Asset Disposal in Sage X3

In this blog we will talk about retiring/ disposing of assets in any organization.

An asset is something which any individual, organization or country owns with expectation for future benefit. They are mapped on company’s balance sheet and created/ bought to increase firm’s value. Once asset is purchased and started getting used, it starts depreciating on periodic/ monthly basis. In layman terms, we all use assets like properties, mutual funds, bonds, etc. until they reach a profitable value and then sell it off to secure our finances.

Many Sage X3 users ask for asset disposal from their company’s accounting when it is no longer in use or for sale purpose. Every client has various reasons to dispose an asset to gain monetary value.

What is Asset Disposal & When to dispose an asset?

An asset disposal is removing an asset from company’s accounting when it is no longer in use and has long term life. An asset can be disposed because of below reasons-

- When it is fully depreciated

- When no longer in use, sold on profit/ loss

- Due to theft

How to perform Asset disposal?

Sage X3 allows its users to perform disposal activity on their own with below shown simple steps.

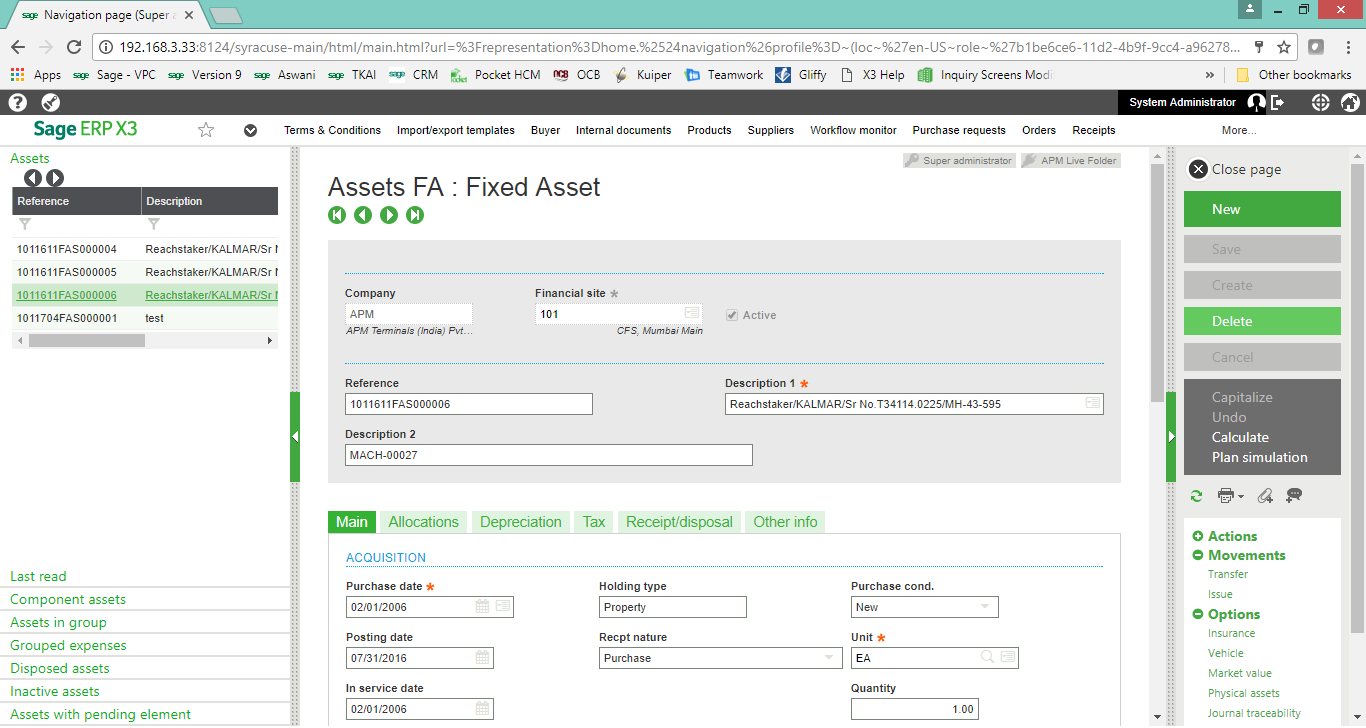

1. For sale of Asset, Navigate to Fixed Asset Module -> Asset

2. Select asset which has to be sale or dispose and click on “issue” button as shown in below.

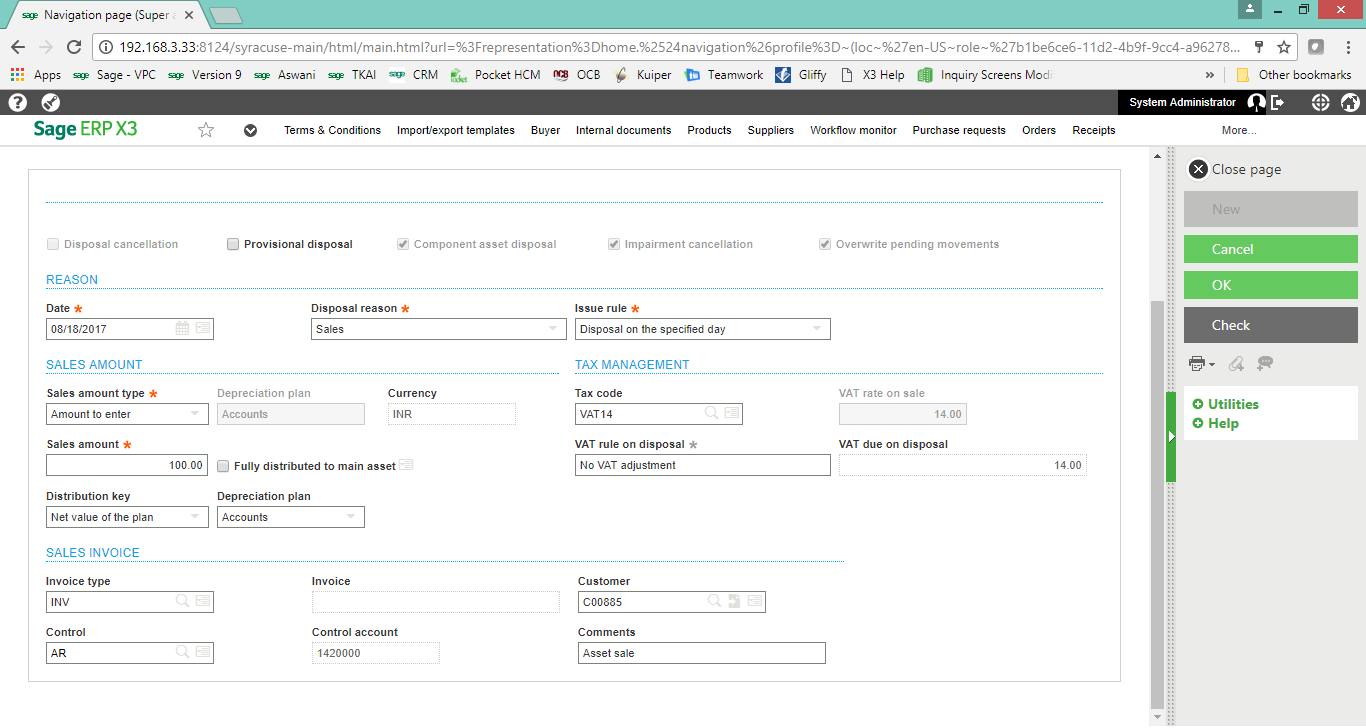

3. Post Asset Disposal, mention the reason behind selling an asset and sales invoice information like date of disposal, disposal reason etc. Now here in below screen select all the information

- Asset sale or disposal Date

- Disposal reason

- Issue rule

- Sales amount type

- Customer

4. Click on OK, then the system will generate one AR invoice against customer only if it is sale of asset and financial impact generated for the particular asset against loss or gain.

Note: If you are depreciating any asset, select Issue rule only, no need for sales information.

Hence, it is important for any company, country or individual managing fixed asset to maintain purchasing date for an asset.

Sage X3 gives you preview by running plan simulation the monthly and yearly charge of the asset.

For more details on Sage X3 features and functionalities for business growth, visit our website or write to us at sales@sagesoftware.co.in. You can also check out industry-specific ERP and CRM solutions here.