What is Days Inventory Outstanding (DIO)?

Days Inventory Outstanding (DIO) is an inventory liquidity metric that denotes the average number of days a company holds its inventory before selling it to the customer. Analyzing the DIO provides insights into the company’s efficiency in converting inventory into sales and accordingly fine-tuning your strategy.

ERP software helps you understand and optimize the average age of inventory and the time your company takes to clear it off. It is a business-critical solution that helps in strategic planning and decision-making to improve your company’s sales, operational & financial efficiency, and prevent your stock from becoming obsolete or unsellable.

Days Inventory Outstanding Formula

Now, let’s discuss the Days Inventory Outstanding formula:

Days Inventory Outstanding (DIO) = Average Inventory / Cost of Goods Sold * No of Days

- Average Inventory: This indicates the average value of your stock either during the reporting period or at the end of it.

- Cost of Goods Sold: This is the direct cost of stock production. It also includes the cost of raw materials, labor, and utilities.

- No of Days: This is the period of the inventory cycle being analyzed. For example, the Days Inventory Outstanding calculation can be limited to 15 days, 30 days, or 31 days.

Examples of Days Inventory Outstanding

XYZ Ltd is a seller of computer accessories. It has an opening inventory worth Rs. 80,000 and a closing inventory worth Rs. 1,00,000. The Cost of Goods Sold (COGS) is Rs. 1,10,000.

To calculate the company’s DIO, we will first find out the Average Inventory.

Average Inventory = (80,000 + 100,000) / 2 = Rs. 90,000

Days Inventory Outstanding (DIO) = (90,000 / 1,10,000) * 30 days = 24.54 days

To conclude, the computer accessories seller in our example has a good turnover ratio of 24.54 days (i.e. 24 days 13 hours).

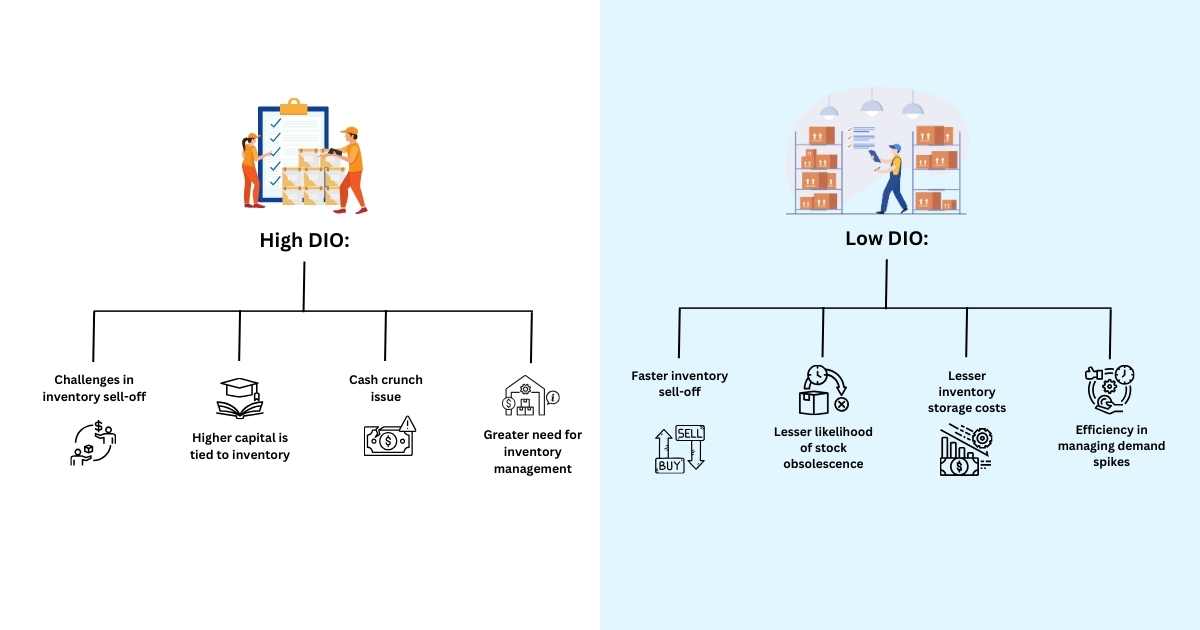

What Do High & Low DIO Indicate?

