In this blog, we are going to take a look at using the ADDITIONAL cost update functionality in Sage X3. What the cost update function does allows you to update costs for stock issues.

For example:

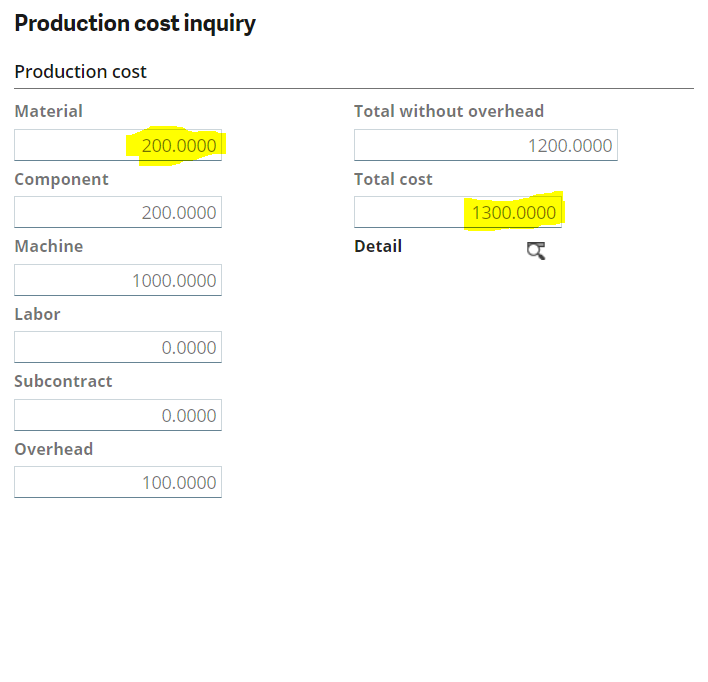

You create workorder for a product and it has cost to it and let’s say one of the components you used comes in with an standard cost is 100 INR so let’s say your ADDITIONAL invoice for 100 INR you receive it you consume it in a workorder you complete you product you cost the work order everything’s said done have a cost on that finished good that has now consumed so let’s say it’s one component and that goes into the work order so if its 100 INR you make one the cost is 100 INR there is no labor, machine cost is 1000 INR and over head cost is 100 INR then your ADDITIONAL invoice for that component that you received in that 100 INR comes in at 200 INR the cost update function allows you to after the fact update the cost of the raw material and the finish good.

So I will show you the set up and how that works below.

