Asset disposal is the process of removing a long-term asset from a business’s accounting records, either by scrapping or selling it.

In the Sage X3 application, this process is straightforward and also ensures that the corresponding accounting impacts are properly recorded.

Process for Disposal of Fixed Asset in Sage X3

Let’s see how this process is done in Sage X3:

Set up for Asset Disposal:

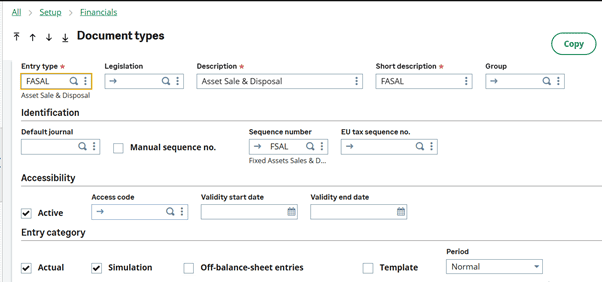

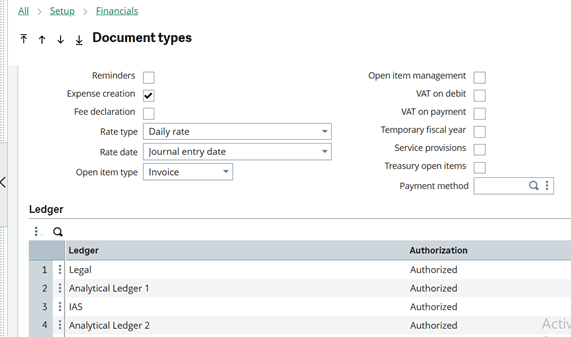

Need to create separate document type navigate to: Set Up → Financials → Document Types

Note: Enable Ledger authorisation as per company’s ledger terms

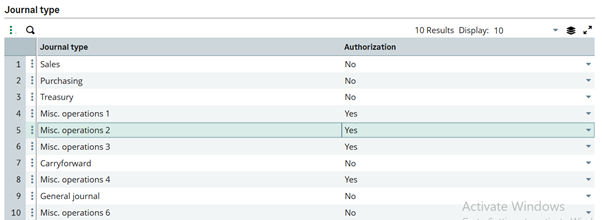

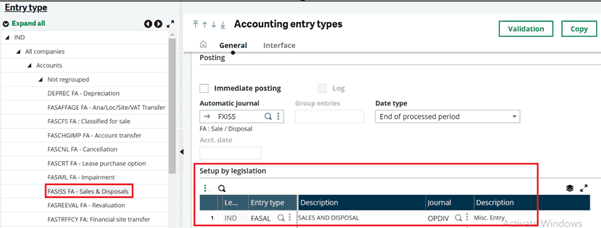

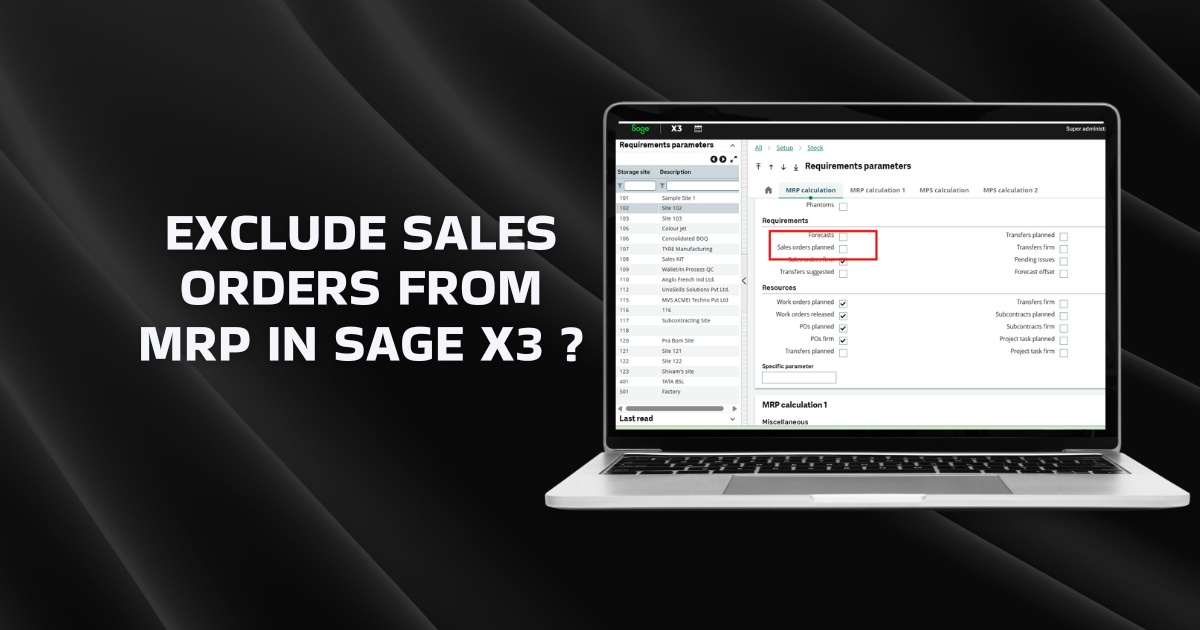

Need to tag journal to fixed asset accounting entry type:

To perform this, navigate to: Set Up → Fixed Asset Module → Accounting entry type

Select “FASISS FA- Sales & disposals type”.

