You may have come across a situation where you would want to load the tax value on received stock when there is no Input tax credit on GST on purchase.

For an Instance, In Wine industry there is no Input tax credit on any purchase so all the tax value should be loaded on stock in order to get the accurate landed cost of an inventory.

How to load the Tax value on Received Qty

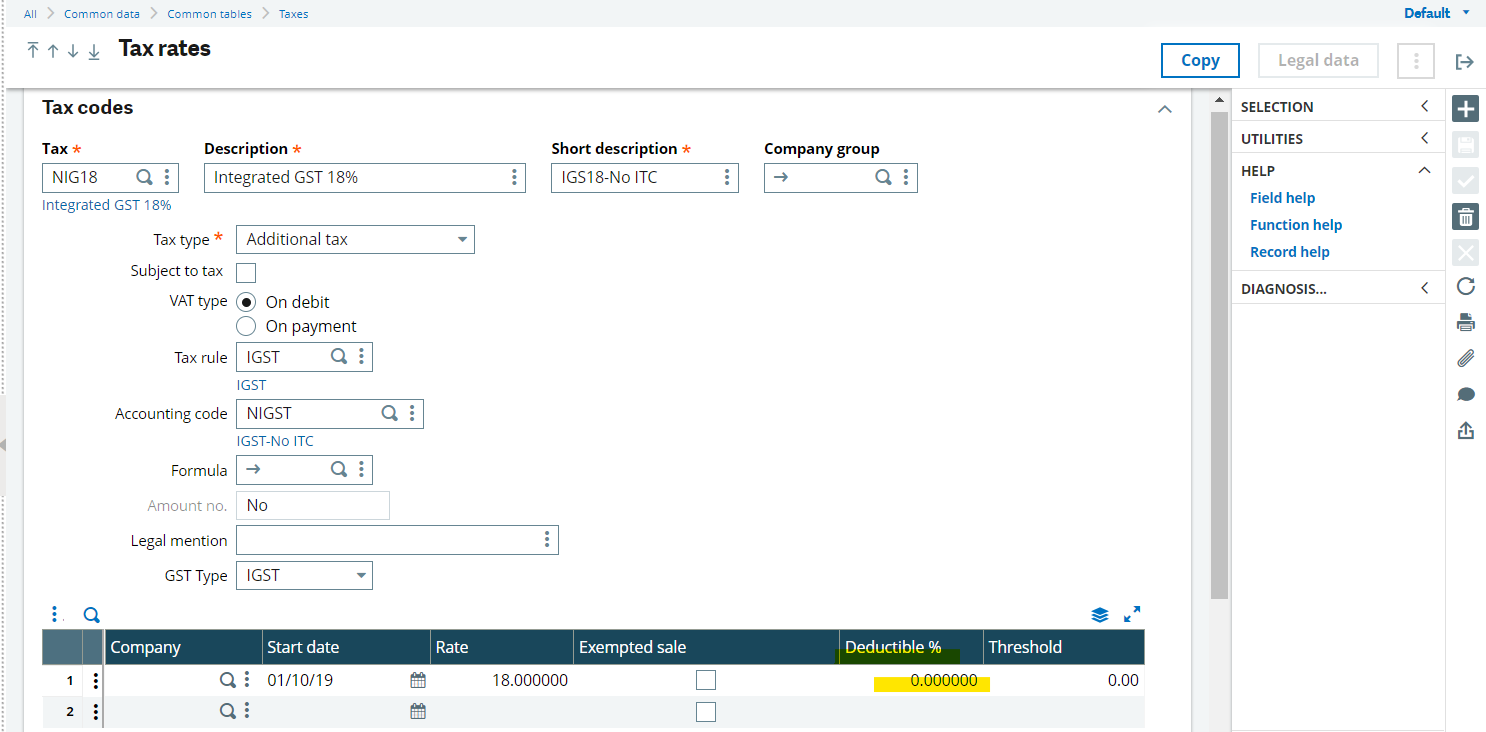

To configure the same, we have to do the configuration in Tax Rates screen.

