What Are Indian Accounting Standards?

Indian accounting standards Ind AS are a series of accounting principles developed along the lines of International Financial Reporting Standards (IFRS), enabling Indian entities to do financial reporting and make accounting disclosures as per global accounting standards.

Framed by the Accounting Standards Board (ASB) and issued under the supervision of the Institute of Chartered Accountants of India (ICAI), Indian accounting standards Ind AS are called IFRS-converged as they contain certain carve outs and carve ins, keeping in view India’s economic environment.

Accounting Standards IND AS: Making Steady Progress

Over the years, India has taken incremental steps to align its accounting standards with IFRS, showcasing its commitment to enhancing transparency and compliance standards for Indian entities.

As Indian manufacturers adopt the new IND AS, they will need to ensure comprehensive financial management. To achieve that, robust and reliable manufacturing ERP software are being increasingly deployed to handle their complex accounting needs.

What Are The 6 Objectives of Indian Accounting Standards?

Indian Accounting Standards Ind AS are developed with the following objectives in mind.

1. Identical Statements

To make it simpler for companies to compare their financial statements with their global counterparts as well as their own financial statements.

2. Uniform Framework

To provide a uniform framework of accounting to all companies doing business in India and ensure consistent reporting over time.

3. Transparent Reporting

To facilitate a clear and understandable presentation of financial statements aligned with IFRS, leaving no room for ambiguity and confusion.

4. Regulatory Compliance

To ensure that companies follow the reporting guidelines set by financial regulators, such as RBI, SEBI and Ministry of Corporate Affairs.

5. International Standard

To enable smooth accounting of inter-country transactions, and enable global investors to easily understand the financial statements of Indian companies.

6. Financial Insights

To empower businesses to gain detailed insights on their financial health and appropriately allocate resources through cost optimization.

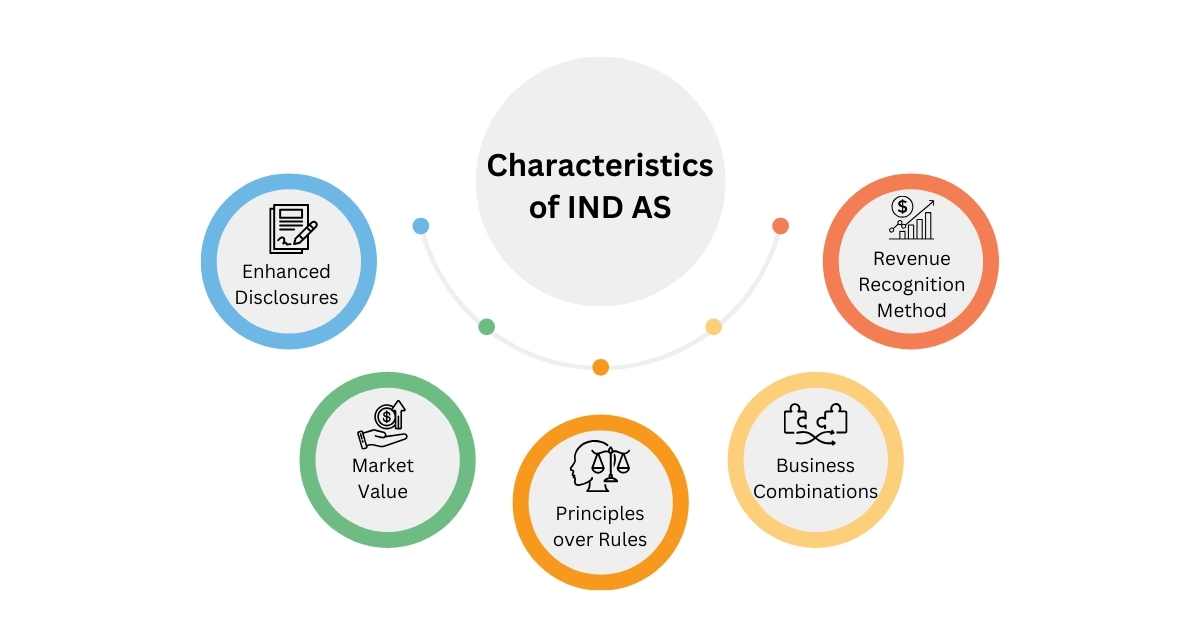

What Are The 5 Characteristics of Indian Accounting Standards?

