Businesses involve lots of receipts and invoices. Both documents are used to record sales that aid in keeping track of every transaction of the business. It will help any business to organise all the payments. Is invoice and receipt the same thing? An invoice and a receipt are almost similar but they are different. Their purpose is different.

What is an Invoice?

If your business has provided goods or services to the customer, you need to issue an invoice to the buyer requesting payment for the same. An invoice is given by the business to the customer. The invoice is also known as a bill of sale. We know that an invoice is a document requesting payment, it is also used as a record for the accounting process(like physical evidence).

→ Given below are some characteristics of the Invoice :

- It is a document to request payment from the customer.

- Invoice is issued first before the payment.

- An invoice is not issued for every type of sales transaction.

- It cannot be used as physical evidence for payment confirmation.

- Invoices are of different types and it it is distinct for each industry.

For example, proforma invoices, are a type of invoice sent to the customer before an official invoice is rendered. This invoice holds no legal value. It gives information regarding the owed cost of the goods or services. One more type of invoice is the commercial invoice, which is used as a customs document for international trade. Hence, the bills and the invoice are similar as both documents request payment from the customer.

What is an Invoice used for?

A customer is provided with an invoice after the customer agrees to the sale of goods or services provided by the business. An invoice is issued to the customer before the goods are delivered or at the same time. In the case of service, the invoice is issued before or directly given after the service is completed.

An invoice can be issued to the buyer in paper format or can be sent through the mail digitally. However, sometimes it is mandatory to issue a physical copy of the invoice to the buyer.

Relying on automation is also the best option for businesses to create invoices. Leveraging invoicing software can help in creation, issuing and approvals. So, once the invoice is rendered to the customer, the payment owed and the payment terms are clearly mentioned in that document. It remains as proof of purchase.

How do you Format an Invoice?

Officially, there is no formal template to format an invoice. However, it is vital to include pieces of information to deliver appropriate, and accurate data to the customer.

→The invoice will include the following:

- Logo and the name of the business

- Contact information of your business

- Client’s contact details

- Unique invoice number

- Date of the invoice created or issued

- List all the goods or services purchased in detail

- Quantity of goods or services provided and their allocated price

- Mention the total amount including taxes and fees

- Include payment terms and payment due date

- Currency and the payment method

- Bank account details

Also Read : What is Invoice Management System – Definition, Importance and Types

What is a Receipt?

A receipt is also a crucial piece of document which is used as proof of payment. It is also known as payment receipts or sales receipts.

→Here are some of the characteristics of receipts:

- Receipts are issued to the customer only after the payment has been made.

- Any business or customer considers receipt as proof of payment

- It is also used to verify if a purchase has been made from some other business.

- In some countries, receipts are mandatory above a certain price range.

- It can be used as proof for any legal proceedings.

The main purpose of a receipt is to verify a payment. A receipt can be used as proof when requesting a refund, or during an exchange of goods or to claim a warranty policy. Besides, this document is beneficial for accounting and legal purposes. The receipt contains important details such as the date, the amount paid and product information.

A receipt is issued as a paper document or sent to the customer electronically. The receipt will be sent to the customer through email or online messaging app. However, digital invoices are mostly used by businesses.

How to Format a Receipt?

Even for receipt, there is no official format. However, it should contain the following information :

- Name of the business and logo

- Contact information of the business

- Date of sale or service

- Products and services list provided by the business.

- Price of the goods and services sold

- Discounts, coupons or promotions are included

- Total paid amount

- Sales and service tax are included

- Additional fees are also included

- Transactions confirmation statement(approved, declined, authorized, not authorized)

Key Difference Between an Invoice and a Receipt

We have learned in detail about receipts and invoices. So, what is the difference between an invoice and a receipt? Let us discuss the key differences between the both below:

An invoice is a document provided by the seller requesting payment from the customer. A receipt is issued after the payment has been made to the business by the customer.

