What is Proforma Invoice?

Proforma invoice is a preliminary invoice issued by the supplier to the buyer, before the goods or services are supplied, mentioning the cost estimate of goods and services, quantity, shipping cost, delivery date, and more, leaving reasonable room for negotiation among the parties.

In other words, the purpose of a proforma invoice is to issue an introductory invoice to customers after they have confirmed the purchase, and it reflects the payment details based on initial discussions of the terms of sale. Once the customer receives the proforma invoice, they can negotiate for a better deal.

How do Proforma Invoices Work?

Serving as a quote and an offer, a pro forma invoice is issued before the actual sales invoice is issued. It is important to note that the proforma invoice, being a ‘document of good faith’, does not mandate payment from the buyer. The payment becomes mandatory once the sales invoice is issued upon delivery of the goods.

However, if the buyer does not pay the dues within the required period after the sales invoice is issued, the suppliers can avail themselves of an invoice discounting facility to meet immediate cash flow requirements. According to the data gathered by India Today, invoice discounting via the Trade Receivables Discounting System (TReDS) electronic platform helped 65,000 MSME suppliers in 2023 get access to cash tied in unpaid invoices and late payments from buyers.

Now let’s take a look at how the proforma invoice works.

1. Initial Discussion

The buyer makes an initial enquiry about products. The buyer and the supplier begin the discussion about the sale of goods, their prices, quantities, delivery and payment terms.

2. Requesting Pro Forma Invoice

Once the preliminary agreement is reached between the two parties, the buyer requests a pro forma invoice from the supplier. It confirms that the supplier is willing to supply the goods as per the terms of sales discussed.

3. Creating Pro Forma Invoice

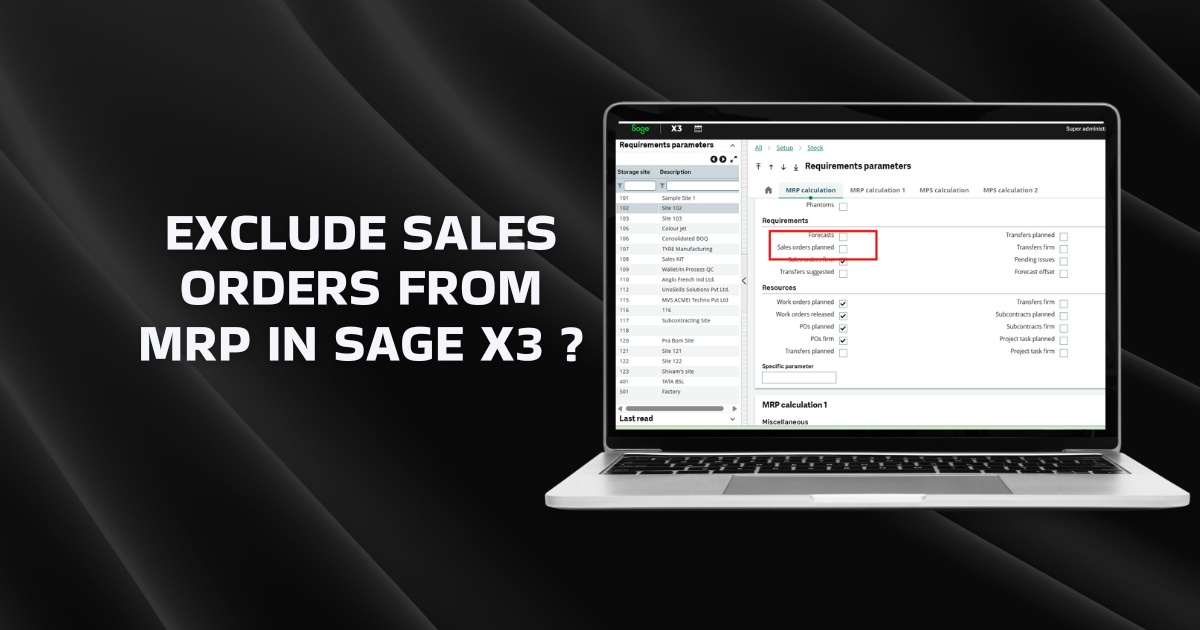

The supplier creates a proforma invoice using ERP software, which helps in generating complete details about the goods and services, and also utilizes accounts receivable automation to send a proforma invoice to the buyer.