Both the business executives and investors calculate the DIO to understand the company’s inventory liquidity. Here’s what the high and low DIO indicate:

1. High DIO

A higher DIO indicates the company is struggling to sell off its inventory and a significant part of the company’s capital is tied up to unsold stocks. This is problematic because the company will struggle to meet its operational needs due to higher inventory holding costs and may face a cash crunch. You can optimize warehouse storage using a dedicated Warehouse Management System.

2. Low DIO

Lower DIO indicates the company is able to sell off its inventory at a faster rate, and there is a lesser likelihood of stock obsolescence and higher inventory holding costs. While this may seem like a good indicator, there is a risk that the company may not be able to meet a spike in customer demand.

How Does DIO Differ from Industry to Industry?

The DIO differs from industry to industry. Here are the industry wise DIO:

1. Clothing & Apparel Industry

In the apparel industry, market trends & patterns keep on changing, and so does the lifecycle of the products. Thus, the DIO for each product may vary from product to product. Similarly, the DIO of a single product may fluctuate during different seasons. Luxury products, however, are often an exception and typically have a higher DIO. Businesses use Apparel ERP Software India to optimize their DIO and effectively handle their everyday challenges.

2. Construction Industry

Unlike the FMCG sector, the construction sector deals with products that are typically larger in size & more expensive. These products have an unpredictable demand curve. Ultimately, the DIO in the construction sector is higher. The best ERP Software in India helps them meet their unique industry needs, streamline projects, optimize inventory, and understand profitability.

3. Fast-moving Consumer Goods (FMCG)

The FMCG sector primarily includes personal care, toiletries, processed foods, natural products, and household cleaning items. In this sector, the DIO is typically lower because of higher turnover, and higher & predictable demand for the products. ERP for food industry addresses various inventory-specific challenges, breaks down information silos, and provides greater flexibility.

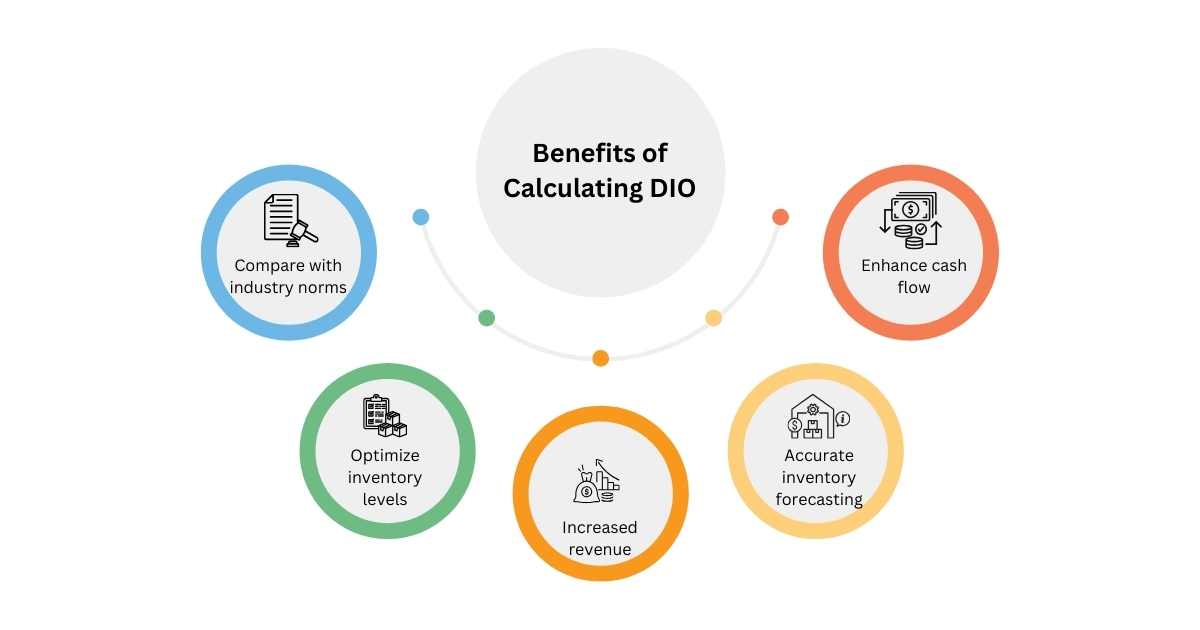

Benefits of Days Inventory Outstanding Calculation

Understanding your current Days Inventory Outstanding is the first step towards optimizing it. Here are the benefits of Days Inventory Outstanding calculation:

1. Compare with Industry Norms

Calculating the Days Inventory Outstanding is the first step towards understanding your position in the industry and comparing your inventory management and sales performance with that of your rivals.

2. Optimize Inventory Levels

A higher DIO indicates that a large chunk of the company’s capital is tied up to unsold inventory. This can be problematic as it leads to higher inventory storage costs. By calculating and optimizing your DIO, you will be able to manage your inventory efficiently.

3. Accurate Inventory Forecasting

Calculating the correct Days Inventory Outstanding helps you in accurately forecasting the demand for your products, and better understanding the customer requirements. As a result, your company will be in a better position to respond to market changes and benefit from lower inventory holding costs.

4. Increased Revenue

Every company strives to reduce costs and improve its profit margins. As your business manages to sell inventory at a faster rate, it will benefit from reduced inventory holding costs, lesser stock obsolescence, and improved revenue.

5. Enhance Cash Flow

A lower DIO adds up to the company’s liquidity. There will be a lower strain on the company’s capital and other resources. The company will be in a better position to convert the cash and invest it in other profitable projects & operations.

Limitations of Days Inventory Outstanding (DIO)

While DIO is a helpful concept for both the company and its investors, it has certain limitations.

1. Erroneous Demand Forecasting

Incorrect or inaccurate demand forecasting contributes to inventory-specific challenges such as excess stock or stockouts and incorrect DIO value.

2. Procurement Delays

Delays in the procurement of raw materials are one of the biggest factors contributing to higher DIO. You can mitigate this challenge by not entirely relying on a single supplier.

3. Dependence on Legacy Tools

If you’re using an obsolete legacy tool to manage your inventory, you may suffer from a lack of data integration, and synchronization, which can impact the DIO.

5 Proven Ways to Improve Your DIO

Let’s discuss some of the proven strategies to improve your DIO, enhance inventory efficiency, and reduce inventory storage costs.

1. Improve Supplier Relationships

Delays in the supply of raw materials can increase your DIO. There are ways to reduce this risk of disruption. For example, you may use the Procurement Management System to track vendor performance and maintain healthy relationships with your suppliers. You may also purchase the raw materials from multiple suppliers to reduce the risk of disruption and maintain an ideal DIO.

2. Run Targeted Campaigns

Poor sales can lead to higher DIO. You can take a variety of measures from simplifying your customer’s experience, providing multiple payment options, optimizing delivery performance, and running targeted marketing campaigns. Furthermore, you can also implement a dedicated Sales Management System and CRM System to manage your marketing needs and customer experience through a single platform.

3. Clear Old Inventory

Offload your excess stock by organizing flash sales, exclusive deals, and discount offers. You can also offer “Buy one, get one free” offers to clear off your old inventory and make room for new items.

4. Accurate Inventory Planning

Using Inventory Management System will help you plan and forecast your inventory accurately. By aligning your inventory levels to the actual market demand and choosing the right inventory method (such as the FIFO method or LIFO method), you will be able to prevent under & over-stocking and improve your DIO.

5. High-demand Products

Having too many low-demand products in your inventory can lead to delays in the product lifecycle and a cash crunch. Move your focus from low-demand products to high-demand products to clear inventory faster and improve your DIO.

