What is Salvage Value?

Salvage Value (also called Residual Value or Scrap Value) is the estimated worth or the estimated resale value of an asset at the end of its useful life, and an important parameter used while calculating the annual depreciation of an asset.

When a business purchases a new tangible fixed asset such as furniture, machinery, vehicle, or building, it expects it to last for a certain period (such as a few years from the date of purchase). Over a while, the value of that asset keeps decreasing due to different factors such as wear & tear, consumption, physical damage, emergence of new technology, or loss of value. Thus, businesses around the world use ERP Software to ascertain the true worth of the asset at the end of its useful life after excluding depreciation.

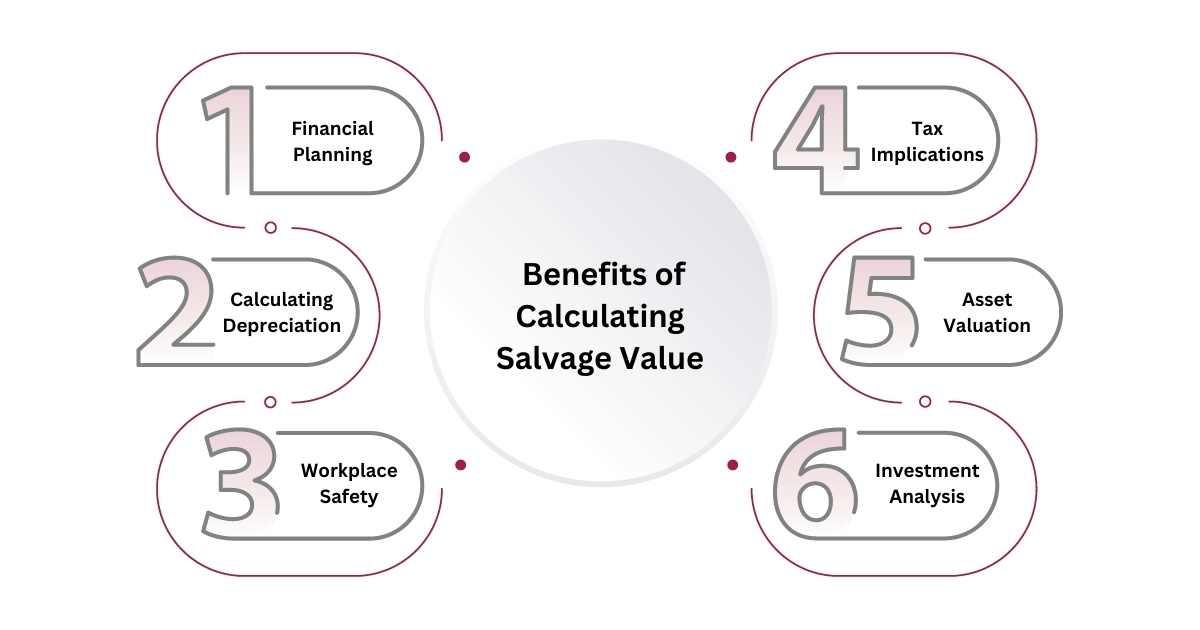

Benefits of Calculating the Salvage Value

Now that we’ve discussed Salvage Value meaning, let us discuss why determining the value of assets is important for businesses.

1. Financial Planning

Financial planning is a critical aspect of financial management to meet your short & long-term targets. Calculating it will help you understand how much time you have before making a significant investment in upgrading your assets.

2. Calculating Depreciation

Depreciation is a mandatory deduction in the value of the asset, according to Indian tax laws. It is mandatory for businesses to calculate depreciation on various assets such as vehicles, furniture, land, and buildings. In order to calculate depreciation, you will need to know the useful life of that asset.

3. Workplace Safety

Businesses can avoid various catastrophic events (such as fires, and heavy machinery accidents), technological failures (such as power outages, and data losses), or business disruptions (such as halt in supply chain operations) by understanding the scrap value of their machinery and taking appropriate measures.

4. Tax Implications

Knowing your asset’s scrap value is important to calculate depreciation, and reduce your company’s tax liability and tax implications. Reduction in tax liability will directly result in higher profit margins and business expansionism.