4. Negotiation

The buyer reviews the details mentioned in the proforma invoice and uses the opportunity to further the negotiation with the supplier to finalize the purchase. After the negotiation, the old proforma invoice has to be revised and sent to the buyer.

What are the Benefits of Proforma Invoice?

1. Transparency

Pro forma invoice helps the parties come to an understanding of the terms and conditions of purchase, including the product price, discounts, quantity and shipping costs, ensuring transparency with accurate price quotes during the sales process and reducing the possibility of disputes.

2. Cash Flow Management

A pro forma invoice gives an estimation of accounts receivable to the supplier. The supplier can perform cash flow projection before the actual payment is received, aligning their financial operations with the help of financial management software to avoid a liquidity crunch.

3. Accurate Budgeting

Proforma invoice helps with financial planning as businesses get an estimate of costs to be incurred and expected revenue from the sales. They can prepare budgets for future purchases, maintaining the financial stability of the organization.

4. Customer Relationship

Pro forma allows the buyer to review the details of the purchase and make a counteroffer to the supplier for negotiation. With control over the purchase process, the buyer feels empowered during the sales process, helping build trust between the parties.

5. Supply Chain Coordination

Coordination and collaboration among different entities are most important in today’s complex business environment. For example, sharing pro forma invoices with logistics partners gives them advance notice to plan resources for upcoming shipping and delivery requirements.

6. Inventory Planning

After the sales department issues a pro forma invoice with the help of a user-friendly sales management system, the purchasing department is notified via alerts generated through the ERP system to anticipate and plan purchases, avoiding a mismatch of demand and supply.

Limitations of Proforma Invoice

1. Non-Legal Document

Though a proforma invoice initiates a sales transaction, the buyer is not liable to make any payment based on a pro forma invoice. In case the buyer changes his purchase decision, there is little a supplier can do to remedy the situation and may even incur losses.

2. Miscommunication

A pro forma invoice is a preliminary document which lists all the product-related costs, shipping costs and tax details. However, all these details can change until a commercial invoice is issued. This change can confuse buyers regarding the products and payment outgo.

3. Unfit For Accounting

As a proforma invoice is not a sales invoice, it can’t be used for accounting purposes or for tracking finances. It is a projected cash flow document and has to be treated accordingly to avoid discrepancies in the accounting system.

4. Misinterpretation

A proforma invoice does not signify a completed transaction. Businesses that choose to rely on it for budgeting and financial planning may make inaccurate cost assumptions, leading to complications in cost management.

Also Read: What is invoice management system?

Proforma Invoice Vs. Sales Invoice, Estimate Bill & Credit Note

| Proforma Invoice | Sales Invoice | Estimate Bill | Credit Note | |

| Meaning | A preliminary sales document sent to buyers before order delivery. | A document issued by a supplier to a buyer detailing the sale and requesting payment. | Approximation of cost of a project or service, given before the work is done. | A document issued to reduce the amount owed by a buyer due to overbilling, returns or errors. |

| Legally Binding | No | Yes | No | Yes |

| Purpose | To inform the buyer of the details and costs of goods or services before sale. | To request payment from the buyer for goods or services provided. | To give a buyer an estimate of potential costs. | To correct or adjust an invoice, often reducing the amount owed. |

| Content | Similar to an invoice but marked as “Proforma”; includes tentative details. | Includes details of goods, prices, total amount, payment terms | Includes a breakdown of potential costs, materials, labor, etc. | Includes details of the original invoice, reasons for credit, and the adjusted amount. |

| Accounting Treatment | Not recorded in financial accounts. | Recorded in financial accounts as receivable once issued. | Not recorded in financial accounts. | Recorded in financial accounts as a reduction in sales or a receivable. |

| Issued When | Before a sale is finalized. | After goods/services are delivered and payment is due. | Before agreeing to a project or purchase. | After discovering an error, return, or adjustment is needed. |