Cost Update Functionality after Production Tracking in Sage X3

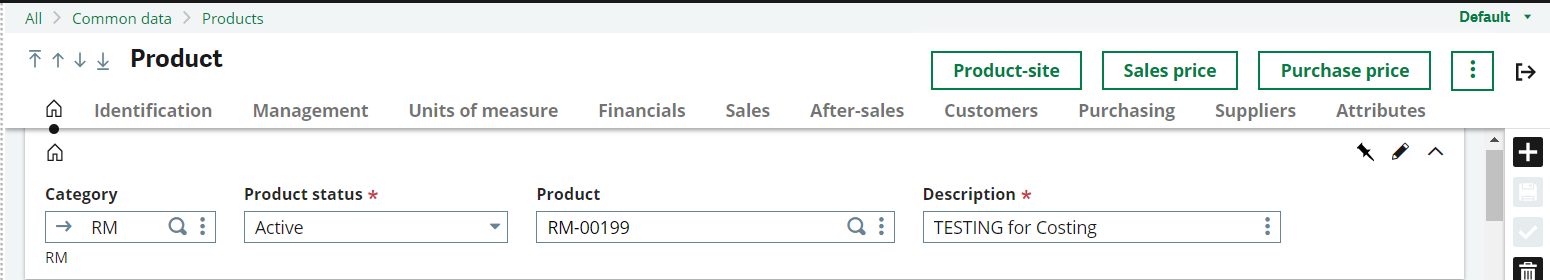

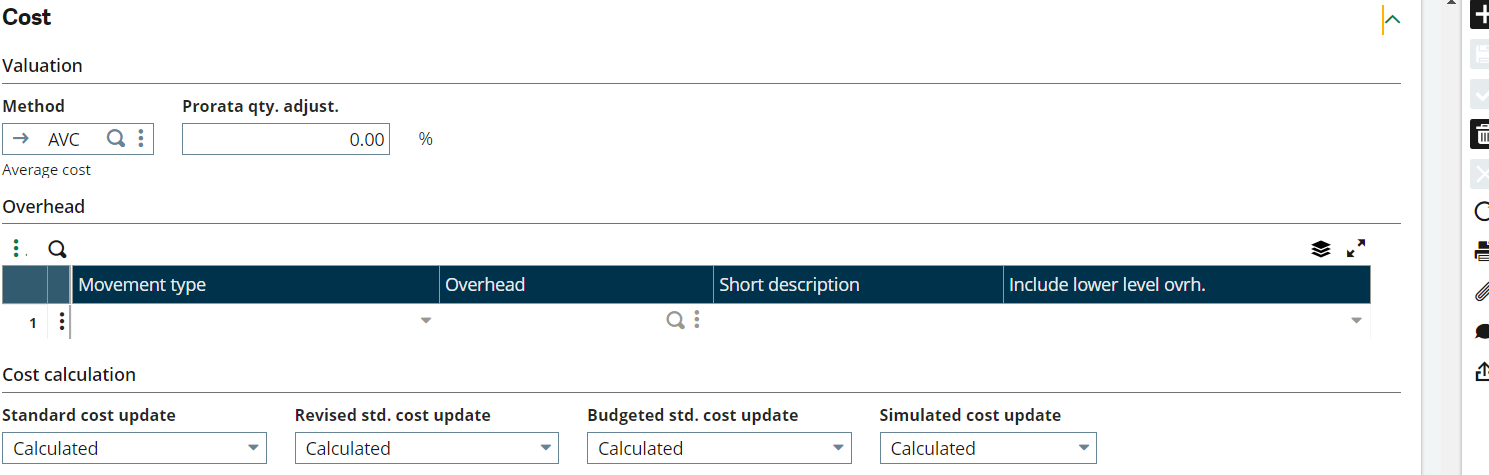

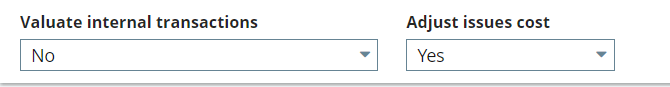

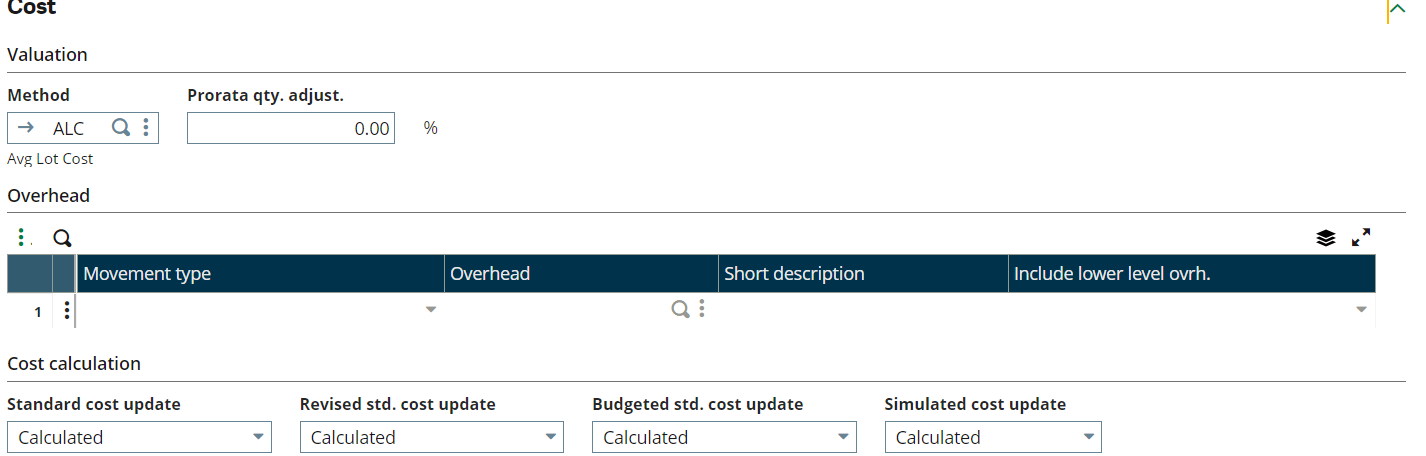

Take a look at the products first of all so I have a couple of test products set up test parent and test child you know create a created a BOM for the parent that uses just quantity one on the child so we’ll go in and take a look here’s my test parent now I created the product records but the setup we need to look at in the product site information so the costing method for this to be valid to use has to be average cost average lot costs FIFO anything but standard or revised standard okay it’s got to use an actual costing basis or roasters if you’re using standard costs there’s no point in updating the actuals because you’re using standards so average costs typically what you would use and other than that that’s all you need to do on that setup then within the costing method there’s also another critical setting you have to turn on and that’s a just issues cost this allows this costing method to be eligible to run the cost update function