5. Asset Valuation

Asset valuation is the process of calculating the true worth of an asset according to the current market value. For accurate asset valuation and risk assessment, businesses must calculate the correct scrap value.

6. Investment Analysis

Real estate companies may want to find the salvage value to determine the return on their properties and take corrective measures to improve their profitability. Similarly, automotive companies may use ERP for automotive industry to make informed decisions.

Limitations of Calculating Salvage Value

Accurately determining an asset’s true and correct value is not easy. There are several things that can go wrong with your estimations. Now that we’ve discussed what is scrap value and what are its benefits, let’s discuss its limitations.

1. Incorrect Estimations

The salvage value is an estimate and not an exact figure. As the future is unpredictable, there is always a likelihood of making incorrect predictions about different circumstances and market conditions. This can result in incorrect values.

2. External Factors

External factors such as new market trends, technological innovations, unexpected economic slowdowns, and unexpected economic boom can impact an asset’s value.

3. Regulatory Changes

Changes in the regulatory policies can have a rippling effect on businesses. For example, the Government may introduce a new billing restricting the use of certain machinery which can negatively affect the asset’s value.

4. Financial Implications

Significant changes in the company’s financial position – whether favorable or adverse – can impact the returns expected from the sale of the asset. For example, if a company is at risk of bankruptcy may be forced to sell its assets at a reasonably lower rate.

The Formula for Calculating Salvage Value

The formula to calculate Salvage Value is as under:

Salvage Value = Purchase Price – (Annual Depreciation * Useful Life Assumption in Years)

In order for us to find out the accurate value of an asset, we will need to know certain information about that asset:

- Purchase Price: This is the purchase price or acquisition cost of your asset, including the cost of transportation, installation, and employee training.

- Annual Depreciation: This is the amount depreciated from the value of the asset each year. It is calculated using the Straight-line Depreciation method.

- Useful Life Assumption (Years): Make a gross assumption about the lifespan of your asset. For example, a desktop computer’s lifespan can be 5-10 years while that of a laptop can be 3-5 years.

Which Factors Affect an Asset’s Salvage Value?

Several internal and external factors can affect an asset’s value. Let’s discuss the most important ones:

1. Age of the Asset

Salvage value and the age of the asset are typically proportional in nature. As an asset becomes older, it loses its value. However, there are always exceptions, and the drop in the value need not be strictly proportional to the asset’s age.

2. Asset Condition

Another important factor that affects an asset’s salvage value is the physical condition of that asset. Well-maintained assets that are in proper physical condition tend to have a higher salvage. In contrast, assets that have undergone damage and wear & tear can have lower value.

3. Technological Obsolescence

In today’s era, new technologies emerge every few months or years. As the existing assets are superseded by more advanced & superior ones, they undergo a significant decrease in the value.

4. Changing Market Circumstances

An asset with higher demand in the market may have a higher value than an asset with lower demand. As the demand for an asset lowers, the company expects to receive a lower value from the sale of that asset.

5. Asset Maintainability

Is your asset repairable? Is there easy availability of replacement parts should the asset need to be repaired? If so, you may expect a higher value compared to an unmaintainable asset. Think of a computer built in the 1990s. Maintaining and repairing such an obsolete system can be difficult, expensive, and time-consuming. Thus, it will have a lower value.

6. Regulatory Compliance

Governments across the world declare new environmental norms with climate changes and changing circumstances. An asset that does not pass the Government’s environmental norms will have a lower value compared to an asset complying with the government’s norms.

