Until recently, the E-way bills on the GST portal were used to facilitate the shipment of goods from one place to another. In the 35th GST Council Meeting, an implementation of the e-invoicing system was decided for a specific set of categories. E-invoicing is the introduction of the digital invoice for goods and services provided by the business firm generated at the government GST portal. B2B invoices are authenticated electronically by GSTN for further use on the common GST portal. The biggest advantage of this arrangement is the automation of multi-way reporting through a single-time input of details. E-invoice compliance needs to be executed for all B2B invoices, Debit Note & Credit Note.

From April 1, 2022, companies with a turnover exceeding Rs. 20 crores will have to mandatorily generate e-invoices for B2B transactions according to the Central Board of Indirect Taxes and Customs.

Present System for Invoicing

At present, businesses use multiple software to generate invoices. The details are then manually uploaded in the GSTR-1 return, after which, the information is reflected in GSTR-2A only for viewing. Additionally, the transporters also need to generate an e-way bill by importing the invoices again in excel or JSON manually. The new return system will mostly replace the GSTR-1 return. Yet, the process of generating and uploading invoice details shall not be changed. With E-invoicing software, users can achieve a seamless data flow for e-way bill generation.

Present E-invoicing Initiative

The 37th GST Council Meeting approved the GST and Indian tax law compliant e-invoicing format adhering to various global and domestic industry standards. As per the present GSTN’s e-invoicing initiative, any existing invoicing/ accounting software provider must follow the PEPPOL (Pan European Public Procurement Online) standard for invoice generation. This will allow the taxpayers to generate a compliant invoice at the source. PEPPOL is the most commonly used standard across the globe. The system enables varied trading communities and business applications to share information over their supply chains through a standard format. This facilitates a single data entry point into e-commerce for businesses, following which, the data progresses across diverse portals through an IRP.

Also Read: GST Impact on E-commerce

The current GSTN’s e-invoice will comprise of the following:

- E-invoice Schema: This will include technical field names, a summary of the individual field, and some sample values with basic interpretation.

- Masters: This will include GSTN pre-defined inputs for specific fields like UQC, State Code, invoice type, supply type, etc.

- E-invoice Template: This will include the GST compliant template for the reader to better understand the terms in other sheets.

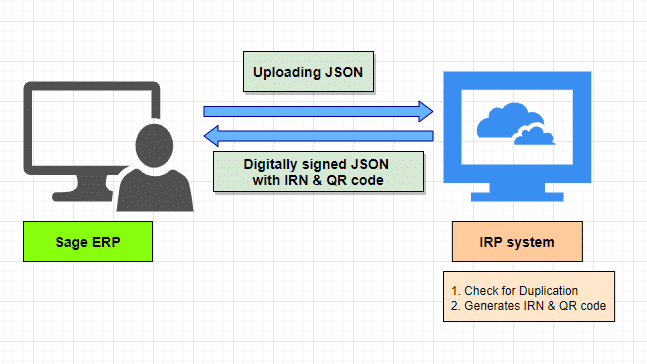

Interaction between ERP System and IRP System

The proposed Indian e-invoicing model requires businesses to generate e-invoices on their internal systems, as opposed to generating them from a central portal of the tax authority.

An invoice shall be prepared after obtaining an Invoice Reference Number (‘IRN’) from IRP.

- User will punch the Sales Invoice in Sage ERP

- Invoice data is uploaded to IRP

- Response sent by IRP comprises of

- Digitally signed JSON response (just for response validation)

- Invoice Reference Number (IRN)

- QR code

Invoice Reference Number (IRN)

IRN (hash) will be generated by encrypting below parameters:

- Supplier GSTIN

- Supplier Invoice Number

- Financial year

- Document Type

Hence, the IRN of an invoice will always be unique in the lifetime of a business.

Please note –IRN will be a 64 character long string, Government is yet to decide if IRN needs to be mandatorily printed on invoice copy or not

QR Code

QR code will consist of the following E-invoice parameters:

- GSTIN of supplier

- GSTIN of Recipient

- Invoice number as given by Supplier

- Date of invoice generation

- Invoice value (taxable value and gross tax)

- The number of line items.

- HSN Code of the main item (the line item having the highest taxable value)

- Unique Invoice Reference Number (hash)

Please note: QR code will be returned by the e-invoicing system (IRP Invoice Registration Portal) will need to be printed on invoice copy. Though, it can be printed on any location (placeholder) on the invoice.

Benefits for Businesses

- Reduced mismatch errors in data reconciliation

- E-invoices can be readable through multiple software allowing interoperability

- E-invoice enables real-time tracking

- Tax return filing process can be integrated backward and automated

- An input tax credit can be made available faster

- Mitigation of comprehensive audit/ survey processes

Takeaway

The current GST structure has been enhanced in a way that the E-invoicing can be utilized in a channelized manner for B2B business reporting. This practice has been incorporated January 1st, 2020 and shall be practiced on voluntary basis. The new GST E-invoicing system allows businesses a seamless data flow for e-way bill generation. The E-invoicing will be mandatory from 1st April 2020 for taxpayers with turnover above INR 100Cr.

Worried about filing GST Returns? Make it look easy with Sage 300cloud

To know how Sage ERP can help your B2B business deploy GST-Ready ERP for smooth filing of tax adhering to GST Council reach us here. You can write to us at sales@sagesoftware.co.in for a quick demo and consultation.