The following notable characteristics of IND AS highlight that Ind AS are a significant departure from IGAAP.

1. Enhanced Disclosures

To meet the challenges of rising complexities in business models, associated risks and uncertainties, Ind AS requires companies to be more upfront and transparent to users of financial statements.

2. Market Value

To minimize the gap between the balance sheet value and market value of an entity, Ind AS emphasizes the concept of fair value measurement, reflecting fair market pricing of assets and liabilities.

3. Principles over Rules

The focus in Ind AS is on using reasoning and judgment specific to a business case while applying the accounting standards, instead of following the exact rules.

4. Business Combinations

During business combinations viz. mergers, acquisitions and joint ventures, Ind AS mandates the use of the acquisition method for fair value measurement of assets and liabilities of the entity being acquired.

5. Revenue Recognition Method

Under Ind AS, the underlying condition for revenue recognition is when a business is certain of the future economic benefits it will gain and can credibly measure the value of such benefits.

List of Indian Accounting Standards Ind AS

Here’s the updated list of all the Indian Accounting Standards, notified by the Ministry of Corporate Affairs, India. It is important to note that the accounting standards Ind AS are subject to revisions to keep pace with global developments in accounting as well as to synchronize with the amendments in IFRS.

| Sr No. | Indian Accounting Standard | Name |

| 1 | Ind AS 1 | Presentation of Financial Statements |

| 2 | Ind AS 2 | Inventories |

| 3 | Ind AS 7 | Statement of Cash Flows |

| 4 | Ind AS 8 | Accounting Policies, Changes in Accounting Estimates and Errors |

| 5 | Ind AS 10 | Events after the Reporting Period |

| 6 | Ind AS 12 | Income Taxes |

| 7 | Ind AS 16 | Property, Plant and Equipment |

| 8 | Ind AS 19 | Employee Benefits |

| 9 | Ind AS 20 | Accounting for Government Grants and Disclosure of Government Assistance |

| 10 | Ind AS 21 | The Effects of Changes in Foreign Exchange Rates |

| 11 | Ind AS 23 | Borrowing Costs |

| 12 | Ind AS 24 | Related Party Disclosures |

| 13 | Ind AS 27 | Separate Financial Statements |

| 14 | Ind AS 28 | Investments in Associates and Joint Ventures |

| 15 | Ind AS 29 | Financial Reporting in Hyperinflationary Economies |

| 16 | Ind AS 32 | Financial Instruments: Presentation |

| 17 | Ind AS 33 | Earnings per Share |

| 18 | Ind AS 34 | Interim Financial Reporting |

| 19 | Ind AS 36 | Impairment of Assets |

| 20 | Ind AS 37 | Provisions, Contingent Liabilities and Contingent Assets |

| 21 | Ind AS 38 | Intangible Assets |

| 22 | Ind AS 40 | Investment Property |

| 23 | Ind AS 41 | Agriculture |

| 24 | Ind AS 101 | First-time Adoption of Indian Accounting Standards |

| 25 | Ind AS 102 | Share-based Payment |

| 26 | Ind AS 103 | Business Combinations |

| 27 | Ind AS 105 | Non-current Assets Held for Sale and Discontinued Operations |

