What is the Total Cost of Ownership (TCO)?

Total Cost of Ownership (TCO) is a comprehensive financial assessment that considers all direct and indirect expenses related to the acquisition, implementation, operation, maintenance, and disposal of an asset. It goes beyond the initial purchase price, encompassing the full spectrum of costs incurred over the asset’s lifespan to provide a more accurate representation of its true financial impact.

The Asset Management module of ERP Software streamlines the activity of building a comprehensive database of your organizational assets with asset-specific details (such as their tags, location, and vendors), thereby allowing you to organize them through a unified interface for maximum efficiency and higher return on investments.

Total Cost of Ownership (TCO) Formula

The fundamental Total Cost formula can be expressed as:

Total Cost of Ownership = Acquisition Costs + Operating Costs + Maintenance Costs + Disposal Costs − Residual Value

1. Acquisition Costs

These are the initial, upfront expenses required to acquire an asset. They include the purchase price, shipping, installation, and any setup fees. Software licensing, initial training, and customization costs also fall under this category. Careful consideration of these is crucial, as they form the foundation of the Total Cost formula.

2. Operating Costs

Operating costs are the ongoing expenses incurred during the asset’s normal use. This includes energy consumption, fuel, supplies, and recurring licensing fees. Labor costs for operations and routine tasks are also a significant component. These costs can vary greatly depending on asset efficiency and usage intensity.

3. Maintenance Costs

Another part of the Total Cost formula is the maintenance costs. They cover the expenses associated with keeping the asset in optimal condition. This includes routine servicing, repairs, upgrades, and replacement parts. Preventative maintenance and emergency repairs are both factored into this category. Reliability and the asset’s expected lifespan directly impact these costs.

4. Disposal Costs

Disposal costs are the expenses incurred when decommissioning and removing the asset. This can include dismantling, recycling, or environmentally compliant disposal fees. Data destruction and secure disposal of sensitive materials are also considered. Environmental regulations and the asset’s material composition significantly influence these costs.

5. Residual Value

Residual value is the estimated worth of the asset at the end of its useful life. This represents the potential salvage value or resale price. Factors like depreciation, market conditions, and the asset’s condition influence this value. Subtracting residual value from the sum of all costs gives the total cost of ownership.