Created Raw material RM00199

Jumped into that product site of that product and checked for cost valuation

Then jump into the cost valuation and set up adjust cost to Yes.

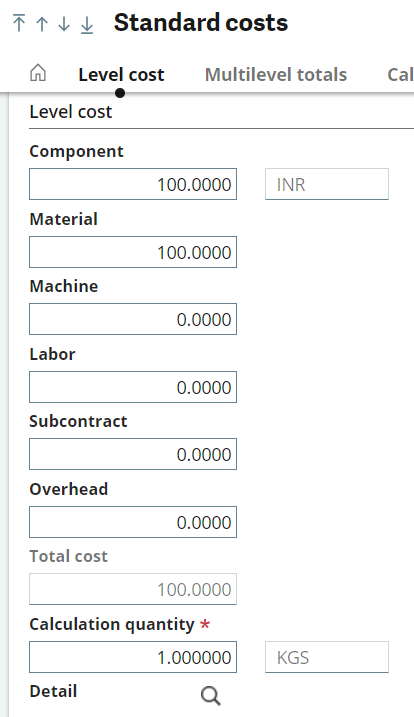

For that raw material updated standard cost

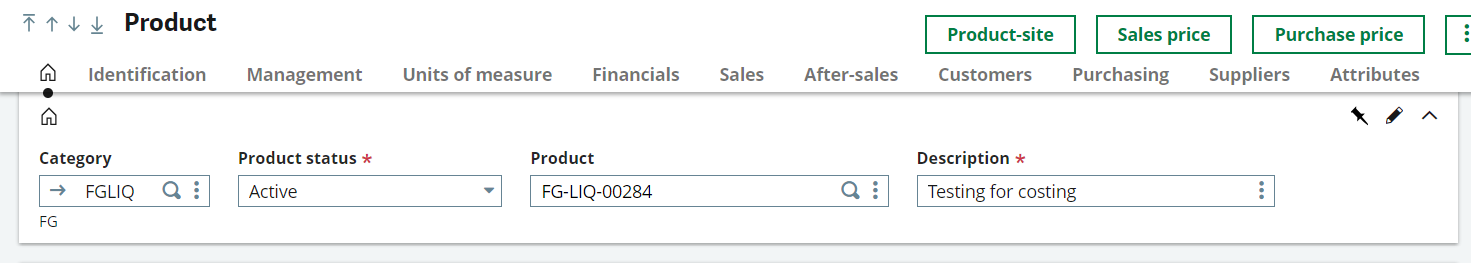

Created FG-LIQ-00284

Jumped into that product site of that product and checked for cost valuation.

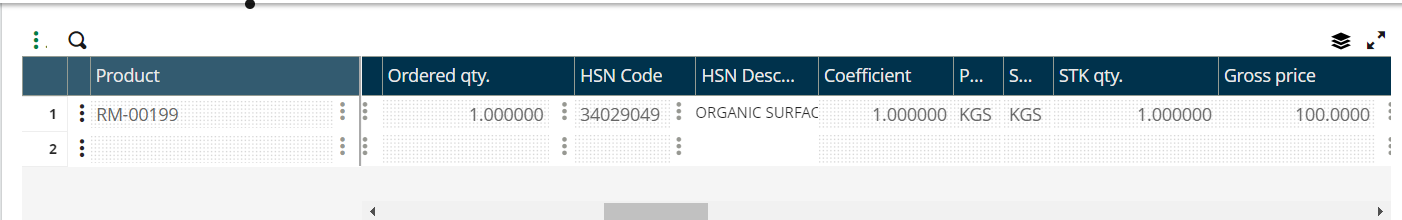

Created purchase order with raw material RM00199 as mentioned gross price rupee 100