| 28 | Ind AS 106 | Exploration for and Evaluation of Mineral Resources |

| 29 | Ind AS 107 | Financial Instruments: Disclosures |

| 30 | Ind AS 108 | Operating Segments |

| 31 | Ind AS 109 | Financial Instruments |

| 32 | Ind AS 110 | Consolidated Financial Statements |

| 33 | Ind AS 111 | Joint Arrangements |

| 34 | Ind AS 112 | Disclosure of Interests in Other Entities |

| 35 | Ind AS 113 | Fair Value Measurement |

| 36 | Ind AS 114 | Regulatory Deferral Accounts |

| 37 | Ind AS 115 | Revenue from Contracts with Customers |

| 38 | Ind AS 116 | Leases |

| 39 | Ind AS 117 | Insurance Contracts |

Ind AS 1 Presentation of Financial Statements

Specifies guidelines and structure for producing consistent and comparable financial statements. The aim is to demonstrate a true and fair view of the entity’s financial records, including additional disclosure for extra transparency.

Ind AS 2 Inventories

Defines the accounting treatment for determining inventory cost and its subsequent recognition as an expense after the sale. Generally, the inventory is calculated at the lower of cost and net realizable value using the FIFO method in inventory.

Ind AS 7 Statement of Cash Flows

Provides principles for presenting cash flows from the operating, investing and financial activities of the entity. It requires declaration of changes in cash and cash equivalents in order to evaluate the entity’s ability to generate and utilize those cash flows.

Ind AS 8 Accounting Policies, Changes in Accounting Estimates and Errors

Ind AS 8 outlines the principles for selecting and changing accounting policies, disclosure of changes in accounting policies, accounting estimates and correction of errors. If Ind AS does not address a specific issue, the entity is required to use its judgment based on a hierarchy of accounting literature.

Ind AS 10 Events after the Reporting Period

Sets out conditions for adjusting entries in the financial statements for events. Events that existed at the end of the reporting period need to be adjusted. Events that arise after the reporting period don’t need to be adjusted but may need to be disclosed.

Ind AS 12 Income Taxes

Details about how to account for income taxes, i.e. how to determine tax on current and deferred assets and liabilities. Following a balance sheet approach, it requires tax calculation based on the difference between the carrying amounts of assets and liabilities and their tax base.

Ind AS 16 Property, Plant and Equipment (PPE)

States how to recognize and determine the carrying amount of PPE. Assets are either carried at their cost in the cost model or at their fair market value in the revaluation model, minus the depreciation of assets and impairment losses, applicable in both models.

Ind AS 19 Employee Benefits

Accounting and disclosure for short-term employee benefits such as statutory sick pay, and post-employment benefits in exchange for employee services. Measured as an expense when benefits have already been given and as a liability when the benefits are due to be paid in future.

Ind AS 20 Accounting for Government Grants and Disclosure of Government Assistance

Government grants, including non-monetary grants, must be recognized provided the entity is sure of complying with stipulated conditions and is likely to receive the grant. It highlights the accounting treatment of both asset and non-asset related grants.

Ind AS 21 The Effects of Changes in Foreign Exchange Rates

Helps account for foreign currency transactions and foreign operations of the entity. Translating statements into a presentation currency, applicable exchange rate and reporting the effects of changes in exchange rates are part of this accounting standard.

Ind AS 23 Borrowing Costs

These are costs associated with borrowing funds, such as amortization, for the acquisition and construction of a long-term asset. Recorded when expenditure for the asset and borrowing costs have been incurred, and activities required to prepare the asset for use or sale have begun.

Ind AS 24 Related Party Disclosures

An entity applies this accounting standard to disclose that its financial position and profit or loss are affected owing to its transactions and commitments with a related party. Related parties could be individuals or entities with significant influence over decision-making.

Ind AS 27 Separate Financial Statements (SFS)

Disclosures of investments in subsidiaries, associates and joint ventures through separate financial statements are either required by law or the entity chooses to do so. SFS are presented by a parent (an investor with control of a subsidiary), an investor with joint control, or a venture in a joint venture.

Ind AS 28 Investments in Associates and Joint Ventures

Applied by entities with a joint control of or significant influence over an investee. Such investments are recognized using the equity method, where investors record their investments at cost and adjust them based on their profit or loss share in the investment.