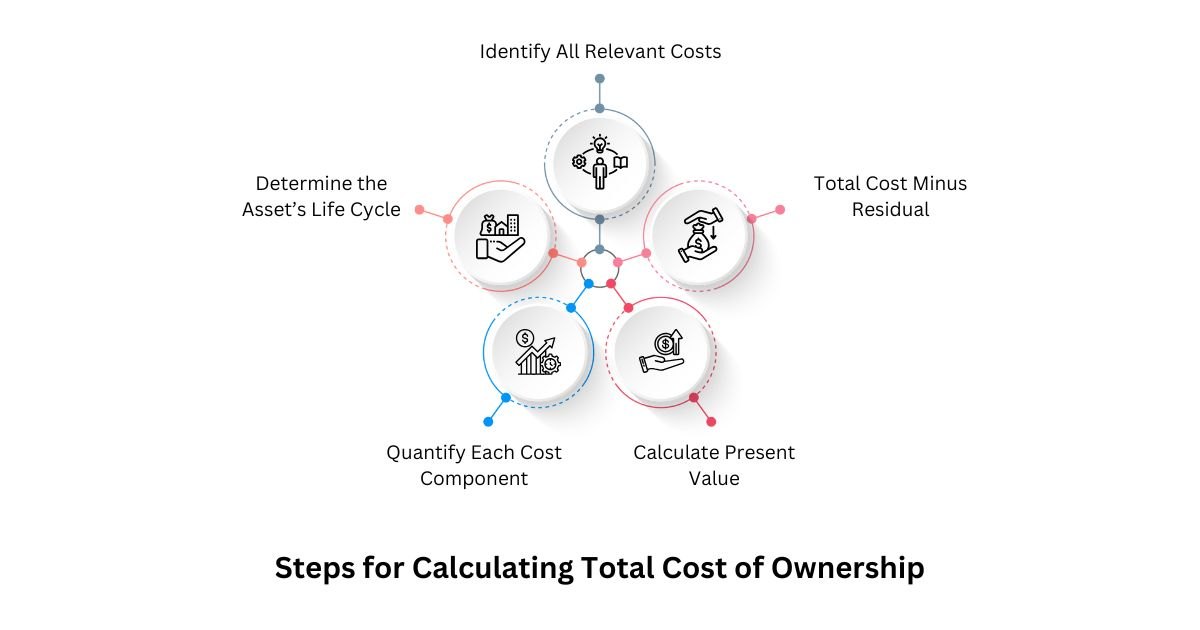

Steps for Calculating Total Cost of Ownership

1. Identify All Relevant Costs

- Begin by meticulously listing all potential costs associated with the asset.

- Consider both direct expenses (e.g., purchase price, software licenses) and indirect expenses (e.g., employee training, downtime).

- Ensure no cost, no matter how small, is overlooked, as even minor expenses can accumulate over time.

2. Determine the Asset’s Lifecycle

- Establish the estimated lifespan of the asset, from acquisition to disposal.

- This timeframe will serve as the basis for calculating all associated costs.

- Consider factors like technological obsolescence, wear and tear, and usage patterns.

3. Quantify Each Cost Component

- Assign a monetary value to each identified cost, using historical data, vendor quotes, or industry benchmarks.

- Project future costs based on realistic assumptions, taking into account potential fluctuations in prices or usage.

- For example, energy cost projections should consider the current and projected cost per unit of energy, and the anticipated usage per year.

4. Calculate Present Value

- If the analysis spans multiple years, consider discounting future costs to their present value.

- This accounts for the time value of money, recognizing that a dollar today is worth more than a dollar in the future.

- This step is very important for long-term asset calculations.

5. Total Costs Minus Residual

- Add up all the quantified costs to arrive at the total cost.

- Subtract the estimated residual value of the asset at the end of its lifecycle.

- The resulting value will be the final value of our Total Cost of Ownership.