Purchase order number: GGOC/PO/202300582

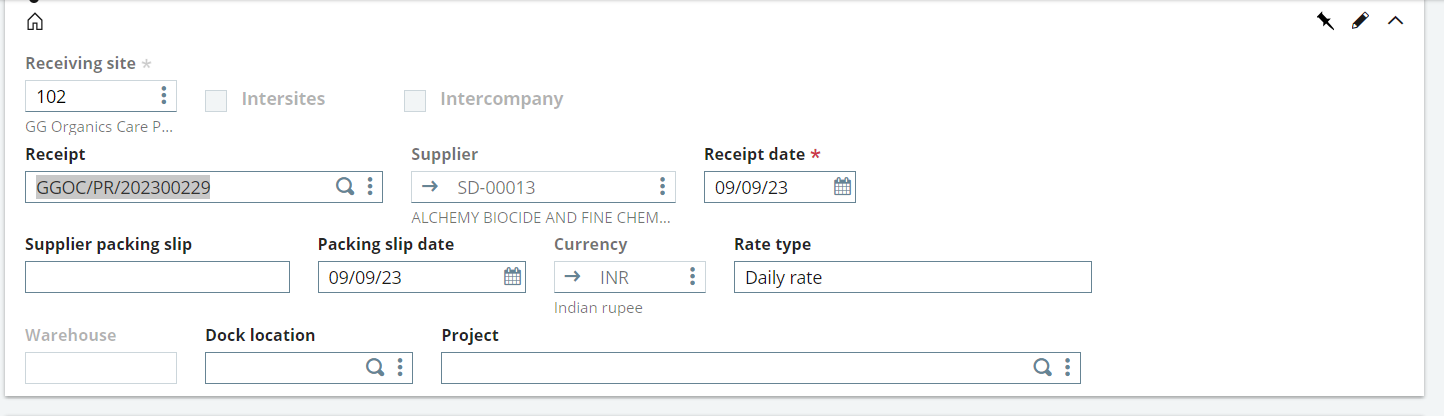

Created purchase receipt with respect to purchase order

Updated standard cost of RM00199

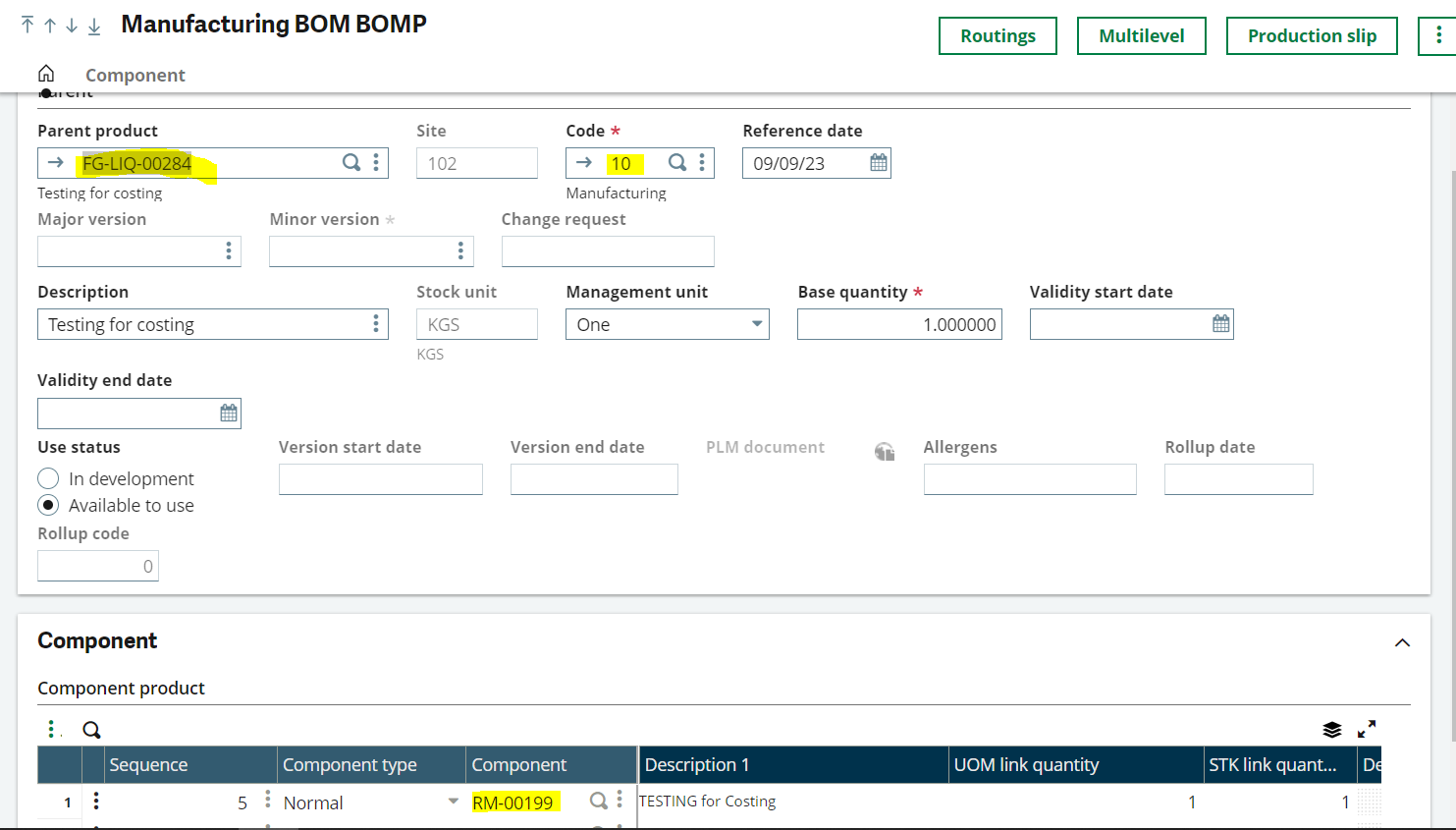

Created production BOM for FG-LIQ-00284 with respect to the component R00199 and created routing with WorkCentre