- TAX RATE:

Common data >> Common table >> Taxes >> Tax rate

Create tax rate and give the tax rule, GST Type accordingly. Accounting code needs to be configured as per the requirement of the client. Also, give the rate accordingly but make the “Deductible %” as 0. By default, the Deductible % is 100 which considers the Tax value to be separate and doesn’t include in the Line value.

As per the above configuration when Purchase Receipt is taken, the Tax value will be loaded on the Stock. That means the Stock GL will be debited with Basic value + Tax value and Accounts Payable GL will be credited with the same value.

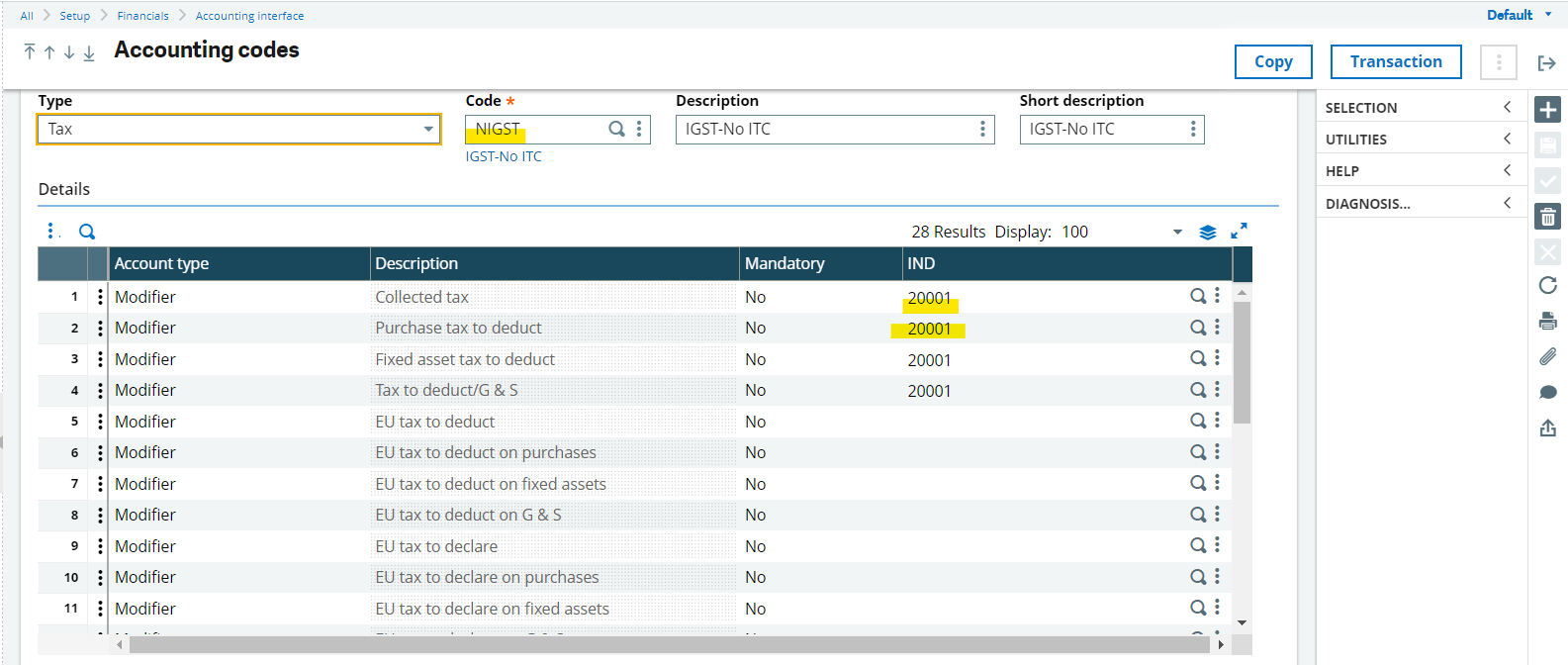

As mentioned above, the Accounting code for the tax rate needs to be configured as per the client requirement. By standard, when tax is applied on Purchase Invoice, it generates the separate Tax Line leaving Accounts Payable separate.