An invoice serves as a request for payment, while a receipt functions as evidence of the completed transaction.

An invoice informs the client regarding the total amount due for payment and by which date it has to be paid. Conversely, the receipt details the total amount paid and the date of payment.

Issuing an invoice aims to provide the customer with a summary of their order, detailing the amount owed and the deadline for payment. In contrast, a receipt serves as formal proof that the customer has fulfilled their financial obligations, indicating that they have made the payment to the seller and are thereby relieved of any further liabilities.

Invoices are sent to the customer to seek payment, however, the receipt confirms the payment and sale.

→Let us discuss some of the similarities between a receipt and an invoice:

- Invoices and receipts are commercial documents.

- They are included in the purchase cycle.

- Seller and buyer details are provided.

- Both the documents can be used for legal and accounting purposes.

Also Read : Bills vs Invoice – What is the difference ?

⇒Examples of Invoice vs Receipt

Now you know the difference between an invoice vs receipt, let us learn more about it with an example. Take for example a graphic designer who provides an invoice for goods or services. He lists down all the goods and services provided to a customer, the costs and the total amount due. Information such as work is also described, payment instructions and due date is clearly mentioned. The seller provides this document as an invoice to the customer. The invoice is a proof of purchase.

A receipt on the other hand is considered as proof of payment. The total amount paid is vividly mentioned in the receipt. Suppose, a customer purchases a laptop from the store and pays the amount. The seller in return provides the customer with a receipt which has details such as the date, purchased items, prices and the amount paid for goods or services.

Hence, invoices and receipts hold crucial value for your business. As a business owner, you must know the difference between both documents.

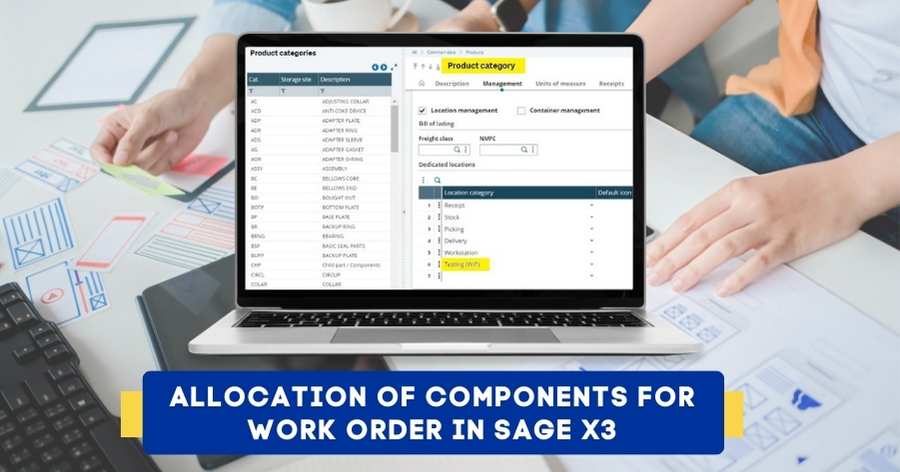

Efficiently Manage Invoice vs Receipt with ERP software

What is a receipt and an invoice? In simple terms, the proof of purchase is an invoice, and the proof of payment is a receipt. You have answers to that now. Manually managing invoices and receipts is tedious and error-prone. Automation is the answer to accurately create both documents and send them promptly to the customer.

We know the function of an invoice and a receipt. Both these documents have different purposes. Your business cannot treat them the same via your ERP as it will create more confusion in accounting and business operations. In this case, we need a robust ERP integration that has the capability to differentiate the invoice and receipt. Use smart intelligent expense software with an ERP system. This will save time, avoid errors and ensure accurate expense data.

Key Takeaways

Your business will have to deal with invoices and receipts every day. We have learned the key differences between both clearly. Your business provides invoice vs receipt to the customer for the goods and services. Their functions are distinct. Having a clear understanding of both will help during tax season.