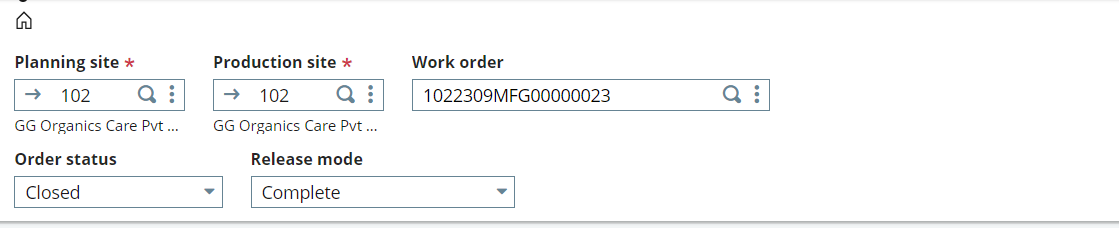

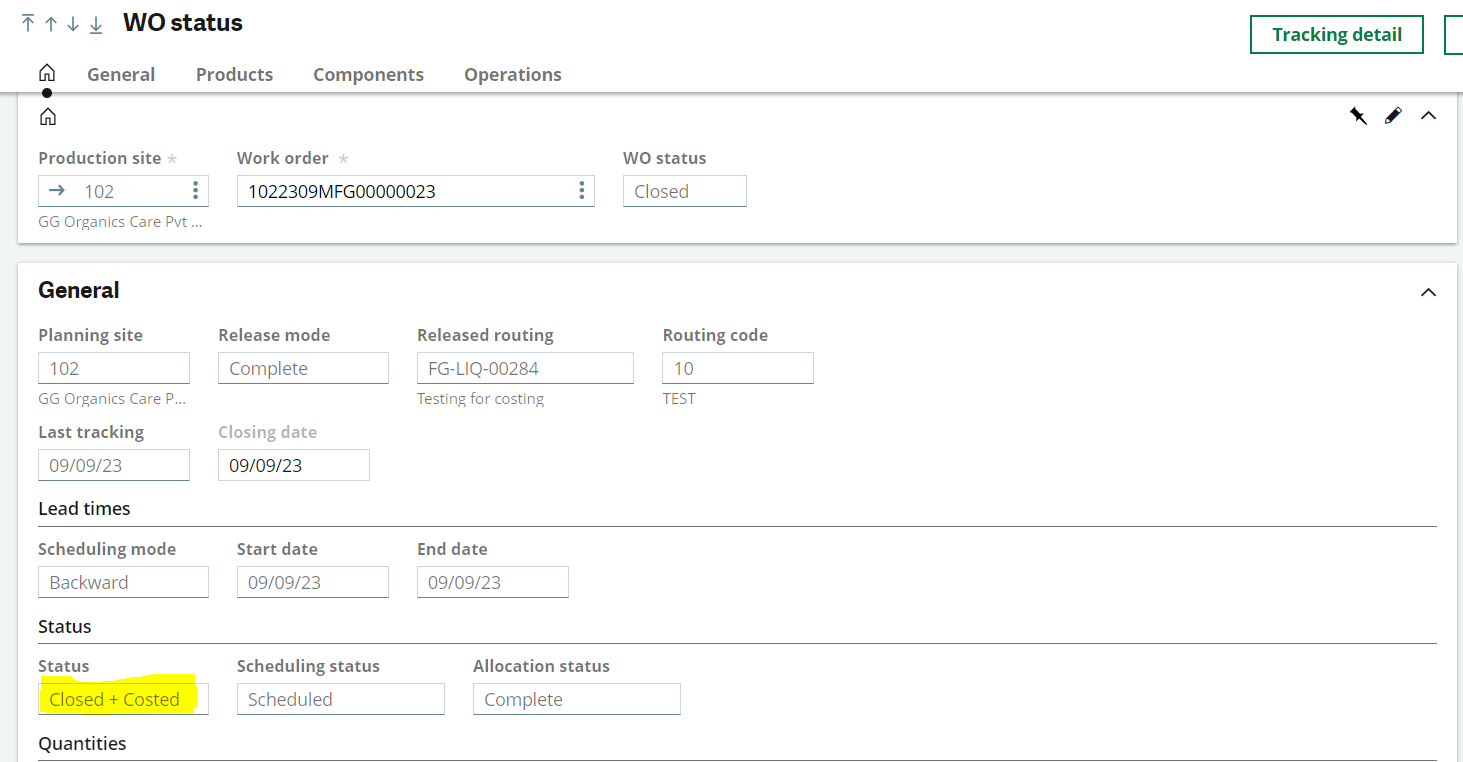

Created work order ,production tracking and work order closed after creating production BOM