But, logically it should Debit the Accounts Payable GL only otherwise the balance of the Accounts Payable GL will never be nullified unless done by manual JVs.

- Creation of Accounting Code

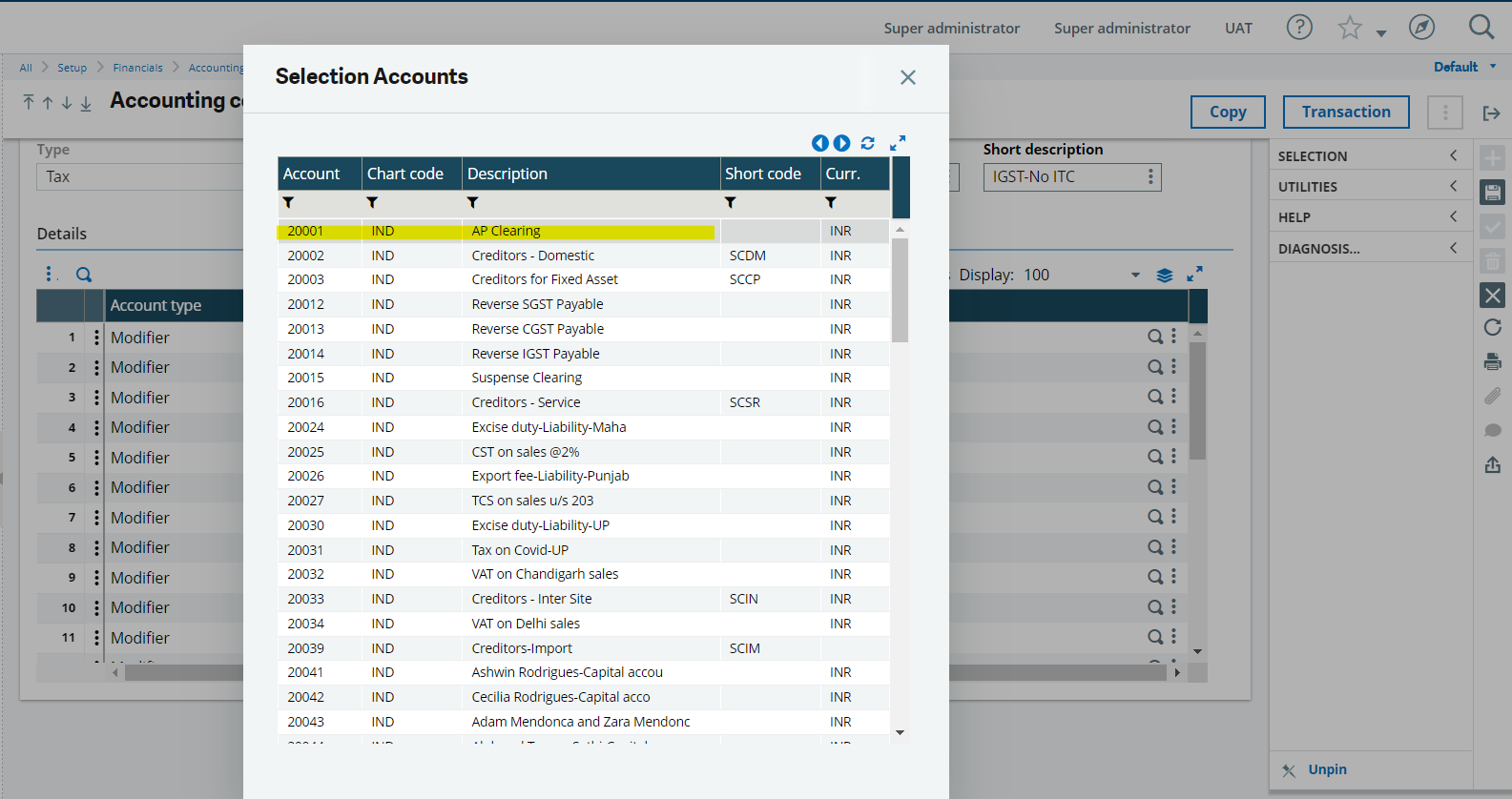

Create new accounting code for Tax applied above…

Here, as per the client requirement, Accounts Payable GL is mapped for Taxes too. Which will be easy to nullify its balance at the Purchase Invoice Level.