Proforma Invoice Vs. Purchase Order

| Proforma Invoice | Purchase Order | |

| Purpose | To provide a preliminary bill or estimate of goods/services | To formally order goods/services from a supplier |

| Issued By | Supplier or seller | Buyer or customer |

| Legal Binding | Not legally binding; serves as a quotation or offer | Legally binding; serves as a contract between buyer and seller |

| Contains | Details about goods/services, quantities, prices, terms and conditions | Details about goods/services, quantities, prices, terms and delivery details |

| Issued When | Issued before a sale is finalized | Issued after buyer decides to purchase goods/services |

| Acceptance | Requires acceptance by the buyer | Requires acceptance by the supplier |

| Use Case | Used for preliminary price agreement, customs, financing | Issued after buyer decides to purchase goods/services |

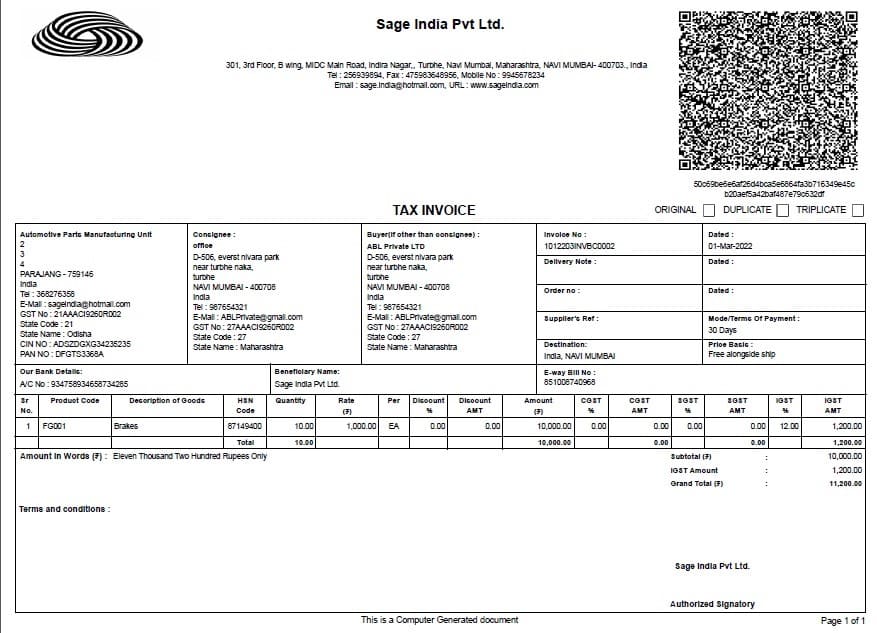

Proforma Invoice vs Tax Invoice

| Proforma Invoice | Tax Invoice | |

| Purpose | Issued as a preliminary bill of sale; not a demand for payment. | Official request for payment, indicating sales completion. |

| Legally Binding | Not a legal document for accounting purposes | Legally recognized for accounting and tax purposes. |

| Contains | Contains estimated prices and details | Contains actual sales details, prices and tax information. |

| Payment | No payment required; it’s a precursor to a formal invoice. | Payment is required as per the terms specified. |

| Tax Information | May include estimated tax information; not used for tax reporting. | Includes applicable taxes (e.g., GST/VAT); used for tax reporting. |

| Issued When | Issued before the sale is confirmed. | Issued once the sale is confirmed and goods/services are delivered. |

What is the Proforma Invoice Format?

Considering that the pro forma invoice is a presales bill, it is not rigid in format. However, including the following details in the proforma invoices enhances clarity before sales finalization.

- Supplier Name and Address

- Buyer Name and Address

- Unique Proforma Invoice Number

- Issue Date

- Validity Date

- List of Products & Quantity

- Description of Products

- Product Price

- Applicable Tax

- Total Amount To Be Paid

- Payment Details

- Proposed Terms of Sales

- Proposed Terms of Payment

- Proposed Terms of Delivery

Proforma Invoice Sample

Also Like: E-Invoicing in Sage X3

Facilitate Smooth Sales Process Using Sage X3

Proforma invoices are estimates of sales quotes issued to the prospective buyer, confirming the ability and intention of the supplier to supply the requested goods. It leaves considerable scope for negotiation as the buyer can request changes in the pro forma invoice before the deal is finalized.

