What is IFRS?

IFRS stands for international financial reporting standards. It’s a set of accounting rules and standards that determine how accounting events should be reported in your business’s financial statements. Issued by the International Accounting Standards Board (IASB), IFRS accounting aims to make financial statements consistent, comparable, and transparent across the world.

What are the benefits of IFRS accounting?

Today, cross-border transactions are commonplace, with vast numbers of businesses seeking investment opportunities across the globe. In the past, this sort of internationalism was hampered by different countries maintaining different accounting standards, adding cost, complexity, and risk to business deals. IFRS accounting eliminates that problem by ensuring that different countries adopt the same, globally applicable set of accounting standards.

IFRS Explained!

IFRS accounting specifies how businesses need to maintain and report their accounts. Created to establish a common accounting language, the goal of the international financial reporting standards is to make financial statements coherent and consistent across different industries and countries. IFRS accounting covers a broad range of topics, including revenue recognition, income taxes, inventories, fixed assets, business combinations, foreign exchange rates, and the presentation of financial statements.

There are many different IFRS standards that you need to pay attention to. Here are a couple of areas where IFRS accounting provides comprehensive rules:

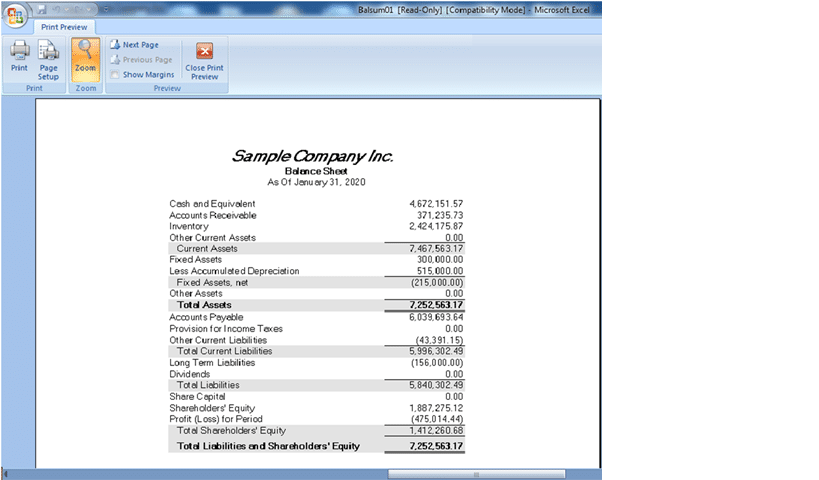

- Statement of Financial Position – More commonly referred to as a balance sheet, IFRS details the different components and how it should be reported.

- Statement of Comprehensive Income – This can be presented as a single statement or a profit and loss statement and a statement of other income.

- Statement of Changes in Equity – Sometimes referred to as a statement of retained earnings, this should document your business’s change in profits over the course of a given financial period.

- Statement of Cash Flow – This document should provide a summary of your business’s financial transactions over the given period, separating your cash flow into Financing, Operations, and Investing.

Preparing your accounting system for IFRS

A key component of preparing for IFRS is ensuring that your accounting, financial management, or ERP (enterprise resource planning) system is capable and ready for the change. If your organization uses Sage 300 ERP, you are in luck. Sage 300 has features and functionality that will support your transition to IFRS.

Sage 300 currently allows users to choose from a wide range of configuration options to ensure their transactions are processed and their accounts are kept in compliance with whatever local rules they happen to operate under. Sage 300 has over 13,000 clients in IFRS jurisdictions.

Sage 300 provides customers with multiple tools to create their financial reports and deal with consolidation. Whether using the standard Financial Reporter included with General Ledger, Sage Accpac Insight, or Financial Link Pro, Sage Accpac customers will be able to meet their IFRS reporting needs.

Sage 300 General Ledger

The general ledger module is the heart of your financial accounting processes.

Sage 300 provides the flexibility to meet the current and future financial management requirements of organizations of all types and sizes.

It provides a robust feature set designed to handle your most demanding budgeting and processing needs.

The Sage 300 General Ledger module has a built-in Financial Reporter Tool that allows you to easily create accurate financial reports such as an Income Statement Summary, Balance Sheet, or other Excel based reports.

The Financial Reporter is a powerful reporting tool that uses Microsoft Excel to manipulate format, graph, and print general ledger data.