In general tab, Setup by legislation lines search and provide “FASAL” document type which is created in 1st stage and give “OPDIV” journal.

Follow the below steps to dispose the asset.

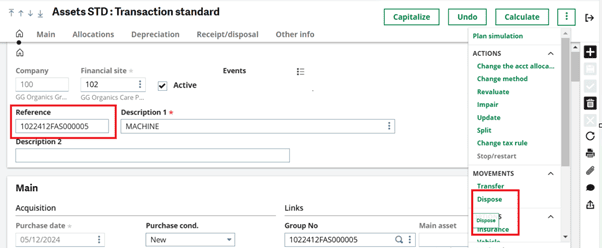

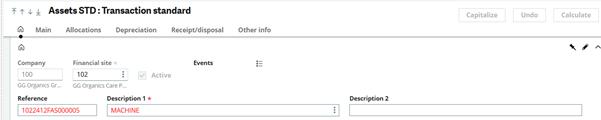

For Disposal of Asset, Navigate to Fixed Asset Module → Asset

Select asset which has to be dispose and click on “Action” button as shown in below and click on “Dispose” option.

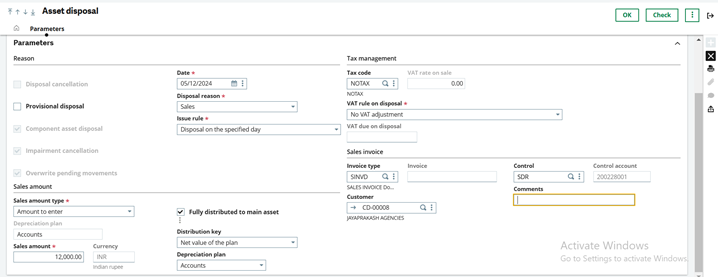

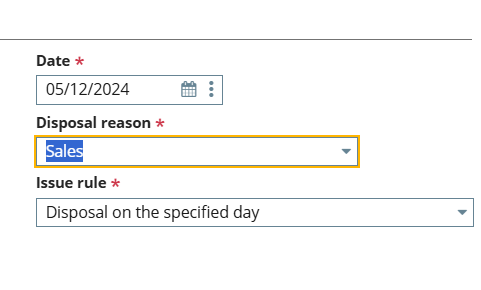

Once “Dispose” option is clicked below screen will open and provide necessary information.

- This date must also be greater than or equal to the asset purchase date of asset.

- Select the disposal reason

- The issue reason can be:

- Sales,

- Scrap, Stolen or

- disappeared.

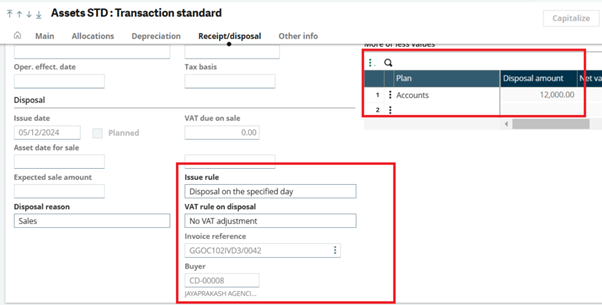

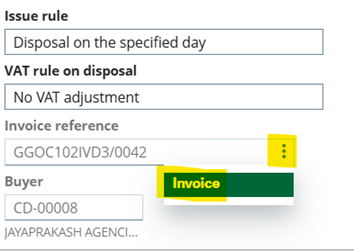

The issue rule: Default rule “Disposal on the specified day”.

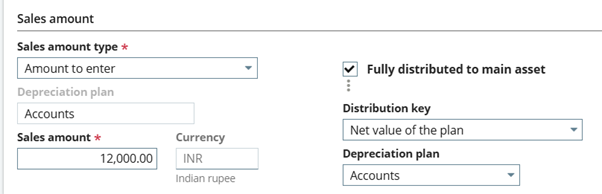

- Sales amount type – Select option “Amount to enter” or “Net value of the plan”.