As per the above configuration, the accounting impacts would be –

- Purchase Receipt –

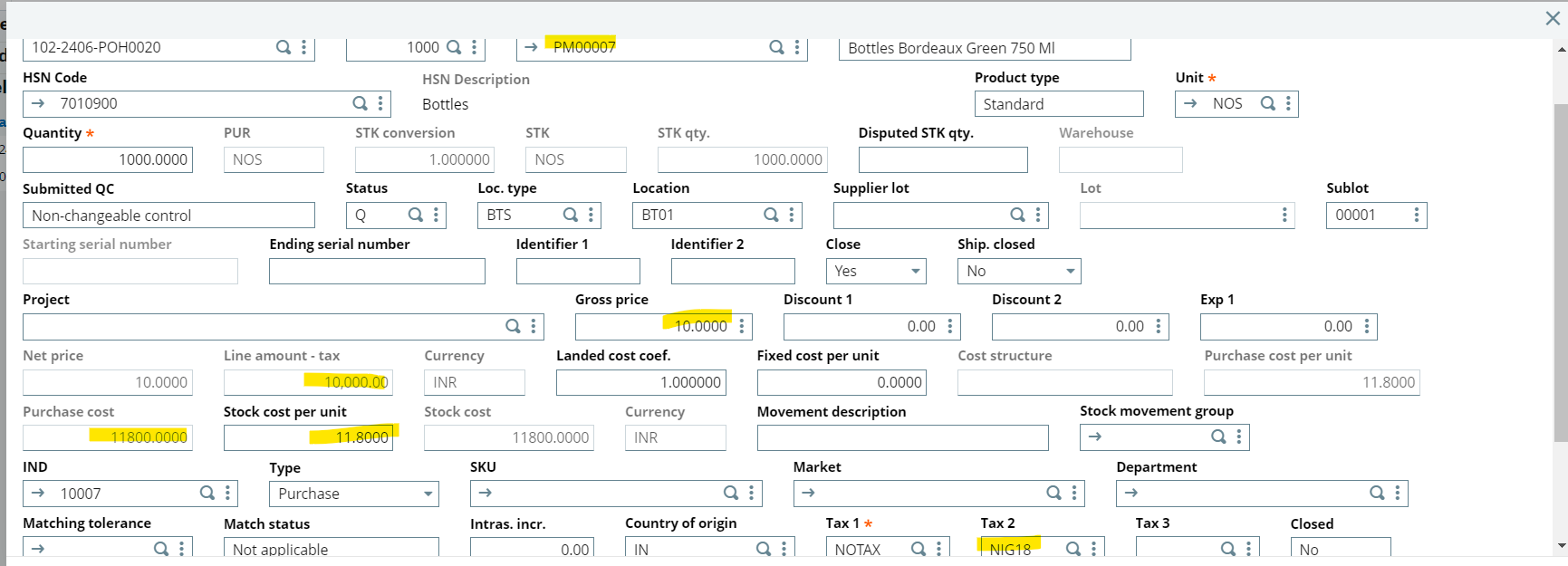

Below screen shows the total Purchase cost of the Product. Which includes basic value + tax value.