General Ledger seamlessly connects with all modules and is the key to maximizing the efficiency and accuracy of your financial data.

Deliver accurate and effective financial information.

- Sage 300 is IFRS accounting compliant, with provision for full transaction threading from modules for complete data auditing.

- Manage up to ten different account segments with simplicity

- Fully configured to provide personalisation around unique processes and company best practice

- Store up to 99 years of financial reporting history

- Target key business information with built in analytics and financial management

- Integrated Financial Report Writer for producing income statements, balance sheets, and cash flow statements fast and effectively.

- Built in business intelligence optimizes financial management and analytics.

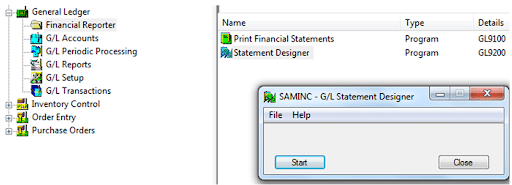

Financial Reporter in General Ledger Module of Sage 300 ERP

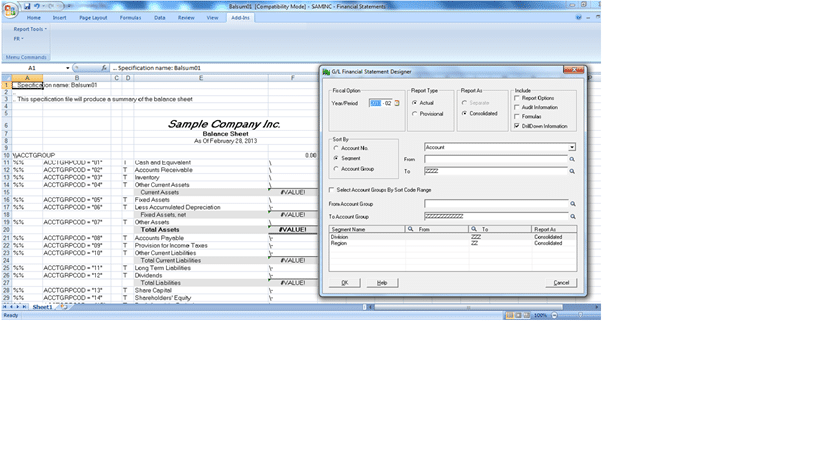

In Sage 300 ERP (formerly known as Sage Accpac ERP), Financial Reporter of General ledger module is very easy and strong reporting tool. To elaborate, Financial Report is a spreadsheet containing functions that read data directly from general ledger. Thus, in GL Statement designer user can create or edit a report specification for creating the financial statements.

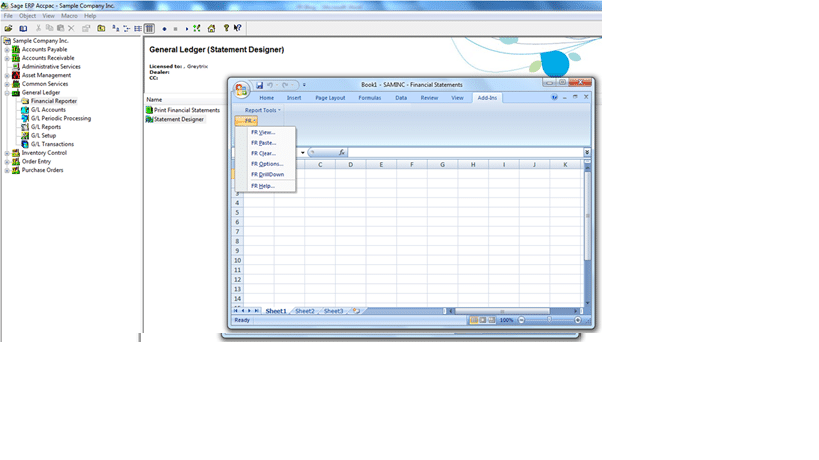

When user choose the Statement Designer icon from the Financial Reporter folder, Sage 300 ERP starts Microsoft Excel spreadsheet program with the Financial Reporter add-in. This add-in is available only when user start excels from the Statement Designer icon. Add-in adds the FR menu item to the Microsoft Excel menu bar. The FR menu includes the following Financial Reporter commands:

1. FR View: Generates Financial Statements from Report Specifications

2.FR Paste: Inserts Financial Reporter Functions, Account Numbers and Selection criteria

3. FR Clear: Clears a previously generated financial statement

4. FR Options: Carry forward the Opening Budget

5. FR Drill Down: Drill Down to associated transactions after user generates a financial statement.

These FR Functions can be useful in designing a new FR. Each Financial Statement is defined in Report Specification. These specifications tell Financial Reporter what data is included in the statement, and how it must be formatted. Columns A, B, C and D are reserved for Control information. All other columns determine the appearance of the report and type of data, which will appear.

