Reconciliation Definition: – In Sage 300, a bank reconciliation is the process by which the bank account balance of an entity’s books of account is reconciled to the balance reported by the financial institution in the most recent bank statement. Any difference between the two figures needs to be examined and, if appropriate, rectified.

In simple words in bank reconciliation process we mark entries present in bank statement with entries posted in SAGE 300.

Sage 300 provide the special screen to reconcile a bank account:

Navigation to bank reconciliation

- In common services Open Bank Services àReconcile Statements.

- Enter the Bank Code for bank account to reconcile.

- In the Reconciliation Description field, enter a description for the reconciliation.

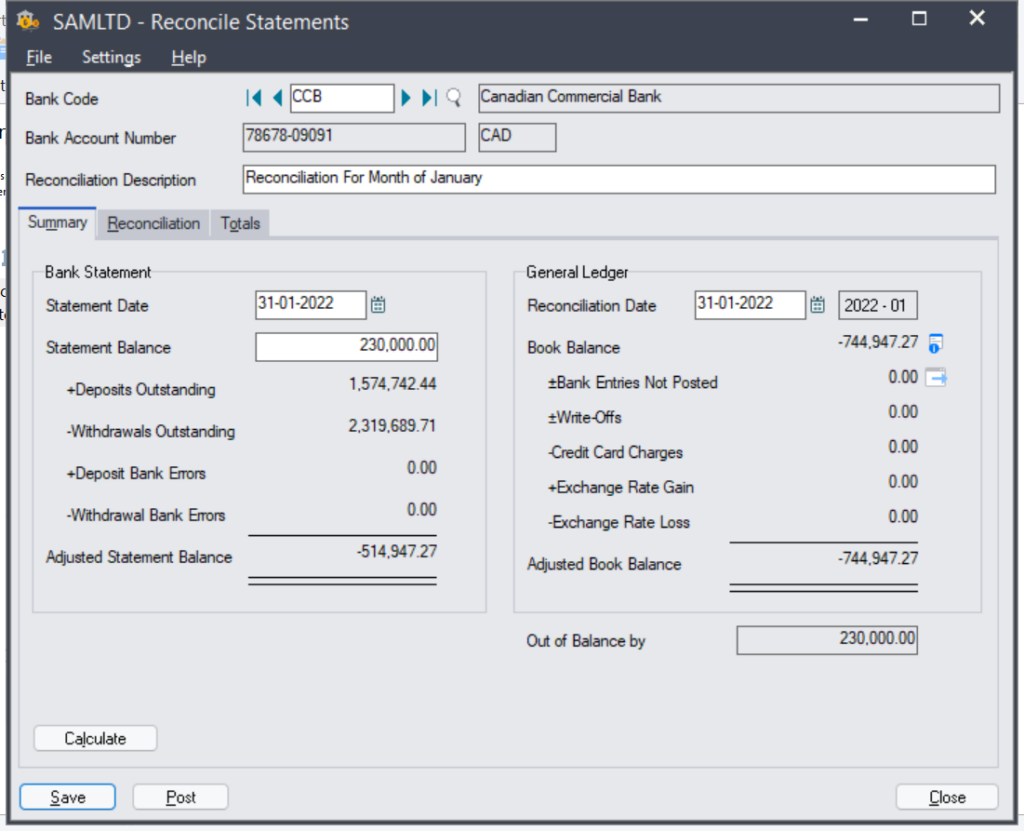

- On the Summary tab, it will show you the information of deposits and withdrawals.

- In the Statement Date field, enter the bank statement date.

- In the Statement Balance field, enter the ending balance from the bank statement of statement date.

- In the Reconciliation Date field, specify the date to which to post the reconciliation. System will show you the outstanding transaction which needs to reconcile.

- Click on Calculate button so system will automatically calculate and update the amounts.

- Out of balance field will show you the difference amount between the statement and book balance.

- Click Save.

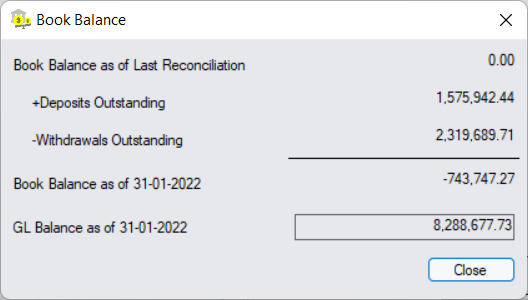

After entering the reconciliation date, user can track the book balance by drill down button where system will show the outstanding deposits and withdrawals amounts.