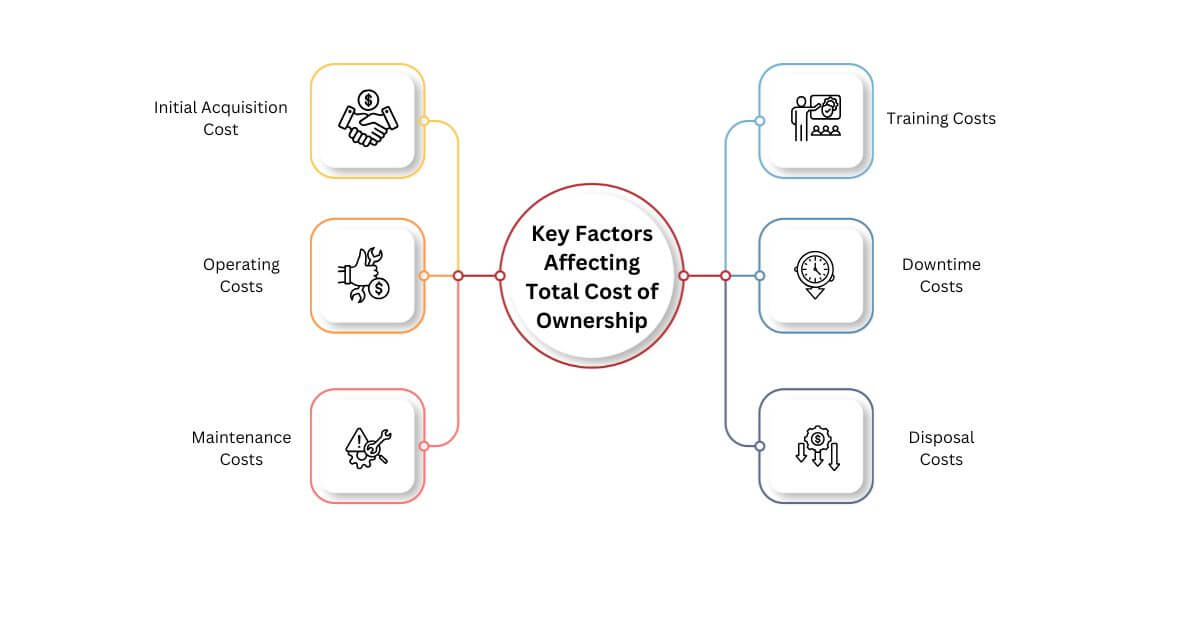

What are the Key Factors Affecting Total Cost of Ownership?

1. Initial Acquisition Cost

The initial cost of acquiring the asset, including any associated fees, is often the most noticeable expense but not necessarily the most significant over time. Discounts and promotional pricing should be taken into account, but only as part of a comprehensive analysis.

2. Operating Costs

Ongoing expenses related to running the asset, such as energy consumption, supplies, and labor. These costs can vary significantly depending on the asset’s efficiency and usage patterns. Energy-efficient assets can provide large savings in operating costs over the asset’s lifetime.

3. Maintenance Costs

Expenses associated with keeping the asset in working order, including routine servicing and repairs. The frequency and cost of maintenance can depend on the asset’s reliability and quality. Preventative maintenance using Maintenance Software should be factored in, as it can reduce larger repair costs later.

4. Training Costs

Expenses related to training employees on how to use the asset and providing ongoing technical support. These costs can be substantial, especially for complex systems or technologies. Consider the learning curve and the level of support required for effective utilization.

5. Downtime Costs

The financial impact of the asset being unavailable due to malfunctions or maintenance. Downtime can lead to lost productivity, revenue, and customer dissatisfaction. Reliability and redundancy are key to minimizing downtime costs.

6. Disposal Costs

Expenses related to decommissioning and removing the asset at the end of its lifecycle. These costs can include dismantling, recycling, and environmental compliance fees. Environmental regulations can significantly impact disposal costs.