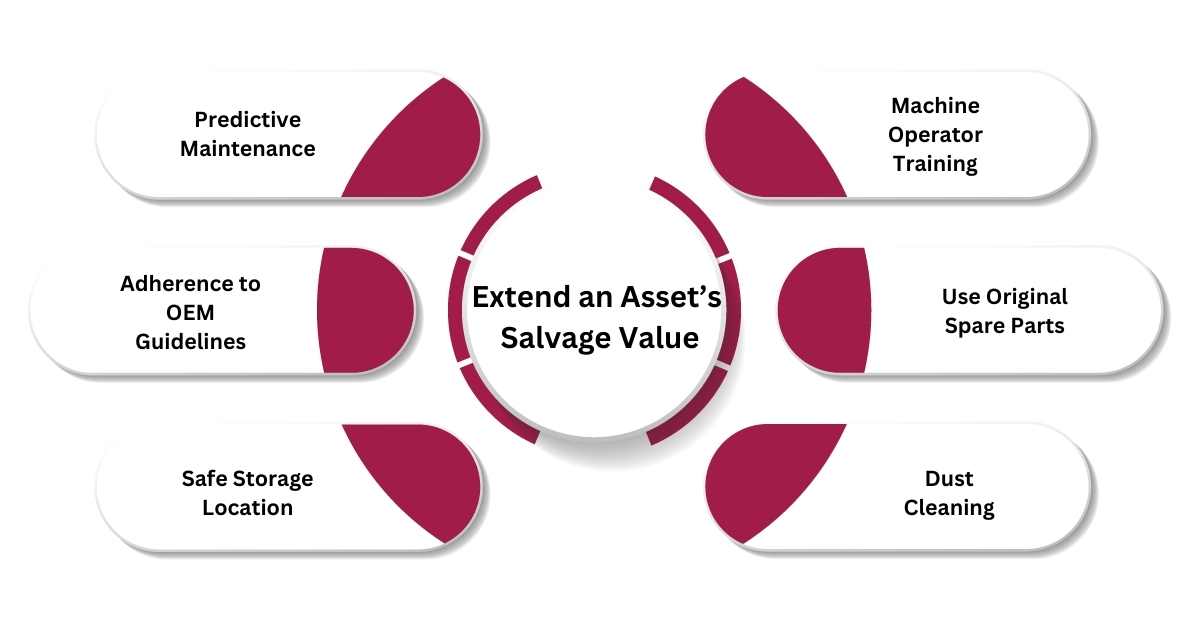

6 Ways to Extend an Asset’s Salvage Value

The easiest way to improve your asset’s value is to invest in improving your asset’s quality, longevity, and lifespan. There are several ways to do so:

1. Predictive Maintenance

Maintenance Software plays an important role in improving the overall performance and longevity of your asset. Timely maintenance repair and overhaul will ensure that your asset is in good condition, and it will unlikely suffer from breakdowns and significant reductions in its value.

2. Machine Operator Training

Training machine operators is an important, yet often neglected, activity. A well-trained employee will have the necessary skills and knowledge to safely handle the complex machinery. When handled correctly, it is less likely to suffer from breakdown, damage, or loss of efficiency.

3. Adherence to OEM Guidelines

These days, every asset from a simple mobile phone to heavy machinery, comes with OEM instructions for optimal equipment functioning and warranty compliance. By strictly adhering to these guidelines, you ensure that your asset continues to work at its peak performance, and will have a higher value.

4. Use Original Spare Parts

Some companies use cheap, duplicate, or generic spare parts during the asset’s repair or maintenance. While such spare parts can add short-term value, they can eventually degrade the asset’s quality, longevity, and lifespan in the long run. Only use original spare parts from authorized distributors to extend your asset’s value.

5. Safe Storage Location

Several assets from electronic products, machinery, sensitive medical equipment, and vehicles to paper documents are sensitive to environmental conditions such as temperature, moisture, and dust. As such, they need to be stored in a proper location to avoid extreme heat or cold and prevent dust accumulation.

6. Dust Cleaning

As dust clogs the different parts of your asset (such as machinery), it results in reduced airflow. Cleaning the existing dust and preventing further accumulation is important to ensure your asset doesn’t heat up, break down, and lose its value due to reduced airflow.

Real-world Examples of Salvage Value

Let’s take a simple example of a construction company. ABC Ltd is a construction company based in India. It gives an order to purchase an excavator worth Rs. 40 Lakh. It estimates that the value of the excavator will be Rs. 15 Lakh in the next 7 years. In other words, the value of the excavator will depreciate by Rs. 25 Lakh over a period of 7 years. Thus, Rs. 15 Lakh will be the salvage value of the asset at the end of the estimated period.

How Does ERP Simplify Calculating the Asset Value?