Difference Between Days Inventory Outstanding (DIO) & Inventory Turnover Ratio (ITR)

Both DIO and ITR are often believed to be the same concept, however, they slightly differ in one or more aspects. Here’s the key difference between them:

| Days Inventory Outstanding (DIO) | Inventory Turnover Ratio (ITR) | |

| Definition | Days Inventory Outstanding (DIO) indicates the number of days it takes to sell your inventory within a stipulated period of time. | Inventory Turnover Ratio (ITR) indicates the number of times it takes to sell your inventory and replace it with other stock within a stipulated period of time. |

| Formula for Calculation | DIO = Average Inventory / Cost of Goods Sold * No of Days | ITR = Cost of Goods Sold / Average Inventory |

| Units of Measurement | No of days | No of times (Turnovers) |

| Idle Value | Lower DIO is generally preferred | Higher ITR is generally preferred |

| Benefits |

|

|

Wrapping Up

Days Inventory Outstanding is an important formula that lets you understand how long you hold your inventory before it is sold to the final customer, and take strategic measures to improve your inventory turnover, reduce holding costs, and enhance your profit margins.

Sage X3 is a top-notch solution that helps you maintain balanced stock levels, understand the degree of stock control effectiveness, and align your stock handling strategies with changing market needs. It is a must-have tool for identifying and fixing any discrepancies in your inventory forecasts & actual sales and deploying more effective strategies for long-term growth & success.

FAQs

1. Which Industries Have a High & Low DIO?

Industries with higher DIO:

- Automotive industry: This is particularly because this industry deals with high-value & complex products. They use an Automotive ERP to optimize their inventory planning & forecasting.

- Aerospace industry: They deal with large investments and complex manufacturing processes, which necessitates the need to use an ERP in Airline Industry.

- Real estate industry: Higher prices and lengthy buying procedures result in higher DIO in the real estate industry.

- Luxury goods: Luxury products are costly and thus they have a lower turnover and higher DIO.

Industries with lower DIO:

- FMCG industry: The FMCG industry deals with food, beverages, and personal care products which have a higher consumption rate, and thus, lower DIO.

- Retail industry: The retail industry attracts new customers through sales promotions, events, and discount offers. Retail ERP helps them with various aspects of their business.

- Consumer electronics: The consumer electronics industry is witnessing new technological breakthroughs and innovations, which creates demand spikes for their products.

- Pharmaceutical Industry: There is a rapid demand for life-saver medicines and medicines move quickly through the supply chain. Additionally, the pharma industry also benefits from the Pharma ERP Software.

2. What is the Ideal Days Inventory Outstanding (DIO) Number?

There is no one-size-fits-all answer to this question. Typically, 30-60 days is considered an ideal DIO. However, it depends on the industry to industry, size & complexity of each organization. A 30-day DIO might be ideal DIO for one industry but it may be considered too high for another industry.

3. What are the Impacts of Days Inventory Outstanding on Accounting?

Here’s how the Days Inventory Outstanding affects the company’s books of accounts:

- Cash Flow Statement: A higher DIO negatively affects the company’s Cash Flow Statement. As the company’s significant capital is tied up in inventory, it will suffer from a cash crunch problem.

- Balance Sheet: Businesses record the Inventory in the Current Assets section of the Balance Sheet. A higher DIO will inflate the value of the current assets.

- Income Statement: If a company is holding higher inventory, it will increase the inventory storage costs, reduce profit margins, and be reflected in the Income Statement.

4. Is the Higher DIO the Better?

No. Typically, a lower DIO is favorable because it indicates efficiency in terms of the company’s handling of inventory, i.e. the company is benefiting from inventory optimization, lower inventory costs, and better sales. The company will be able to sell its inventory at a faster rate and generate more revenue, which can be deployed in other projects and business expansion. In contrast, a higher DIO indicates the company is holding more inventory and is likely to face a cash crunch.

5. Are Days Inventory Outstanding & Inventory Turnover Ratio the Same Concept?

Days Inventory Outstanding and Inventory Turnover Ratio are both interrelated yet distinct concepts. Inventory Turnover Ratio suggests the number of times an inventory was sold and replaced by other stock during a specific timeframe (such as a year). It is measured in the number of turnovers. In contrast, Days Inventory Outstanding suggests the number of times an inventory was sold during a specific timeframe. It is measured in the number of days (such as 30 days, 60 days, 90 days, etc.).