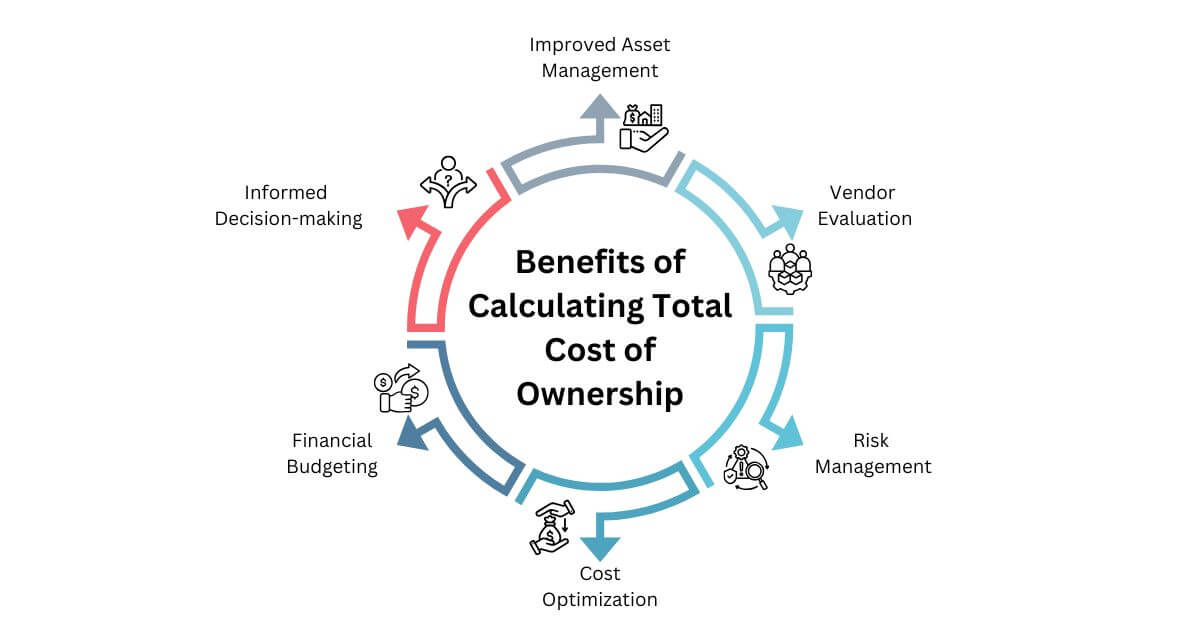

Benefits of Calculating Total Cost of Ownership

1. Improved Asset Management

TCO alongside the Asset Management module provides a clear understanding of the full cost of assets, leading to better asset management decisions. It helps organizations optimize asset utilization, maintenance schedules, and replacement strategies. This leads to increased asset lifespan and reduced overall costs. It promotes a lifecycle approach to asset management, ensuring maximum value extraction.

2. Informed Decision-making

It provides a comprehensive view of all costs, enabling businesses to make informed decisions about investments. It helps you identify the most cost-effective options over the long term, rather than focusing solely on the initial price. This leads to strategic choices that align with the organization’s financial goals. It can also help determine if leasing or purchasing an asset is more beneficial.

3. Financial Budgeting

It helps businesses accurately budget for future expenses related to the asset. Financial Management Software facilitates long-term financial planning by providing a clear picture of anticipated costs. This allows for better resource allocation and reduces the risk of unexpected expenses. By understanding the complete cost picture, businesses can improve financial forecasting accuracy.

4. Cost Optimization

Identifying all cost components helps businesses pinpoint areas for cost reduction. For example, leading manufacturing businesses use the manufacturing ERP to reveal hidden expenses and inefficiencies that may not be apparent when considering only the purchase price. This enables businesses to implement cost-saving measures and improve overall profitability.

5. Risk Management

ERP implementation and TCO analysis help businesses assess the potential risks associated with an investment. It highlights the financial impact of factors like downtime, maintenance, and technological obsolescence. This allows businesses to develop contingency plans and mitigate potential risks. With a better understanding, they can make strategic decisions pertaining to warranties & service agreements.

6. Vendor Evaluation

The adoption of the Online Procurement Management System allows for a more comprehensive evaluation of vendor offerings, including support, maintenance, and reliability. This helps businesses select vendors that provide the best long-term value. It enables more effective negotiation with vendors by highlighting the importance of long-term costs.

Limitations of TCO Calculation

1. Quantifying Indirect Costs

Some indirect costs, such as the impact of downtime or employee productivity, can be challenging to quantify accurately.

2. Reliance on Assumptions

The calculations often rely on assumptions about future costs, which may not always be accurate.

3. Time-consuming Process

It can be time-consuming and resource-intensive to calculate accurately.

4. Market Shifts

It may not account for unforeseen technological advancements or market shifts.

Best Practices in Calculation of Total Cost of Ownership

1. Involve Affected Stakeholders

Gather input from all relevant departments, including finance, IT, operations, and procurement. This ensures that all potential costs are identified and considered. Cross-functional teams provide a wider view of the asset’s impact. This helps to eliminate bias and improve the accuracy of the calculation.

2. Use Reliable Data

Rely on accurate and up-to-date data from reputable sources and deploy the Best ERP Software in India to quantify costs using historical data, vendor quotes, and industry benchmarks. Regularly review and update data to reflect changing market conditions. Ensure all data used is verifiable and auditable.

3. Include Entire Asset Lifecycle

Include all costs associated with the fixed assets, from their acquisition to disposal. Do not overlook any stage of the asset’s lifecycle, as even small costs can accumulate over time. Think of the asset as an investment, not just a purchase.

4. Employ Sensitivity Analysis

Vary key assumptions to understand their impact on the final TCO. Identify the most sensitive cost drivers for closer scrutiny. Create best-case, worst-case, and most likely scenarios for risk assessment. Helps to understand potential variability within projected costs.