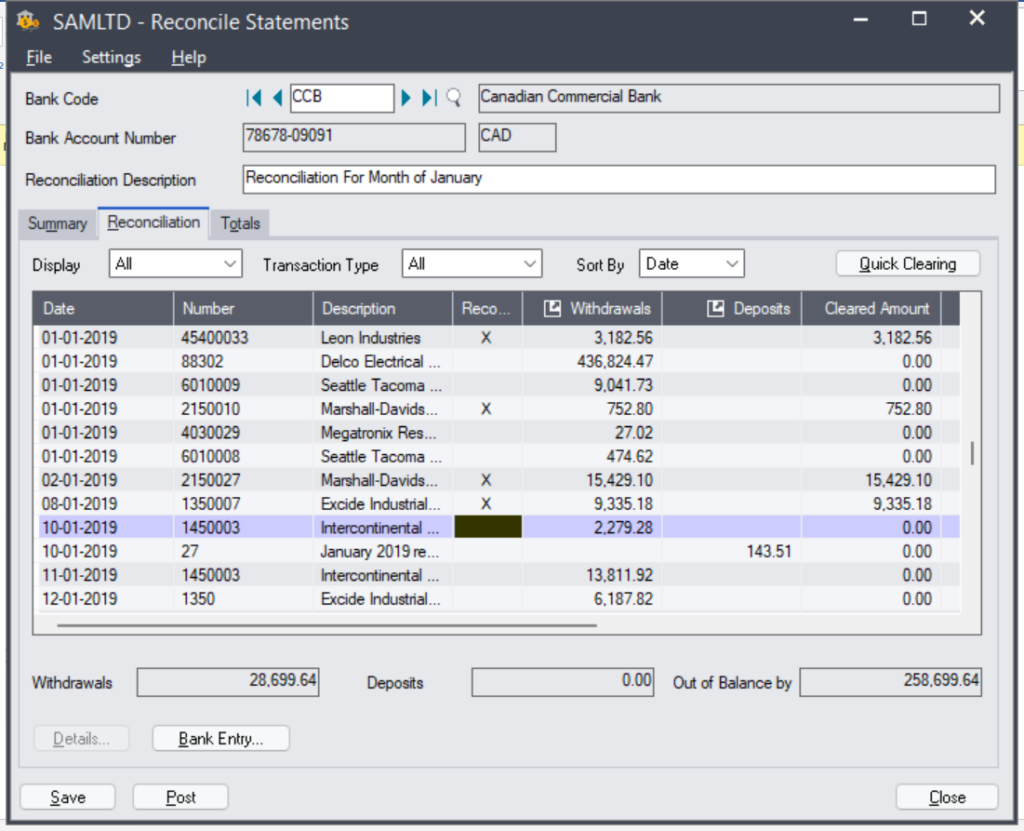

In case of any mismatch, user need to check the entries manually through the Reconciliation tab where system will show all the records as seen in the below reference screen shot.

Possible Reasons of mismatch :-

There are several reasons your account may not balance:

- The statement ending balance is incorrect.

- The bank has cleared a check or deposit with an amount different from that stated in the Banking Service, but you have not changed the cleared reconciliation amount accordingly.

- Check, deposit or return has wrong status. Item has cleared the bank but is still in Unpaid or in transit, or item has not been banked but marked cleared.

- A bank entry was made for the wrong amount.

- A check or deposit that appears on the bank statement has not yet been posted.

- A direct GL-JV passed into the bank account.

You use the Reconciliation tab to reconcile the balances and record adjustments.

Resolution :-

On the Reconciliation tab, review the each and every transaction and reconcile balances manually.

Use the Display, Transaction Type, and Sort By fields to differentiate between the outstanding deposits or withdrawals, also can sort them by date or transaction number through the filter

Reconcile balances and record adjustments:

- Clear individual deposits and withdrawals, and reverse withdrawals.

- Clear entire ranges of withdrawals or deposits that your bank has already processed.

- Record and post a bank transaction that does not exist in Sage 300. Review the receipts for a selected deposit that has multiple receipts. You can also clear individual receipts within the selected deposit, if you set the deposit’s status to Reconcile by Deposit Detail. Click Save.

When the Out of Balance by field displays zero, the adjusted bank balance and the adjusted book balance are equal. This means that the bank account is reconciled, and you can post the bank reconciliation .Click Save.

STAY UPDATED

Subscribe To Our Newsletter

At Sage Software Solutions (P) Ltd., we are home to world-class ERP software and CRM software that will solidify your business tech support fundamentals and enable you to build a customer-centric organization. You can also write to us at sales@sagesoftware.co.in.

Disclaimer: All the information, views, and opinions expressed in this blog are those of the authors and their respective web sources and in no way reflect the principles, views, or objectives of Sage Software Solutions (P) Ltd.