Ind AS 29 Financial Reporting in Hyperinflationary Economies

If an entity’s functional currency belongs to a hyperinflationary economy, it needs to restate the financial statements. Some indicators of hyperinflation are a preference for holding wealth in a stable foreign currency or a near 100% cumulative inflation rate over three years.

Ind AS 32 Financial Instruments: Presentation

Sets out the principles for classifying financial instruments as assets, liabilities, or equity from the issuer’s perspective, including how related interest, dividends, gains and losses are treated, and when to offset financial assets and liabilities.

Ind AS 33 Earnings per Share (EPS)

Ind AS 33 outlines the criteria for presenting earnings per share. Disclosures are required for both the consolidated and separate financial statements in case both statements exist for an entity. It prescribes two methods for calculating EPS: basic EPS and diluted EPS.

Ind AS 34 Interim Financial Reporting

Interim financial reports are a condensed or complete set of financial statements for a period shorter than the annual reporting period. Usually published for cost considerations and timeliness, interim reports have to fulfill the minimum content requirement for financial reporting.

Ind AS 36 Impairment of Assets

Prescribes the procedure for disclosure and reversal of impairment loss for non-financial assets such as property, plant and equipment. When the carrying amount of the asset is more than what can be recovered through its sale, it is declared impaired.

Ind AS 37 Provisions, Contingent Liabilities and Contingent Assets

Outlines accounting treatment for provisions, contingent liabilities and contingent assets, except for those that arise from cumbersome or costly executory contracts. This Indian accounting standard enables accurate presentation of potential assets and liabilities.

Ind AS 38 Intangible Assets

Ind AS 38 advises on accounting for intangible assets that are not specifically addressed in another accounting standard. It provides details on measuring the carrying amount of intangible assets.

Ind AS 40 Investment Property

This Indian Accounting standard focuses on an investment property – a property, including land or building, kept to earn rentals or for capital appreciation. Such properties should not be involved in the production of goods and services or generating sales.

Ind AS 41 Agriculture

Ind As 41 applies to agricultural activities, involving biological assets such as living animals and plants intended to generate future economic benefits, agricultural produce at the point of harvest, and conditional and unconditional government grants related to a biological asset.

Ind AS 101 First-time Adoption of Indian Accounting Standards

To ensure that an entity’s first financial statements in Ind AS and corresponding interim financial reports are in accordance with Indian accounting standards. They have to be transparent and comparable, and provide a suitable starting point for accounting as per Ind AS.

Ind AS 102 Share-based Payment

Discusses the accounting treatment for payments made to employees and non-employees in equity-settled transactions such as shares, instead of cash. Share-based payment transaction is measured at fair value unless it cannot be accurately assessed.

Ind AS 103 Business Combinations

Requires accounting for business combinations – a transaction when an acquirer gets control of one or more businesses. It is measured using the acquisition method by identifying the acquirer, determining the acquisition date, and recognizing identifiable liabilities and assets including goodwill accounting.

Ind AS 105 Non-current Assets Held for Sale and Discontinued Operations

Non-current assets held for sale are monetized through sales instead of continuing use. Such assets are presented separately in the balance sheet and are not amortized or depreciated. Further, it requires disclosure of discontinued operations separately in the income statement.

Ind AS 106 Exploration for and Evaluation of Mineral Resources

The key feature of Ind AS 106 for the exploration and evaluation (E&E) of mineral resources is to recognize pre-exploration expenditure i.e. expenses before the technical and commercial feasibility of the project could be demonstrated. E&E assets are also assessed for impairment.

Ind AS 107 Financial Instruments: Disclosures

Ind AS 107 of accounting standards deals with disclosures of financial instruments in the financial statements, highlighting an entity’s financial position and performance, the risk involved and the ability to manage those risks.

Ind AS 108 Operating Segments

This accounting standard requires disclosure that allows evaluation of the economic environment in which an entity operates and the financial impact of its business activities. It mandates reporting of financial information of operating segments regularly reviewed by the chief operating decision maker.