Enterprise Resource Planning (ERP) is a business planning and management software that streamlines various activities and consolidates data from different departments. Here’s how ERP implementation helps you ascertain the true worth of your assets:

1. Data Consolidation

ERP Application consolidates data from different business functions and builds a centralized database to aid timely decision-making and reduce inefficiency.

2. Asset Management

The Asset Management module of your ERP builds a complete database of all the organizational assets and provides powerful tracking features throughout the lifecycle of your assets.

3. Regulatory Compliance

Manually dealing with ever-changing financial regulations can be a time-consuming and complex procedure. Worry not, Financial Management Software provides complete transparency throughout the recording and management of the assets and ensures stricter compliance.

4. Business Aspect Integration

ERP integrates itself with different aspects of your business. While the AP Automation module reduces human interventions in payment automation, the Maintenance module facilitates predictive maintenance.

5. Supplier Relationship Management

The Supplier Relationship Management module enables evaluating supplier performance, managing service-level agreements, and cultivating better relationships with them.

Final Takeaways

A medium or large-sized business can have hundreds of thousands of assets. As such, manually calculating the salvage value of each asset can be an error-prone and time-consuming procedure. This is where an ERP comes into the picture.

Sage X3 is an exceptional ERP tool that helps businesses around the world improve asset longevity, and streamline their asset management & financial activities. Thanks to its multi-country, multi-currency, and multi-regulatory functionality, it excels in handling transactions involving multiple currencies.

FAQs

1. How Does Salvage Value Affect Financial Planning?

Except few methods such as Double Declining Balance, calculating the depreciation of your assets isn’t possible without understanding the true resale worth of your asset. As we’ve seen in the Scrap Value meaning, it affects your depreciation amount which in turn impacts your financial statements and the financial planning.

2. How Does Salvage Value Affect the Company’s Investment Decisions?

In order to make data-driven investment decisions on asset acquisition, degradation, or disposal, businesses need to know the true worth of their asset. Best ERP Software in India aids in calculating salvage amounts, accurate decision-making, and reducing unnecessary costs.

3. Which Depreciation Methods Take the Salvage Value into Consideration?

Several depreciation methods such as Straight-line Depreciation, Sum-of-the-Years-Digits (SYD) Depreciation, Units of Production Depreciation, and Declining Balance Method, take the salvage into consideration. This is because all these depreciation methods require estimating the useful life of your asset and the amount it can be sold in the market. In contrast, Double Declining Balance (DDB), Modified Accelerated Cost Recovery System (MACRS), and 150% Declining Balance Method, do not take it into consideration.

4. Is it Necessary to Adjust the Salvage Value to its Present Value?

No, it is not required to adjust the Salvage Value to its Present Value. Doing so would increase the labor cost associated with the fixed assets, and a further reduction in it over a period of a long time.

5. Are Depreciation & Useful Life of an Asset the Same Thing?

Depreciation and the useful life of an asset are both different, yet interlinked, concepts. Depreciation is an accounting process of estimating the reduction in the value of an asset due to various reasons such as wear & tear. The useful life of an asset, on the other hand, is the time period within which an asset is estimated to depreciate.

6. Is Salvage Value 100% Accurate?

No, the Salvage Value may not be 100% accurate given the various risks associated with it. However, these risks can be managed to a certain extent through periodic re-evaluation and by accommodating changing market circumstances.

Here are the risks associated with it:

- Incorrect predictions about market conditions and demand for the asset

- Accidental damage to the physical asset

- New Government regulations (such as bans) affecting the use and resale of the asset

- Under-estimating the total lifespan of the asset

- Changes at the macro economical level (such as a rise or drop in inflation)

- The emergence of new technologies that replace the older ones

7. What is the Difference Between Scrap Value and Salvage Value?

Both scrap and salvage amounts are almost the same concepts and are often used interchangeably, however, they differ slightly. Here’s the difference between Scrap Value and Salvage Value:

- What is Scrap Value?: Scrap value meaning is that it is the value of an asset that will be no longer used and ultimately dismantled or scrapped after the end of its useful life.

- What is Salvage Value?: Salvage value meaning is that it is the value of an asset that will be resold in the market after the end of its useful life.