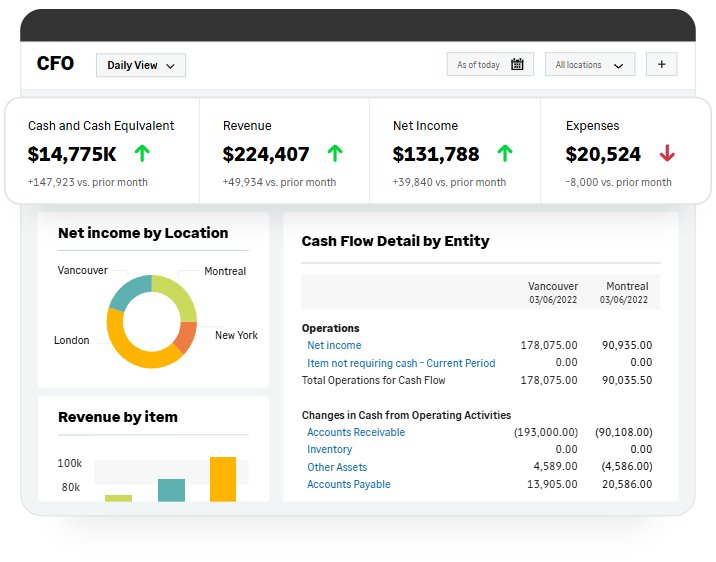

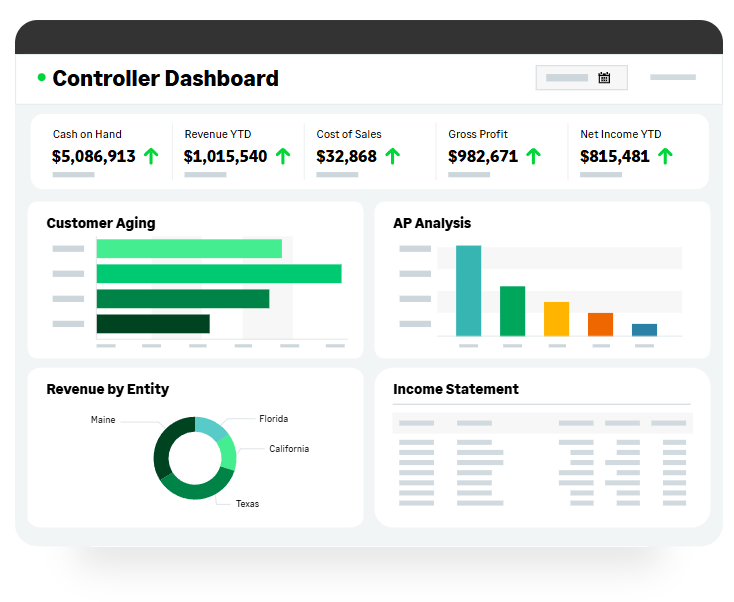

With Sage Intacct SaaS ERP, your business is well-positioned to outsmart competitors through AI-powered accounting processes and analytics, bringing enhanced financial accuracy and visibility.