Ind AS 109 Financial Instruments

Provides guiding principles for reporting of financial assets and liabilities that allow assessment of the amounts, timing and uncertainty of an entity’s future cash flows. It also prescribes hedge accounting requirements for the entity’s risk management activities.

Ind AS 110 Consolidated Financial Statements

When an entity controls one or more entities, it is required to present consolidated financial statements. Here the assets, liabilities, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity.

Ind AS 111 Joint Arrangements

All entities party to joint arrangements (i.e. joint operations or joint ventures) need to assess their rights and obligations resulting from the arrangement. Also, they need to suitably account for the assets, liabilities and investments in the joint arrangement.

Ind AS 112 Disclosure of Interests in Other Entities

This principle of Ind AS requires entities to disclose all information that allows evaluation of the nature of their interests in other entities along with the associated financial risks. It applies to entities with interests in subsidiaries, joint arrangements, associates and unconsolidated structured entities.

Ind AS 113 Fair Value Measurement

Prescribes financial reporting principles for fair value measurement of an asset or liability. An entity measuring fair value would have to consider the asset condition, its location, and restrictions on its use or sale if market participants use those criteria for pricing the asset.

Ind AS 114 Regulatory Deferral Account

Enables entities to defer the recording of income or expenses, provided they offer goods or services that are subject to rate regulation. However, the decision to apply this Indian accounting standard has to be taken when the entity files its first Ind AS financial statement.

Ind AS 115 Revenue from Contracts with Customers

The core principle behind Ind AS 115 is that an entity should record revenue from contracts with customers in a way that accurately represents the payment the entity expects to receive in exchange for those goods or services.

Ind AS 116 Leases

Establishes principles for the accurate disclosure of leases. The lessor has to classify a lease as an operating or finance lease and report lease income, while the lessee has to recognize its right of use of the leased asset and the liabilities to make lease payments.

Ind AS 117 Insurance Contracts

The new accounting standard notified by MCA, Ind AS 117, which replaced Ind AS 104, sets out principles for disclosure of insurance contracts. Ind AS 117 is also applied to reinsurance contracts an entity issues or holds, as well as investment contracts issued with discretionary participation features.

Who Does Indian Accounting Standards Apply To?

The Ministry of Corporate Affairs devised a phase-wise implementation plan for applying Ind AS. After the first notification for adoption of Ind AS in 2015, the government offered voluntary adoption of Ind AS for preparing financial statements for FY2015-16. Thereafter, it was made mandatory for companies to apply Ind AS depending on business structure (listed or unlisted) and its net worth.

Mandatory phases of Ind AS applicability:

- FY2016-17 – Parent, subsidiary, associates and joint ventures of unlisted and listed companies with a net worth greater than or equal to Rs500 crore.

- FY2017-18 – All listed companies not covered previously as well as unlisted companies with a net worth of Rs250 crore or more, except Banking, NBFC and Insurance companies.

- FY2018-19 – NBFCs with a net worth of Rs500 crore or more

- FY2019-20 – All listed NBFCs not covered previously, along with unlisted NBFCs with net worth between Rs250 to Rs500 crore

| Phase | Criterion | Companies | NBFC |

| Phase I | Any Company / NBFC(Listed or Unlisted or in the process of listing in India or Outside India) having Net worth of | 500 Crore or More | 500 Crore or More |

| Applicability date | April 01, 2016 | April 01, 2018 | |

| Phase II | Any unlisted Company / NBFC having Net worth of | 250 Crore or More but less than 500 Crores | 250 Crore or More but less than 500 Crores |

| Other companies / NBFC not covered in Phase I (Listed or in the process of Listing) (Other than Companies listed on SME Exchange) | All covered. No net worth criterion. | All covered. No net worth criterion. | |

| Applicability date | April 01, 2017 | April 01, 2019 | |

| Common points for Companies & NBFC : ► Once a company is covered in any phase, its Holding, Subsidiary, Associates and JV are also covered in its respective Phases. ► Once Ind AS are applicable (either mandatorily or voluntarily), an entity shall be required to follow the Ind AS for all the subsequent financial statements. ► Ind AS is applicable for both Consolidated and Individual Financial Statements | |||

What Are The Challenges of Indian Accounting Standards?

