In Sage X3, managing accurate stock costs is critical for ensuring the true cost of goods is recorded, particularly when dealing with additional expenses such as customs duties, freight, and other surcharges. This is where the Fixed Cost per Unit field comes into play.

This blog will guide you through how to use the Fixed Cost per Unit field within Sage X3 to include these additional charges, ensuring that stock costs reflect the total expense of getting goods into inventory.

What is Fixed Cost per Unit?

The Fixed Cost per Unit field in Sage X3 allows you to input additional costs that aren’t directly related to the purchase price of the product but are still critical to the overall cost of goods.

⇒ These could be costs such as:

• Customs duties

• Freight and shipping fees

• SWS (Statutory Welfare Scheme)

• Any other incidental charges

By incorporating these costs at the time of the Goods Receipt Note (GRN), you ensure that the final stock value is as close to reality as possible.

Also Read : Automating In-Transit Inventory Management with Sage 300cloud Goods in Transit module

How It Works:

1. Open the GRN (Goods Receipt Note): When you receive goods, Go to GRN screen in Sage X3.

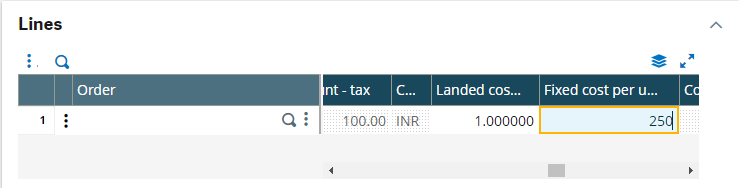

2. Enter Fixed Cost per Unit: At the GRN lines level, add any additional charges per unit product.

→For example:

• Customs: 200 INR per unit

• Freight: 30 INR per unit

• SWS: 20 INR per unit

Enter the total of these charges (e.g., 250 INR) in the Fixed Cost per Unit field.

3. System Calculation: Sage X3 automatically calculates the total fixed cost based on the units received.

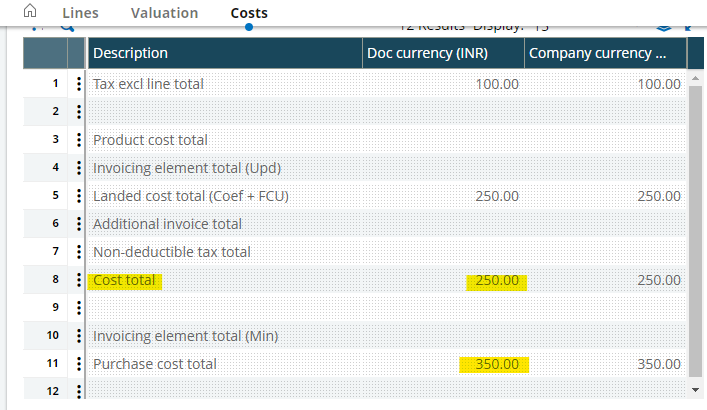

4. Check Total Cost: In the Cost Tab of the GRN, you’ll see the total cost (stock cost + fixed costs).

5. Create the GRN: Once everything looks good, Create the GRN to update stock values.

Conclusion:

By effectively utilizing the Fixed Cost per Unit field in Sage X3, you can ensure that all your additional expenses are captured in your stock value. This leads to more accurate costing, better financial insights, and improved decision-making for your business.