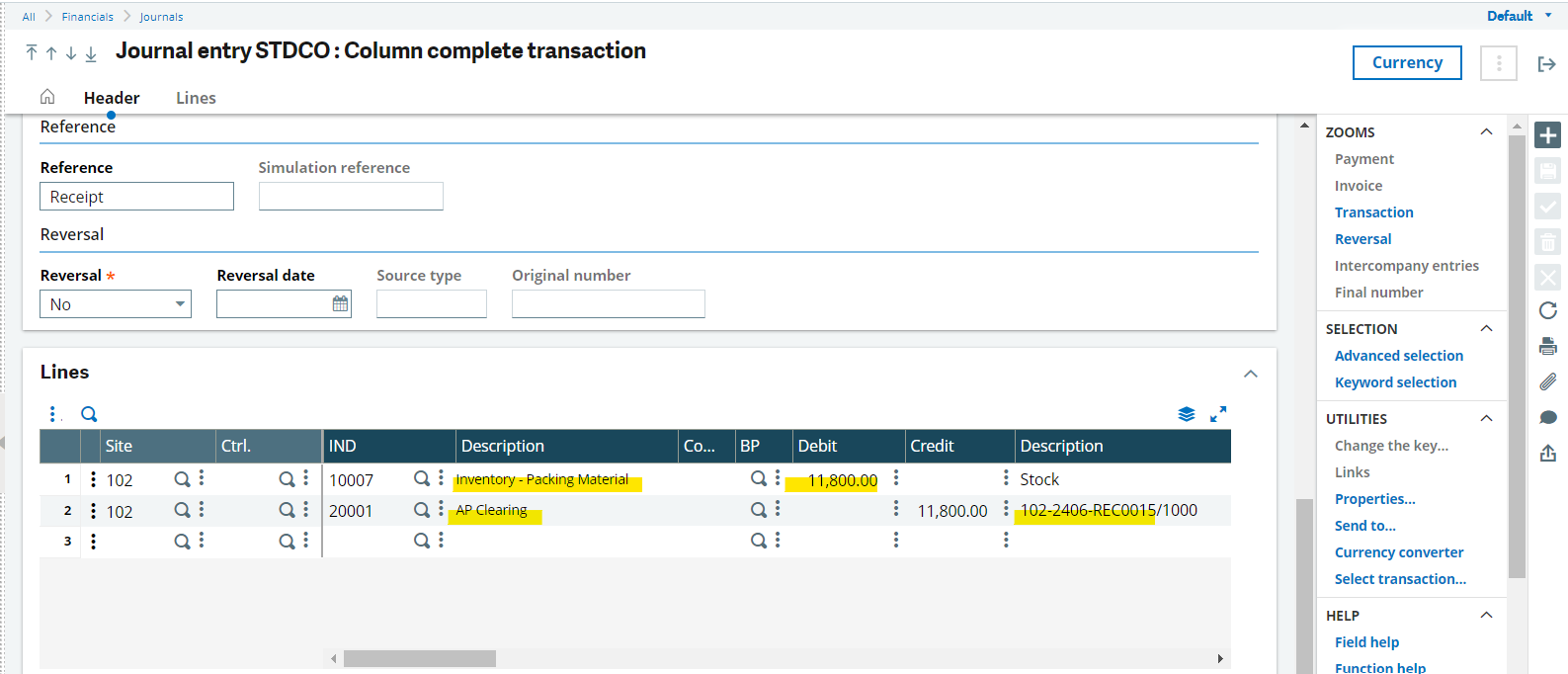

And below would be the Journal Entry of Purchase Receipt –

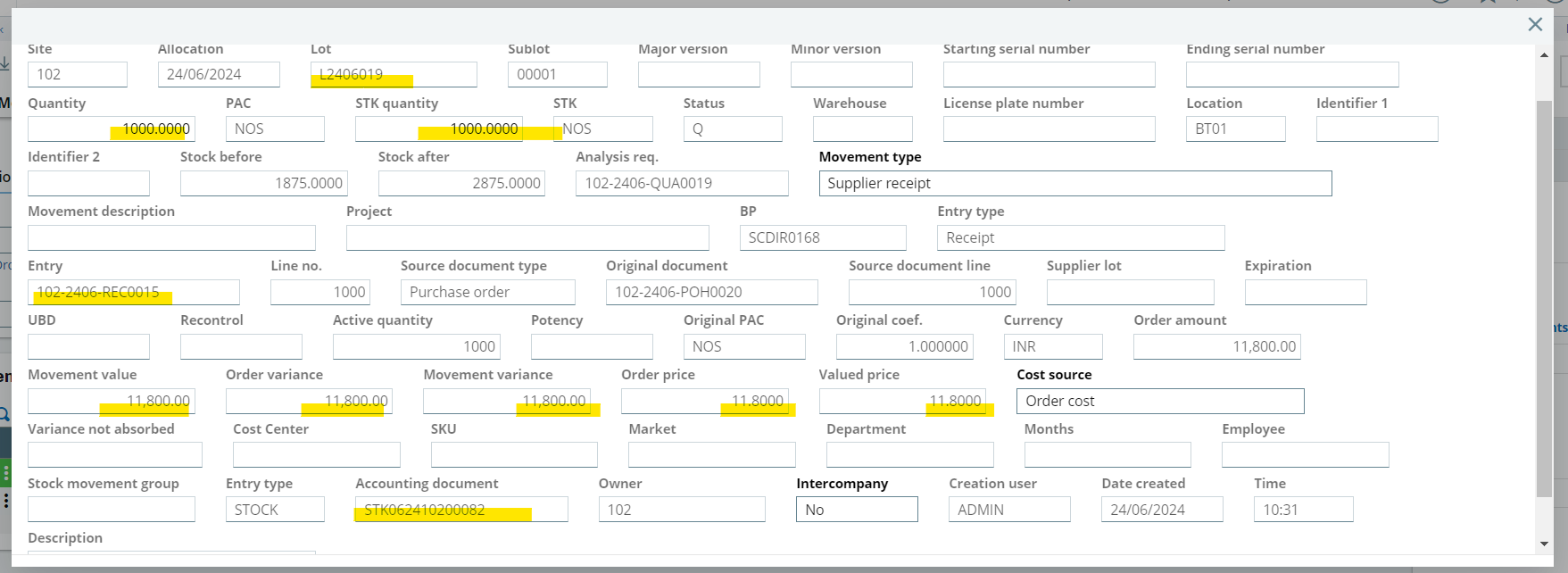

Below stock transaction inquiry shows the detailed valuation of the Receipt.

- Purchase Invoice –