1. Disclosures

Ind AS requires businesses to be more transparent about their transactions. They would have to intensify their efforts to meet regulatory compliance and be open to revealing sensitive financial information.

2. Complications

Though the aim of Ind AS is to bring uniformity, its principle-based approach demands a thorough understanding of different accounting standards for correct interpretation and reporting, which can be challenging for accountants.

3. Investment

To adapt to the Ind AS, businesses need to invest in training their accounting teams, make significant adjustments to their internal processes, and deploy modern ERP software to streamline reporting.

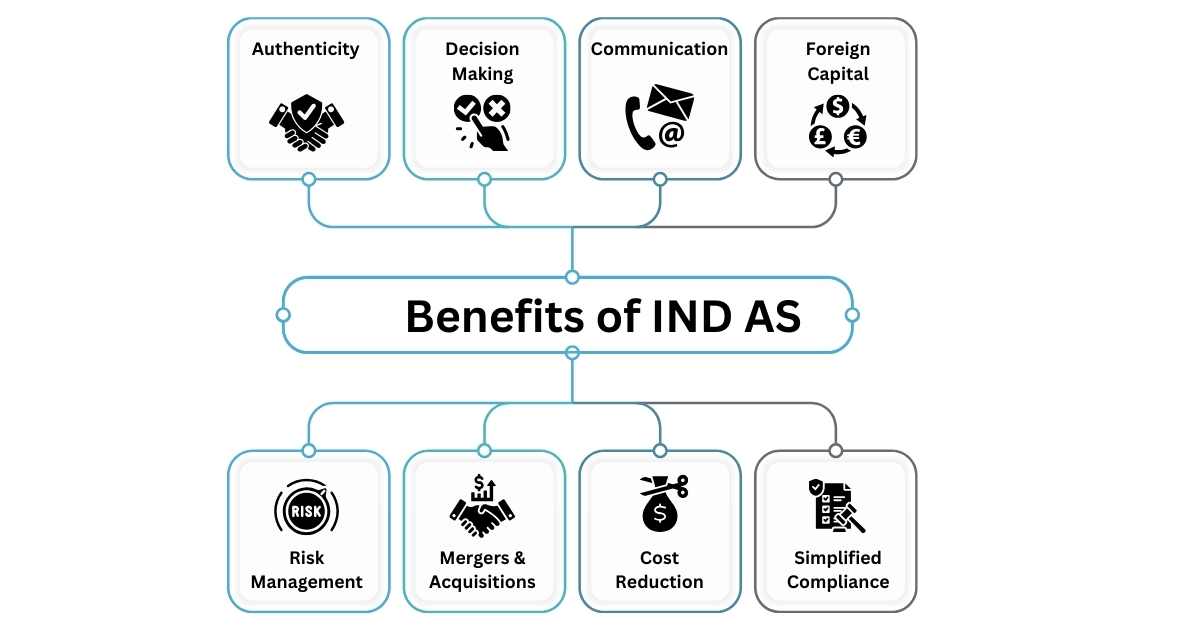

What Are The Benefits of Indian Accounting Standards?

1. Authenticity

Through the implementation of Ind AS businesses would follow a standardized accounting framework. It would make it easier for auditors to validate the financial statements, ensuring the reliability of the information.

2. Decision Making

The reliance on fair value for the valuation of assets and liabilities, and enhanced disclosures, offers better insight, which can be refined using business intelligence software, aiding better decisions.

3. Communication

Ind AS ensures that the interpretation and understanding of disclosures and statement of cash flows by investors, management and stakeholders is consistent, boosting collaboration throughout the organization.

