What is an Annuity?

An Annuity Meaning is a contract between a policyholder and an insurance company where the policyholder pays a premium either as a lump sum or in a series of installments for a fixed tenure, in exchange for a guaranteed regular income stream that begins at a predetermined future date.

Often referred to as a pension plan, in an annuity, the income can be disbursed in monthly, quarterly, or yearly payouts, and continues for a set tenure or probably the lifetime of the policyholder. Annuities offer financial stability and predictable income for an individual looking forward to a secure retirement.

What are Annuity Types?

Now that you’re familiar with annuity definition, let’s take a look at different types of annuities.

Depending on the financial goals of the policyholder, or the annuitant, there are different annuities options to choose from. Based on how the annuitant chooses to pay the premium, there are two main annuity types:

1. Immediate Annuity

An immediate annuity is a product where the policyholder makes a lump sum investment and the payout begins immediately or within a month of investing.

- Unlike deferred annuities, there is no accumulation phase in an immediate annuity, and the payout can be fixed or variable based on the plan chosen.

- It is usually preferred by people who have retired or are close to retirement with a retirement corpus ready to be invested, to meet their immediate financial requirements.

2. Deferred Annuity

A deferred annuity is a type of annuity where the policyholder pays a fixed or variable premium during the accumulation phase for a certain number of years before the benefits of payout begin at a future date.

- Unlike immediate annuities which start paying immediately, the payments in deferred annuity are received during the payout phase either in lump sum or in regular long-duration payouts.

- The earnings in deferred annuities are tax-deferred, attracting tax only after the payout begins, thus allowing account holders to benefit from a compounded rate of growth.

Based on the structure of payouts chosen by the annuitant, both immediate and deferred annuities are broadly classified into two categories as follows: fixed annuity and variable annuity.

3. Fixed Annuity

A fixed annuity is a contract where the account holder receives regular payments at a fixed interest rate, thus offering a predictable income stream.

- The premium contributed in fixed annuities is invested in secured investments, offering guaranteed principal protection and guaranteed minimum rates.

- It is usually preferred by an individual who does not want any uncertainty in returns, making it ideal for conservative retirement planning.

4. Variable Annuity

Variable annuity, as the name implies, offers variable payouts. In other words, the interest rates vary significantly based on the performance of the underlying securities the premium is invested in.

- Unlike fixed annuities which offer guaranteed minimum returns, a variable annuity has the potential for higher returns, balancing risk and reward.

- The principal invested in a variable annuity is subject to market risks, but the payouts can be customized based on your financial needs.

How Does an Annuity Work?

First, you have to purchase an annuity from an insurance company, either with a lump sum or in a series of installments for a decided tenure, usually between 5 to 15 years. If you opt for an immediate annuity, there is no accumulation phase and the investment starts paying returns almost immediately. However, if you opt for a deferred annuity, your investment grows tax-deferred with compound interest during the accumulation phase.

The payouts received by the policyholder are fixed or variable, based on the type of annuity plan chosen. Fixed annuities offer guaranteed, regular payouts whereas payouts in variable annuities fluctuate based on investment performance. After the accumulation phase is over or at the time of retirement, you can opt for lump-sum withdrawal, periodic payouts or lifetime income. The decision on the type of payout is made at the time of purchase of an annuity plan.

Some annuities include a death benefit, according to which, if the annuity account holder dies during the accumulation phase i.e. the premium payment phase, the listed beneficiaries receive the benefit to the extent listed in the policy document. There is also an option to add riders to the annuity insurance policy at an added cost, which offers features like inflation protection, long-term care, and more – just as you would add ERP modules to build upon existing capabilities of ERP software like Sage 300.

In case the annuity plan is surrendered during the accumulation phase, you are liable to pay considerable surrender charges or penalties for premature withdrawal of investment. That’s why, it is never advisable to prematurely end an investment. So whether it is handling personal finance or managing an ERP implementation, both require a financial commitment to meet your long-term goals.

What is Annuity Plan?

To get the benefits of annuities, you have to buy an annuity plan, which is typically a retirement plan offered by life insurance companies in India, where you have to invest a certain amount in a lump sum or parts, to receive payouts during your retirement.

Annuity plans are also viewed as a secure long-term investment instrument to meet your financial goals at a later stage in life. There are various types of annuities or pension plans available in the market. The one appropriate for you will depend on your future personal financial needs.

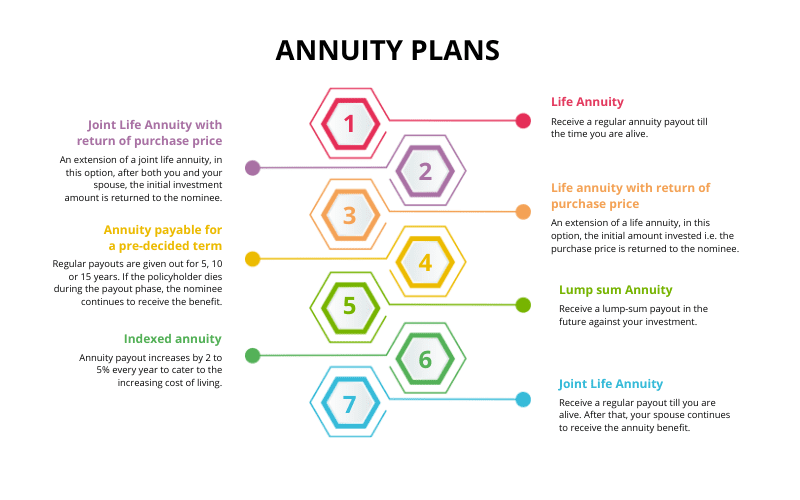

Some of the common annuity plans offered by insurance companies are listed below.