5. Regular Reviewal

Market conditions and technology change, necessitating periodic reviews. Track actual costs against projections to identify discrepancies. Refine the model based on new data and experiences. Ensures it remains relevant and accurate over time.

6. Process Standardization

One of the easiest ways to achieve process standardization is through the implementation of an ERP application. Develop a consistent methodology for calculating it across all assets. Create templates and guidelines to ensure uniformity and efficiency. Document all assumptions and calculations for transparency and auditability. Promotes comparability and facilitates better decision-making across the organization.

Summing Up

Total Cost of Ownership is a powerful tool for making informed financial decisions, moving beyond the initial purchase price to reveal the true cost of an asset over its entire life cycle. By meticulously accounting for acquisition, operating, maintenance, and disposal costs, businesses can identify the most cost-effective solutions and optimize their investments. Implementing TCO analysis leads to better budgeting, risk management, and overall financial health.

Sage X3 enables scheduled maintenance based on usage or time, preventing breakdowns and extending asset life. By providing a single database, ERP systems facilitate comprehensive tracking of maintenance history, aiding in proactive care. Overall, it helps ensure the timely availability of spare parts, reducing downtime and enabling efficient repairs.

FAQs

1. What is the TCO Full Form?

The TCO full form is Total Cost of Ownership which encourages businesses to seek out vendors that offer the best value over the asset’s lifespan. It helps businesses compare different vendors based on the total cost of ownership, not just the initial price.

2. What is the TCO Meaning in Simple Words?

Let’s try to understand the TCO meaning in simple words: It is the complete expense of owning an asset, including its purchase price plus the costs of operation, maintenance, and disposal. It’s about looking beyond the initial price tag to understand the full financial impact over the asset’s lifespan.

3. Why is it Important to Include Indirect Costs in Total Cost of Ownership?

Including indirect costs in a Total Cost of Ownership analysis is crucial. Here’s why:

- Revealing Hidden Expenses: Indirect costs, such as training, support, and downtime, are often overlooked but can significantly impact the overall cost of an asset.

- Informed Decision-Making: By accounting for all costs, businesses can make more informed decisions about investments, ensuring they choose the most cost-effective option in the long term.

- Accurate Long-term Projections: Including indirect costs provides a more realistic view of the asset’s lifecycle costs, leading to better budgeting and financial planning.

4. How Often Should a TCO Analysis Be Updated?

The frequency of the analysis updates depends on several factors:

- Regular Reviews: The analyses should be reviewed periodically, at least annually, to account for changing market conditions, technological advancements, and internal business changes.

- Trigger Events: Significant changes, such as new vendor contracts, major upgrades, or shifts in usage patterns, should trigger an immediate reassessment.

- Lifecycle Considerations: For assets with long lifecycles, like infrastructure, more frequent reviews may be necessary, especially in rapidly evolving industries.

5. What are Some Common Mistakes in TCO Calculations?

Common mistakes in the calculations include:

- Overlooking indirect costs.

- Using inaccurate assumptions.

- Failing to consider the entire asset lifecycle.

6. How Does Residual Value Affect the Total Cost of Ownership?

Residual value significantly impacts the Total Cost of Ownership by reducing depreciation expenses. A higher residual value lowers the effective cost of owning an asset over its lifespan. Consequently, it decreases the overall TCO.

7. What are the Benefits of Total Cost of Ownership for Vendor Selection?

It allows for a comprehensive comparison of vendors by considering not just the initial purchase price, but also long-term costs like maintenance, support, and potential upgrades. This enables businesses to select vendors that offer the most cost-effective solution over the asset’s entire lifecycle, rather than focusing solely on upfront costs.

8. How Does TCO Relate to Risk Management?

It helps in risk management by identifying potential future costs associated with an asset, such as maintenance spikes, downtime, or security vulnerabilities. By understanding these risks, businesses can implement mitigation strategies, like investing in better support or more robust security measures, which ultimately reduce the overall TCO by preventing costly disruptions or failures.