4. Foreign Capital

As Ind AS aligns with IFRS and global accounting standards, it makes your businesses more attractive to investments from foreign investors, providing the necessary capital for innovation and expansion.

5. Risk Management

With detailed financial reporting in Ind AS, Indian entities are better placed to identify potential risks and take timely action, protecting stakeholders’ interests and business reputation.

6. Facilitate Mergers & Acquisitions

For investors looking for mergers and acquisitions, the only window to your company’s financial health are your simplified IND AS financial statements, increasing the probability of a fair deal.

7. Cost Reduction

In aligning with IFRS, IND AS ensures that your business does not have to incur unnecessary expenses to meet the guidelines of different accounting frameworks.

8. Simplified Compliance

IND AS helps you prepare standardized financial statements in line with Indian taxation laws and regulations. Further, IND AS-compliant statements are easier to process for auditors.

Don’t Miss: Importance of Audit Trail Feature for Business Accounting

Maximize Business Productivity By Streamlining Accounting Operations With Sage X3 ERP

The implementation of accounting standards Ind AS is aimed at bringing uniformity and transparency in India’s financial reporting landscape on par with global standards. A comprehensive understanding of the Indian accounting standards list is necessary to ensure the accuracy of financial statements. Despite certain implementation challenges, India Inc. is making steady progress towards Ind AS.

Sage X3 is an industry-leading ERP software to make your transition to Ind AS smooth and stress-free while supporting the long-term growth of your business. A custom business management solution, it automates reporting, reduces compliance risks and ensures data accuracy of all your business transactions. Scale your business to new heights with the multi-dimensional competencies of Sage X3.

FAQ

1. What Do You Mean By Accounting Standards?

The meaning of Indian Accounting Standards is that they are a set of guiding principles issued by the Institute of Chartered Accountants of India, for streamlining financial reporting in India in accordance with International Financial Reporting Standards (IFRS).

2. Is Ind AS Applicable To All Companies?

No, Ind AS is not applicable to all companies. Its applicability depends on various factors such as net worth, whether it is listed or unlisted company, and the sector in which the company operates like banking, non-banking financial institutions and insurance.

3. Is IFRS Mandatory in India?

No, IFRS is not mandatory for all companies in India. However, many companies have voluntarily adopted IFRS, which is called IND AS in India, to improve the quality of their financial reporting.

4. What Is The Turnover Limit For Ind AS?

All listed companies must comply with Ind AS irrespective of their turnover. Unlisted companies whose net worth exceeds Rs250 crore must adopt Ind AS. And companies with a turnover between Rs100 crore and Rs250 can voluntarily adopt Ind AS.

5. Who Issues Accounting Standards In India?

The accounting standards in India are issued by the Institute of Chartered Accountants of India (ICAI), a professional accounting body, controlled by the Ministry of Corporate Affairs, India.

6. Who Writes Accounting Standards In India?

The Indian accounting standards are framed by the Accounting Standards Board, a statutory body under the supervision of the Institute of Chartered Accountants of India (ICAI).

7. How Many Indian Accounting Standards Are There?

Currently, the list of Indian accounting standards IND AS comprises 39 accounting standards, developed along the lines of IFRS.

8. Does India follow IFRS or GAAP?

Most small Indian companies still follow the traditional GAAP accounting system as it is not mandatory for them to follow Ind AS. However, medium to large-sized corporations have to follow the IFRS-converged IND AS depending on their net worth.

9. What Is The Difference Between IFRS and Ind AS?

IFRS in India is called Ind AS and it is IFRS-converged with certain carve outs and carve ins, adapting to the unique Indian economic environment. Ind AS can be expressed in a formula as follows:

Ind AS = IFRS + Carve outs – Carve ins

10. Is IFRS implemented In India?

IFRS was first implemented in India in 2015 and is called Ind AS. The government of India notified a phase-wise implementation of Ind AS.