Summary: Managing finances when your Software as a Service (SaaS) start-up begins to grow is challenging. You start investing more in spreadsheet software and hiring more employees. But handling numerous financial transactions for a SaaS business using traditional accounting software might be overwhelming. Thankfully, a finance tech stack plays a pivotal role in such situations.

Look for the following five things to know that your existing financial system isn’t up to the mark and you need a finance tech stack:

- Your back-office is solely responsible for business data reporting

- You are struggling to automate and scale your business processes

- Your existing enterprise software isn’t allowing you to boost productivity

- Your billing cycles and close times are extending limitlessly

- Your data is managed manually and you are unable to gain valuable insights from it

This article will discuss how building a fintech stack can help organizations manage financial data and gain valuable insights from it.

What is a finance tech stack?

A fintech stack consists of multiple technologies that allow companies to move beyond traditional financial spreadsheet software like Excel and help them cope with future growth demands.

Big Time, a leading professional services company, has a fintech stack that integrates various technologies like Customer Relationship Management (CRM), Business Intelligence (BI), and Human Capital Management (HCM).

The best part about a fintech stack is that you can add new modules or remove existing ones whenever required, which helps control implementation costs.

Why is a fintech stack crucial for your SaaS business?

A finance tech stack helps respond to customer demands quickly and efficiently.

For example, granular reports provide data that allow shaping strategy for finance and other business areas. They help in two ways. Firstly, they provide crucial data for different business departments, including sales & marketing, production & manufacturing, finance & accounting, etc. Secondly, they allow business stakeholders and investors to analyze your market performance and decide whether your business provides a lucrative investment opportunity.

A finance tech stack also allows your customers to get a frictionless billing experience. Moreover, it also facilitates digital payments encouraging customers to buy more products and subscribe to more services.

6 steps to grow your fintech stack

General Ledger (GL) is the source of truth for your financial data that lies at the heart of your fintech stack. It improves business visibility and eliminates manual work. Here are 6 essential steps to grow your finance tech stack further.

1. Set up a Chart of Accounts (CoA)

Start by building a CoA that provides a complete breakdown of all your financial transactions during specific accounting periods. It also helps investors and stakeholders analyze your organization’s financial health, helping them make crucial investment decisions.

2. Automate contract-based billing

As your customer base grows, it becomes challenging to bill them manually because of two reasons:

- Employees have to spend substantial time preparing bills that they might have otherwise utilized for finishing mission-critical tasks.

- Human-induced errors often crop up in hand-made bills.

3. Create GAAP and SaaS dashboards

Real-time business metrics such as GAAP and SaaS allow the senior management to comply with global standards and make better decisions regarding hiring, investments, churn, acquisitions, and many more.

4. Automate revenue management

SaaS organizations have to keep track of many things, including complicated subscription modifications, add-ons, cancellations, renewals, and pauses. Recording and analyzing this data is challenging if you use traditional spreadsheet software. On the other hand, SaaS businesses would want to automate their revenue management process and other crucial accounting tasks.

5. Integrate Quote to cash

Quote to cash (QOC) combines various processes, including quote creation, proposal drafting, and receiving payment for the services delivered. For implementing QOC, SaaS businesses should integrate CRM software with the finance tech stack.

6. Forecast cash, revenue, and expenses.

The finance tech stack helps SaaS businesses brainstorm the right strategies for hiring new employees, acquiring new organizations, and scaling their business.

Boost your finance tech stack with your business

Your finance tech stack is directly proportional to the size of your SaaS business. Here are the various kinds of funding that you should remember:

1. Seed

Early investors provide seed funding that help manufacture products and distribute them in the market. However, at this stage, you don’t have dedicated finance professionals to help you with your finance & accounting challenges. Therefore, implementing an automated account payable and payroll software will help you.

2. Series A

You can expect to get Series A funding as your revenue increases, customer base expands, and performance metrics improve.

You are more concerned about having enough investments and a workable model for ensuring long-term profits in this stage.

Moreover, your finance tech stack will become more prominent as your financial challenges (such as cash collection, billing, etc.) become more complicated.

Over here, it would be best if you focused more on technologies that help with expense management, revenue recognition, reporting, and SaaS dashboards.

3. Series B

You have an extensive customer base and are well ahead of the initial development phase. Also, you have significant funding backing your products and services.

However, there is considerable scope for further expanding your business by building a recurring revenue model. For example, you can create new upselling and cross-selling opportunities to increase your growth rate.

In this stage, your finance tech stack should contain modules for managing revenue, commissions, subscriptions, expense, and business metrics.

4. Series C to F

Your business model is outperforming and delivering excellent results. So, it’s the right time to call a financial expert to manage your company accounts professionally.

The primary focus of your finance tech stack in this stage should be on forecasting/variance, budget vs. actuals, and reconciliations.

5. Sale/IPO

You can think of taking the initial public offering (IPO) route after you have expanded to adjacent markets and similar geographical locations.

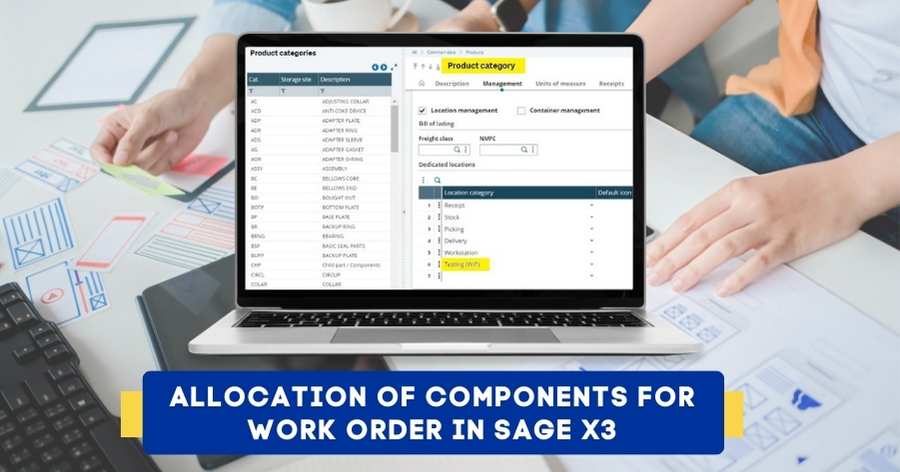

In this stage, you require an ERP software that takes care of international consolidations, public company reporting, and ensures that you adhere to compliances.

STAY UPDATED

Subscribe To Our Newsletter

At Sage Software Solutions (P) Ltd., we are home to world-class ERP software and CRM software that will solidify your business tech support fundamentals and enable you to build a customer-centric organization. You can also write to us at sales@sagesoftware.co.in.

Disclaimer: All the information, views, and opinions expressed in this blog are those of the authors and their respective web sources and in no way reflect the principles, views, or objectives of Sage Software Solutions (P) Ltd.