Financial Reporter creates statement based on specification and options chosen. Whenever user wants to print or view financial statement, there are two ways to print financial reports;

1. Navigate to General Ledger >> Financial Reporter >> Print Financial Statements(Generally used for Running Financial Reports)

2. Navigate to General Ledger >> Financial Reporter >> Statement Designer (Generally used for Creating, Editing and Running Financial Reports)

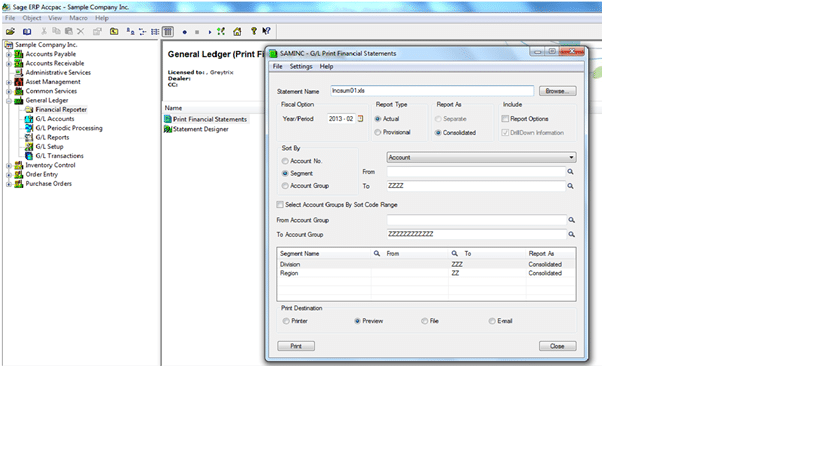

When User run FR from Print Financial Statement icon, it allows following print options:

- Statement Name– Browse and select the FR file path

- Report Type– Actual and Provisional

– Actual includes those amounts which have been permanently posted to General Ledger.

– Whereas, Provisional includes those amounts that have been provisionally posted to general ledger accounts, as well as permanently posted amounts. - Report As– Separate or Consolidated

– It allows printing single consolidated report or separate reports for different account number segments. - Include– Report Options or Drill Down Information

– Report Options includes the following options, Statement Name, Fiscal Year and Period, Account Sorting Order, Account Selection ranges, etc.

– Drill Down Information allows to drill down the output to the transaction level. - Print Destination– Printer/Preview/File or E-mail

–Printer – Prints to a physical printer

– Preview – Displays the report onscreen

– File – Saves the report as a file

– E-mail – Sends the report as an attachment in the E-mail

When User run FR from Statement Designer, it opens an excel file. Here, user has to Select FR View from FR -> Add-ins and it would populate the Financial Statement Designer UI from where user can run FR.

Advantage of using Statement Designer for running FR than Printing through Financial Statement is that; it allows changing the formulas at runtime through Statement Designer, whereas printing through Financial Statements prints only the output.

As a result, Sage 300 ERP accurately manages income and expense details of business enterprises and prepares the general ledger, thus providing an alternative solution from the complicated and time-consuming paper-pen based financial tasks. It enables users to design the following financial reports:

a. Balance Sheet to view the current snapshot as well as long-term forecast of assets, liabilities and net changes

b. Profit & Loss Statements that gives up-to date Profit & Loss statements for anytime period

c. General Ledger to view GL accounts with updated financial transactions

d. Trial Balance to view a comprehensive worksheet showing the balances in each account

STAY UPDATED

Subscribe To Our Newsletter

At Sage Software Solutions (P) Ltd., we are home to world-class ERP software and CRM software that will solidify your business tech support fundamentals and enable you to build a customer-centric organization. You can also write to us at sales@sagesoftware.co.in.

Disclaimer: All the information, views, and opinions expressed in this blog are those of the authors and their respective web sources and in no way reflect the principles, views, or objectives of Sage Software Solutions (P) Ltd.