- Sales amount – 4500

- Distribution key – Net value of the plan

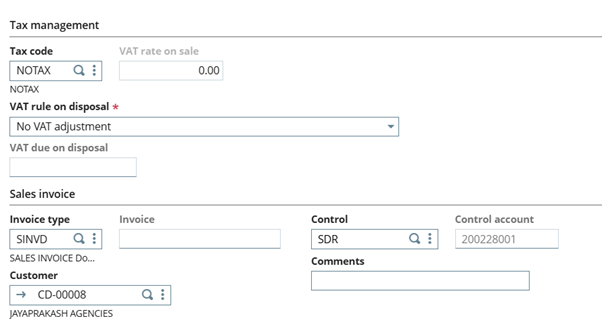

- Tax code – NOTAX (As per terms)

- VAT rule on disposal – No VAT adjustment

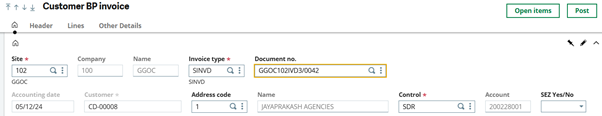

- Invoice Type: Select respective invoice type

- Enter the customer – Select the respective customer

- Select the control a/c and enter a comment

Once entered all the information click on OK and save then the system will generate one AR invoice against customer only if it is “sale of asset”.

Once the disposal is complete the asset reference and description colour will change to Red.

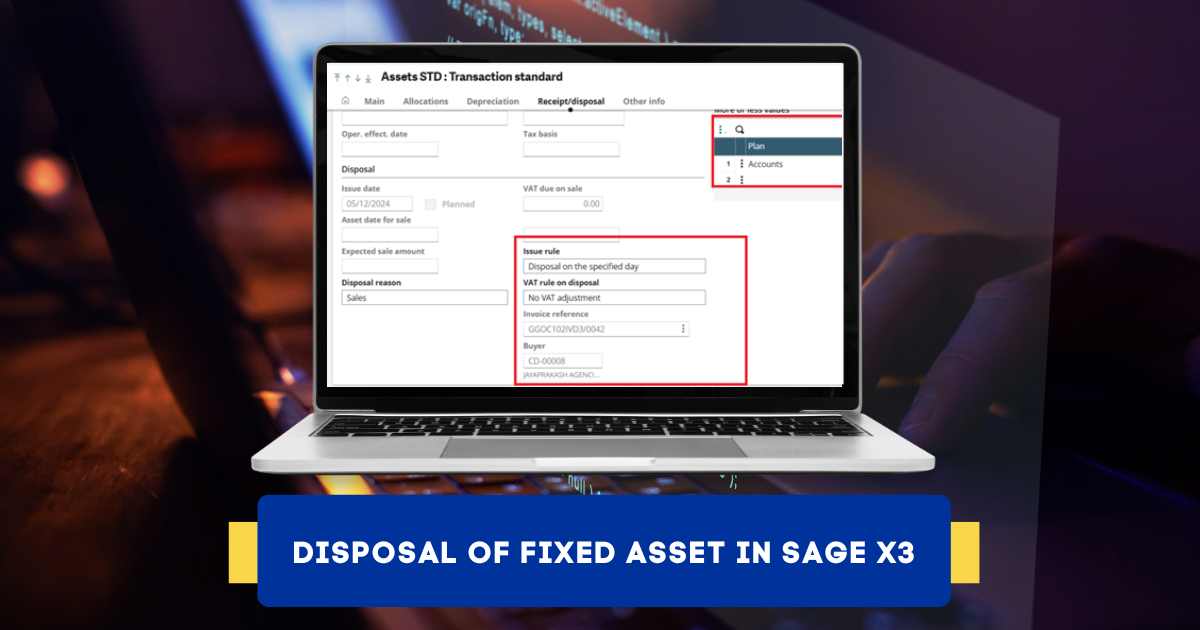

Click on Receipt/disposal tab to examine the asset disposal details.

We can even verify the customer invoice using invoice reference number.

Click on 3 dots in Invoice reference field this will navigate to Customer BP invoice screen and post the invoice to get accounting impacts.

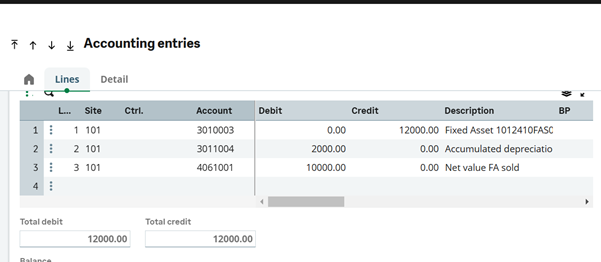

Finally, we need to generate accounting entries for disposal asset against loss or gain.

To generate accounting impacts, Navigate to Fixed Asset Module → Account. Interface → Generation of accounting entries

Select the respective company and site

Select account type as – FASISS

The log file will generate, to examine the accounting entries Navigate to Fixed Asset Module → Account. Interface → Accounting entries

In left side grid we can verify asset disposal impacts by selecting FASAL: Asset sale & Disposal option.