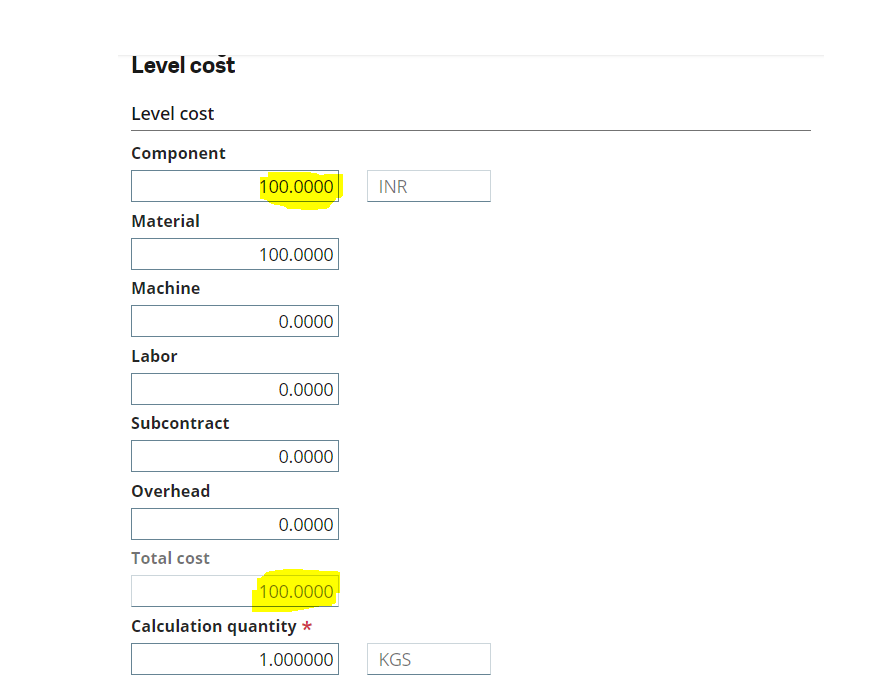

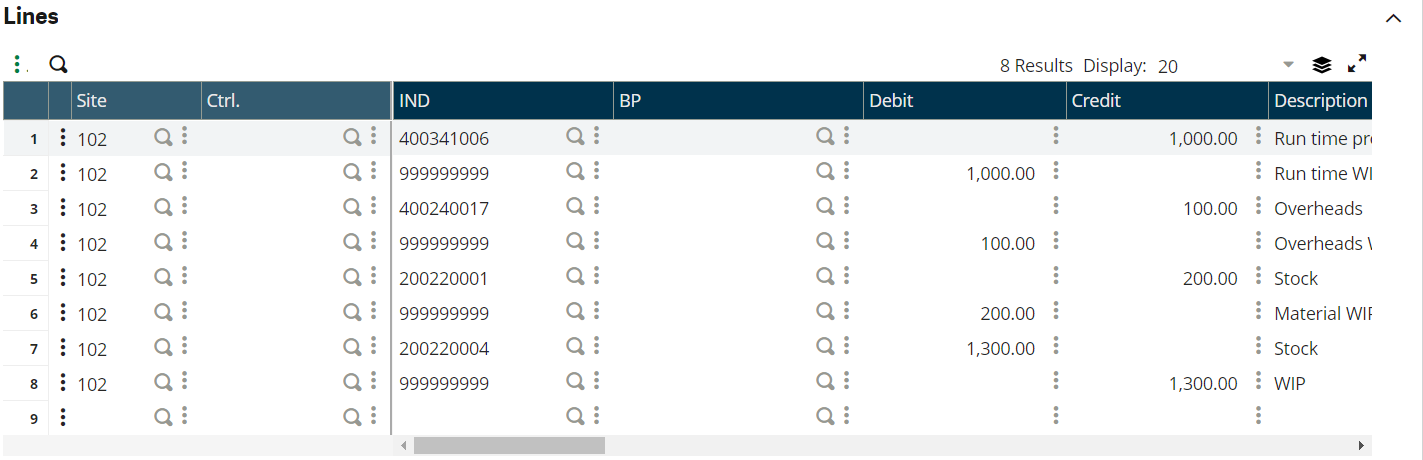

Before creating ADDITIONAL the material cost as 100 rupees and total cost 1200 rupees, After creating ADDITIONAL did cost adjustments after that the material is updated as 200 rupees and total cost as 1300 rupees

ADDITIONAL number: GGOC/ADDITIONAL/2023036

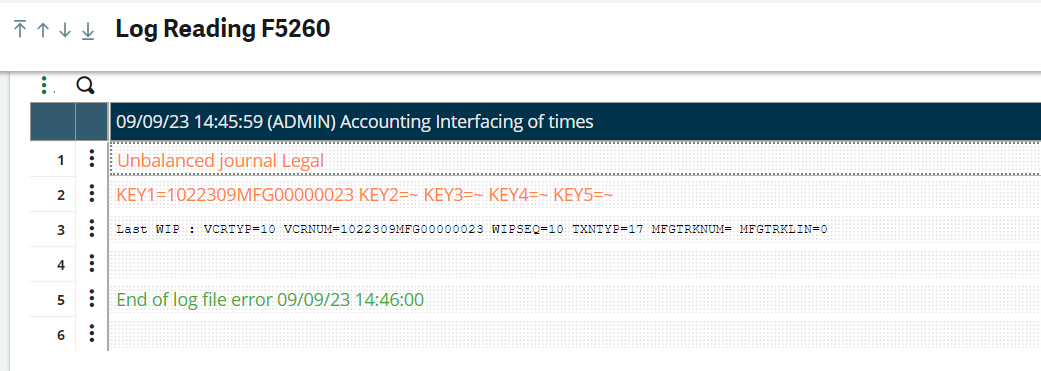

After that Tried to post WIP posting in costing getting error like unbalance journal legal