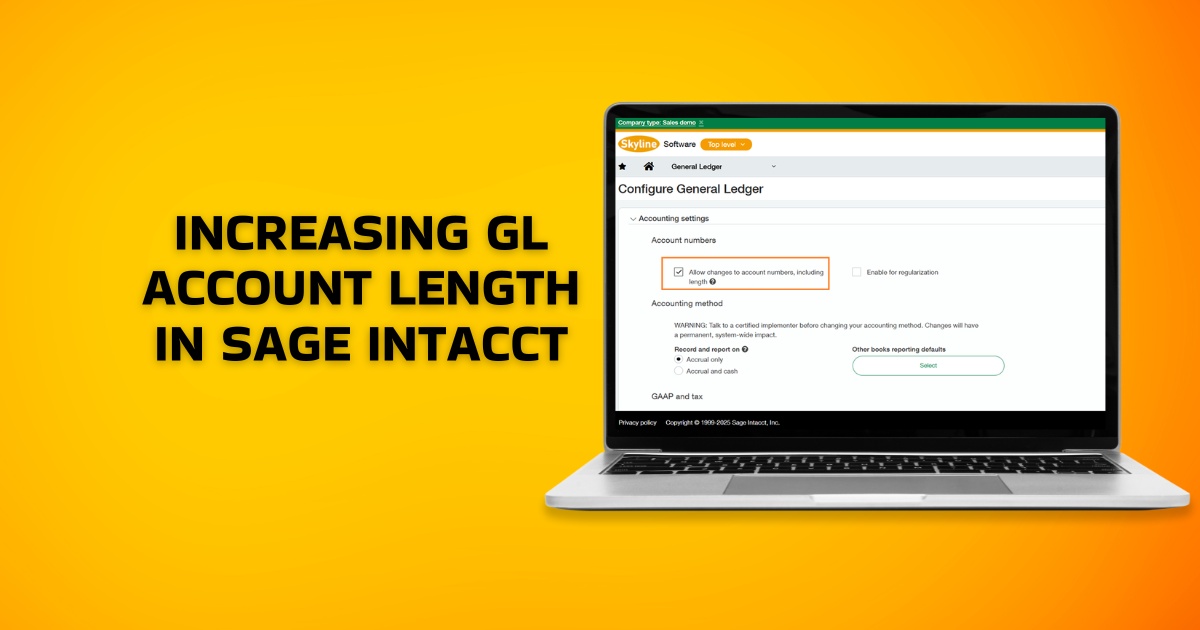

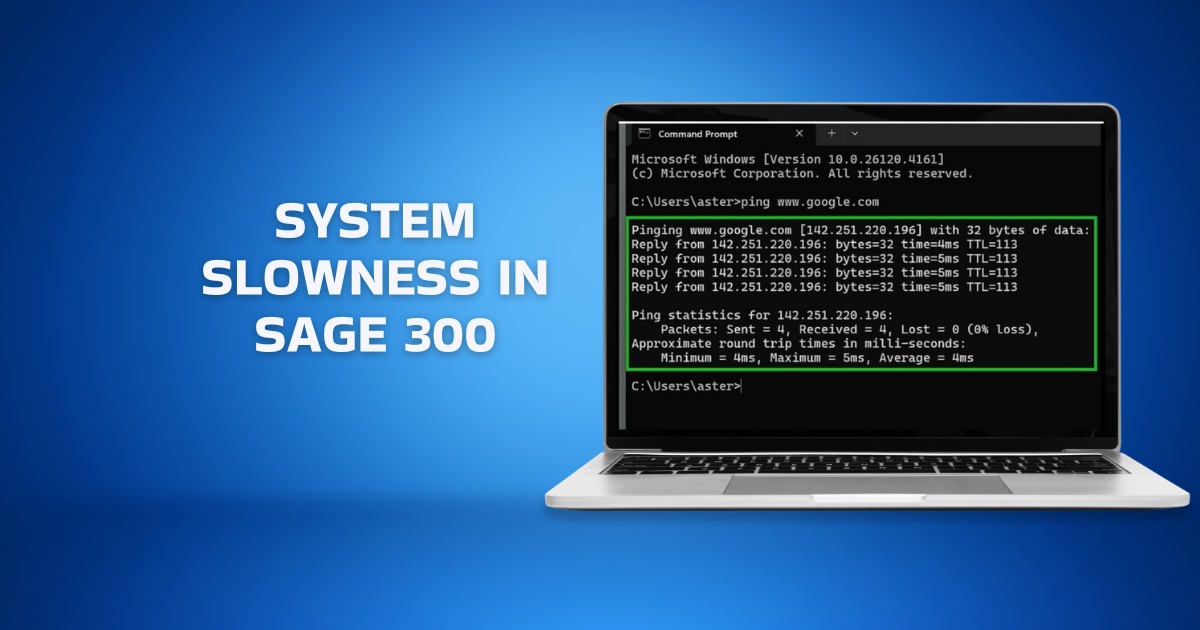

Using Sage X3 ERP, you can easily and quickly generate and send proforma invoices to multiple buyers, improving the efficiency of the sales transaction. The pro forma invoices with their unique numbers are systematically stored in the ERP application for simplified tracking before following it up with a sales invoice.

Frequently Asked Questions

1. What is the Meaning of Proforma Invoice?

Proforma invoice meaning is that it is a preliminary document issued before the sales invoice and gives clarity to the buyer about the goods and price details along with a leeway to negotiate the terms of sale.

Literally, the pro forma invoice means ‘as a matter of form’ or ‘for the sake of form’ in Latin, and it is used for cash flow projection in financial statements and not for recording sales.

2. What are the Main Features of a Proforma Invoice?

The main features of pro forma invoice are as follows:

- Supplier and client information

- Issue Date

- Expiry date

- Proforma invoice number

- Description of goods and services

- Prices and quantities

- Terms of sales

3. Is a Proforma Invoice Legally Binding?

No, a proforma invoice is not legally binding. It is a document issued in good faith after the client has confirmed the details of the purchase. In a scenario, where the client decides to back out of purchase, the supplier cannot hold them accountable.

4. Can a Proforma Invoice Be Cancelled?

As the proforma invoice is not legally binding, it does not need to be cancelled once issued. If the sales does not go ahead, you instead change the status of the document to invalid in the ERP application.

5. Can a Proforma Invoice Be Used to Request for Advance Payments?

No, the proforma invoice cannot be used to request advance payments from the buyer. The buyer always requests a sales invoice before initiating any payment.

6. Who Issues the Proforma Invoice?

The pro forma invoice is issued by the supplier to the buyer after the discussion of the terms of sales.

7. What is a Proforma Invoice Example?