What are the Tax Implications of the Annuities?

Whether it is meeting regulatory compliance in business or filing personal taxes, a basic understanding of how you will be taxed is always beneficial.

Investment in annuities enjoys tax exemption on the principal investment as well as on the maturity amount withdrawal. Moreover, as the returns earned are tax-deferred, you are not liable to pay any tax until you start receiving regular payouts during the payout phase.

The annuity payouts are regarded as regular income and are accounted for under the category of “Salaries”. The payout income, therefore, is taxed as per your income tax slab. However, it is important to note that annuities may attract an additional 10% tax if the withdrawals are made before the age of 59 1/2 years.

While a certified Chartered Accountant can help you with filing your personal and corporate taxes, using accounts payable software offers you peace of mind in managing your day-to-day financial operations with real-time visibility into business performance, ensuring that you always stay compliant with relevant financial and tax regulations.

Annuity Meaning with Example

Annuities are a type of financial product that offers an investor a regular payment option over a predetermined period, usually for life. Let’s understand annuity meaning with example.

Example 1 – An investor X buys an immediate life annuity with a lump sum investment amount of Rs.10,00, 000 at the age of 60 years. Supposedly, the interest rate offered is 6.5%. The investor will receive a regular monthly payout of Rs.5416 throughout his lifetime.

Example 2 – An investor Y buys a deferred life annuity plan with return of purchase price at the age of 45 years with a lump sum investment of Rs.10,00,000. The investment grows tax-deferred till the age of 60. Thereafter, the investor receives a monthly payout of Rs.8,000 for life, while the purchase price is returned to the nominee upon the annuitant’s death.

What are the Benefits of Annuity?

The benefits of annuity vary depending on the annuity plan chosen. Let’s take a look at the most common benefits offered by annuity plans.

1. Steady Income

Annuities ensure a guaranteed and secure source of income post-retirement, providing financial stability for those without regular earnings, and with minimal risks involved.

2. Capital Protection

Fixed annuities offer a safe investment option protecting your principal investment and delivering steady returns whereas you can tap into higher returns with variable annuities, leveraging market dynamics.

3. Tax Benefits

Deferred annuities provide a tax-deferred growth of your investment, without any tax liability until payouts begin. Moreover, many annuity plans come with tax-saving benefits under various sections of the Income Tax Act 1961.

4. Simplicity

Investing in annuities is a great and simple way to ensure a long-term predictable income with tailored options. With clear terms and conditions and minimal ongoing management, it is an attractive financial product for an individual expecting stress-free returns.

What are the Drawbacks of an Annuity?

Following are the common drawbacks of annuities that might want you to explore other investment options.

1. Limited Liquidity

Considering its long-term focus, annuity is a highly illiquid product, and you might have to bear significant surrender charges if you decide to withdraw your investment before maturity.

2. Low returns

Although variable annuities offer better returns, the returns offered by fixed annuities are limited in scope as compared to many other market-linked investment schemes.

3. High Charges

Annuities often involve high administrative fees owing to financial risk management for guaranteeing lifetime income, and sales commissions paid to agents and brokers, which can be discouraging for some investors.

Final Takeaways

In conclusion, annuities are suitable investment option for securing income for life through guaranteed payouts. The amount of payment you receive from annuities depends on whether you choose immediate or deferred annuities.

While assuring advantages like steady income, capital protection and tax savings, it also comes with limitations of liquidity constraints and potentially lower returns. Do your research to understand the pros and cons to ensure your investment decision is aligned with your long-term financial goals.

FAQs

1. What is the Meaning of Annuity?

Annuity is a retirement planning financial product that assures a long-term income for you and your family, in exchange for an investment amount.

2. What is the Definition of an Annuity?

Annuity definition: A financial contract between a life insurance company and an investor, where the investor pays premiums in exchange for a guaranteed regular income stream starting at a future date.

3. What Do You Mean By Annuity?

An annuity is a set amount of money that is paid to an investor, typically for the duration of the investor’s life.

4. What is an Annuity?

An annuity is an agreement where the policyholder pays a premium for a guaranteed future income stream from an insurance company.

5. What is Annuity Insurance?

Annuity meaning in insurance refers to regular payments an individual receives, especially as a retirement income, with an added benefit of life insurance cover to the nominee.

6. What is the Application of ERP in the Insurance Industry?

ERP software is widely used in the insurance sector to streamline operations, enhance efficiency and offer a superior customer service experience. Some key applications of ERP for insurance company are as follows:

- ERP reduces operational and administration costs through automation and better resource utilization.

- Supports underwriting accuracy, and streamlines claims settlement and policy management via automated processes.

- ERP provides full visibility into financial data for accurate planning and decision-making.

- Comprehensive data analysis capabilities in ERP identify bottlenecks, manage risks and improve efficiency.

- Personalized sales and marketing campaigns through ERP’s customer database and analytics.

- Improves workflow with centralized data, helping to stay compliant with IRDA regulations.

7. Can You Withdraw Money From Annuities?

Premature withdrawals from annuities can usually be made after a specific period as per the terms and conditions, often subject to penalties and tax implications.

8. How Much Money Do Annuities Pay?

The amount of payout from annuities is dependent on factors like age, gender, type of annuity plan chosen and existing interest rates.