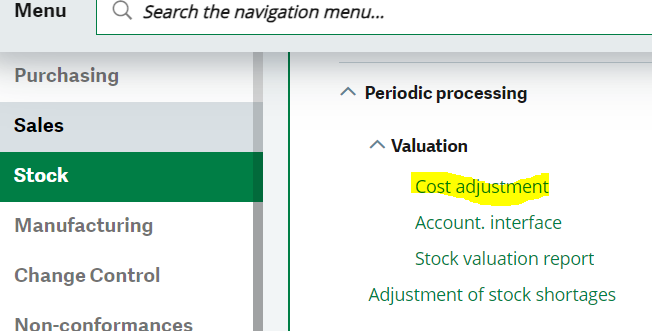

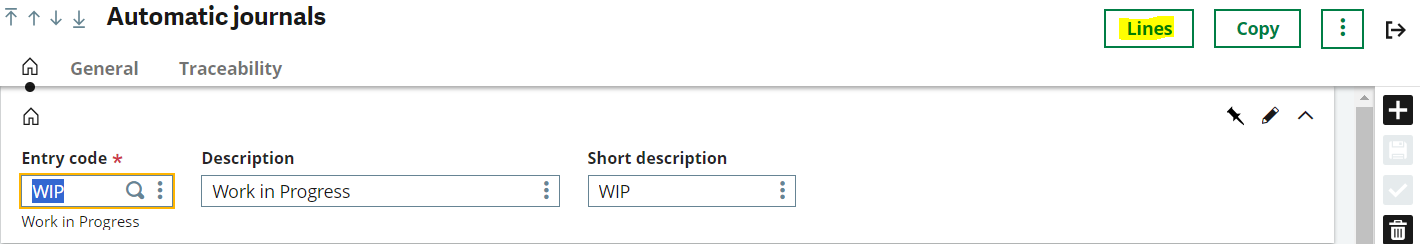

If we get any error like above screenshot then we need to go for automatic journals and select WIP then click on lines.

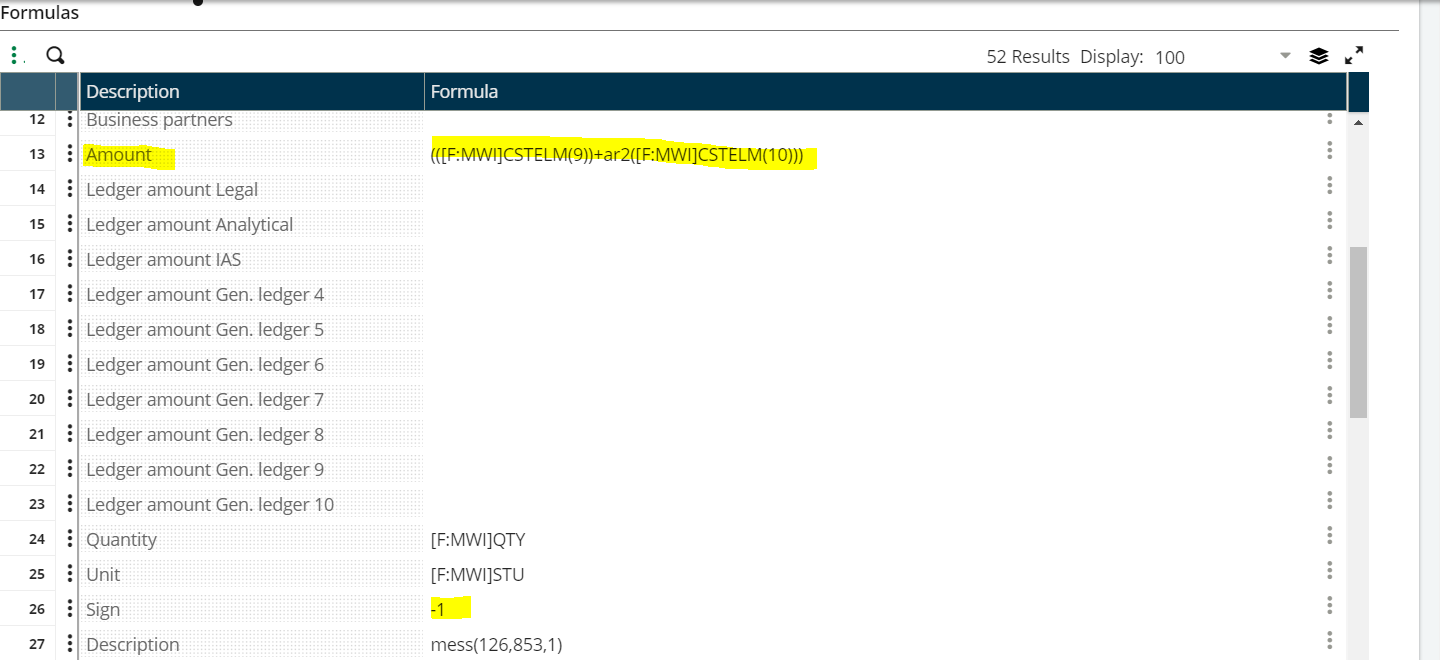

Click on 35 line then change the formula (([F:MWI]CSTELM(9))+ar2([F:MWI]CSTELM(10))) in amount tab and change the sign 1 to -1 then save.

Once try to post the WIP then WIP impacts will be generated.