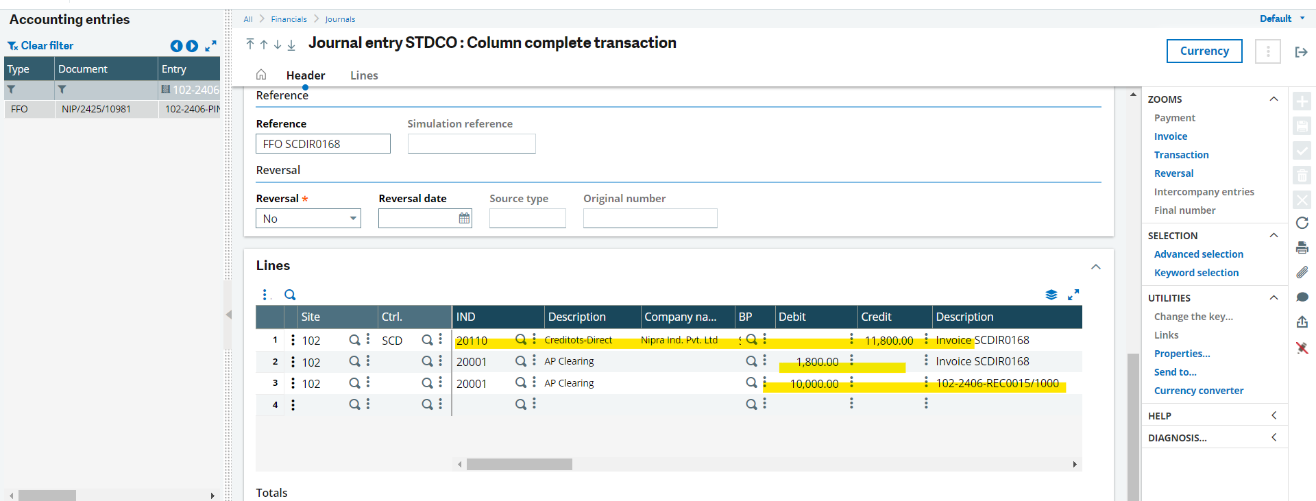

This way we can nullify the Accounts payable GL balance through Purchase Invoice.

Note: If client require the tax GLs to be impacted on Purchase Invoice, then he/she need to nullify the Accounts payable GL balance.