A CFO is a critical post in any company that supervises various department functions. Some of the crucial financial tasks that a CFO has to carry out are:

1. Brainstorm profitable financial strategies.

You should be able to devise pricing strategies that are profitable to your customers and your company.

2. Forecasting short and long-term revenue.

You should possess the knowledge, skills, and expertise to forecast your SaaS business’s short- and long-term revenue. It includes calculating monthly recurring revenue (MRR) and annual recurring revenue (ARR).

3. Decreasing churn rate

Apart from creating concrete financial and pricing strategies, you are also expected to devise techniques and methods to decrease the churn rate to its bare minimum.

The first 90 days play a pivotal role in your career as a CFO of a SaaS company. It projects your skills, expertise, experience, and determination to succeed and tells your senior management you have what it takes to grow the company.

Are you already working as a CFO in a SaaS Company? If not, we will first delve deep into the questions you should prepare for landing a CFO role. And after that, we will recommend the main points you should keep in mind for the first 90 days as a CFO.

Interview tips & tricks for landing a CFO role

Interviewing for a senior role in a SaaS company is challenging, but you can keep the following points in mind to subside your fear and fare well in the interview.

Mark the following list:

1. Get a deep understanding of the company

It would be best to comprehensively understand the company’s vision, mission, values, and culture. Then, check whether your interests align with the company’s culture and whether you are passionate about achieving their short- and long-term goals.

2. Focus on the following three questions

Pay attention to the following three questions before making the final call to join the SaaS company.

- What are the primary challenges facing the SaaS company?

- Do you have the required skills, knowledge, and expertise to solve those challenges?

- Would you like to invest time and are you passionate about solving those challenges?

3. Be an equal partner in charting your CFO journey

Most newly hired CFOs make the mistake of accepting the 90-day action plan designed by the interviewers and other panel members in the senior management. As a result, your performance will be suboptimal for the first 90 days, which can form a bad image in front of the senior leadership.

Below you will find a list of what should be your approach in the first three months.

Month 1: Listen & learn as much as you can

The first month is about listening, communicating, and assimilating as much information & data as possible.

In the first month, learn the company’s mission, vision, and values. Then, pay attention to their strategic positioning, customer segment & target market, and get an in-depth understanding of their products and services. Other essential things you should know about are:

- What market segments do they offer products — niche or general?

- Which marketing metrics do they use as benchmarks?

- What is their investment strategy and how do they raise funds?

It would be best if you note down these facts & figures in a notebook that you can refer to again. It would help if you also formed robust relationships with many employees to bank upon at times of need. Genuine relationships help you seek answers to difficult questions, get sincere feedback, and seek valuable insights.

Keep this famous quote by Richard Branson always handy.

At least in your first month as a CFO, you should listen more than you speak. Once you get a clear sense of your challenges, risks, and what you are expected to do, you will be able to deliver your best.

Month 2: Start prioritizing and strategizing your activities

After assimilating critical business information, it’s time to plan, strategize, and brainstorm effective market strategies to keep pace with changing market trends and customer preferences. So, now it’s time to implement business management solutions and find solutions to critical business issues.

This discussion brings us to the essential term “organizational capital”. And there are two things you must consider while discussing this topic:

1. Leadership capital: It refers to the goodwill you have generated with your fellow team members while you are working in the company. Another important thing is your leadership style. A CFO should be a powerhouse of energy. They should know when to sit with team members like a friend, when to handhold them, when to admonish them, and when to threaten them with punitive action.

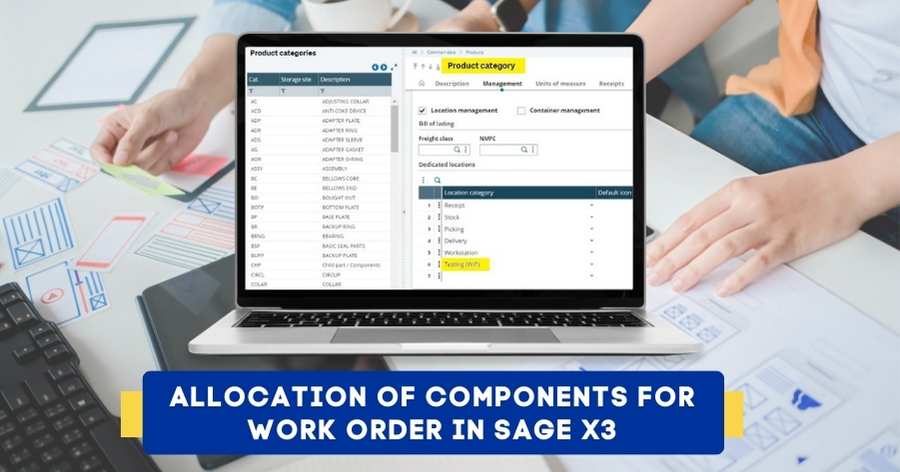

2. Integrating technology: Organizational capital focuses on implementing business management solutions to enable the SaaS company to scale up quickly and efficiently. These include Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems that help increase productivity, enhance efficiency, cut operational costs, and forge robust customer relationships.

Focus on developing both components of organizational capital in the second month. Along with implementing the best quality control mechanisms and automation technology, you should also focus on developing strong relationships with your team.

Month 3: Implement & Act

After two months of intense deliberation, brainstorming, and forming better relationships, it’s time to implement your learnings and get into action mode.

So, here are three essential accounting processes that SaaS companies need to streamline:

- Internal reporting: What KPIs are being used as a benchmark for evaluating accounting processes? Based on what metrics are these KPIs selected? How often are these KPIs tracked?

- External reporting: Are the company’s external reports precise, accurate, consistent, and reaching the right people?

- Taxes & compliance issues: With automated accounting software, calculating taxes and adhering to compliances is easier than ever.