Here’s an example of when a proforma invoice is issued.

A pharmaceutical manufacturer supplying Active Pharmaceutical Ingredients (API), a key ingredient for medicine production, to a drug manufacturer can issue a pro forma invoice to the drug manufacturer, specifying the complete details about the API quantity, prices and delivery date. Once the drug manufacturing buyer confirms the details mentioned in the proforma invoice, the API manufacturer prepares for the delivery of goods and issues a sales invoice to request payment.

8. When to Send a Proforma Invoice?

A proforma invoice is sent after the buyer and the seller have discussed the details of the prices and the list of goods to be purchased. It is a written record of the discussion but the details can be revised later on.

9. Can a Proforma Invoice Be Used For Accounting Purposes?

The proforma invoice is only used for projecting cash flow. It cannot be recorded as an accounts receivable entry for accounting purposes until it is followed by an actual sales invoice.

10. Is It Okay to Use a Proforma Invoice For International Imports & Trades?

Although it is not an official document, it is commonly used as a customs invoice to declare the value of goods to customs authorities, mentioning the details about the shipment, addresses of consignee and shipper, description of goods and country of origin. It’s important to accurately define proforma invoice to ensure all parties understand the preliminary costs and the associated terms of transaction.

11. Is GST Included in the Proforma Invoice?

The Goods and Services Tax (GST) details can be mentioned in the pro forma invoice but neither the seller nor the buyer is liable to pay GST based on a proforma invoice. For GST payment, a separate GST invoice has to be issued to the buyer.

12. What is the Difference Between Sales Invoice and Tax Invoice?

While both documents contain the necessary details about goods and their prices, the sales invoice may not include tax details on every item. On the other hand, a tax invoice contains a detailed breakdown of GST, VAT and other tax details.