Summary: In the past, distilleries depended upon age-old tools to manage their finances, including endless Excel sheets, post-it notes, and manual spreadsheets. But with the advent of modern business management solutions like Enterprise Resource Planning (ERP) software, it has become easy for distilleries to streamline business operations and address challenges in a better way. Distillery ERP software allows companies to systematically organize and effectively run logistics, manufacturing, operational, and accounting & financial systems. The accounting module consists of features that help solve the various accounting challenges that distillery companies face daily.

Distillery companies must watch their profit margins to get a complete understanding of their profitability.

The profitability of distillery companies is dependent upon two things, namely the cost of manufacturing the beverage and its selling price. So, the more control you have over the manufacturing cost, the higher the probability of running a profitable business. But there are several challenges while calculating the final cost of the beverage.

Let’s start by learning about relevant accounting strategies to understand the various production costs involved in the process.

Basic Accounting Principles

Let’s start by learning about two essential accounting principles:

- COGP (Cost of Goods Produced): It includes all the costs involved in manufacturing the final beverage, including labor, raw materials, overheads — direct and indirect costs, services, quality & assurance, and bottling the manufactured beverage.

- COGS (Cost of Goods Sold): It refers to the cost of beverages sold within a specified duration — monthly, quarterly, half-yearly, annually, or any random period.

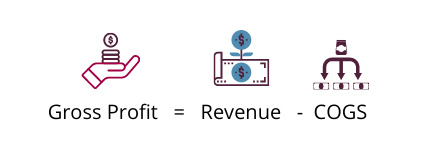

Two things are recorded when a beverage is sold — the cost of making a beverage (recorded as COGS) and the revenue earned from the sale of that beverage.

The difference between the beverage’s COGS and the revenue generated is the gross profit.

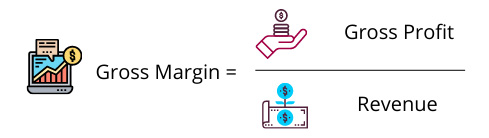

Understanding Gross Profit margins

Calculating the gross profit margin is the stepping stone towards gauging the distillery company’s profitability. You can calculate the gross profit margin in two steps:

Accounting methodology

Distillery companies often use GAAP accounting principles while generating financial statements. This is because it provides a more accurate reflection of the business’ performance when compared with other tax-related accounting methods.

Inventory Methods

The multi-year beverage production process poses many inventory cost-related challenges because there’s a time lag of several years between when the production costs were incurred and when the beverage is finally sold. Therefore, distilleries have multiple years of beverages in stock spread across varying production stages.

Most distilleries track and report their beverage inventory costs across different inventory pools like packaging materials, bulk beverages, and finished cased beverages. However, there are multiple advantages of separating the costing pools at various production stages, such as error-free tracking of the component costs of blended beverages and more precise allocation of overhead costs.

Now, let’s move towards understanding the various methods for finding the inventory cost. Remember that the technique changes with the production processes involved.

1. Specific Identification (SPID)

The cost of each inventory item is recorded at every stage — from the time they were purchased through the time the beverage is bottled. Accurate data input and recordkeeping are used to track costs throughout the manufacturing process. You can calculate wine yields or exact juice for different varieties of wine grapes through this method. Moreover, you can trace each barrel used for each beverage lot as they are blended to their final form.

2. Average Cost

Using this method, you can calculate the mean value of similar items available during a given period. You can also use average, weighted average, or other ratios if tracing costs isn’t easy. This method is best suited for calculating the cost of consumable supplies, including sulfur and yeast, and additional costs associated with utilities, storage, and labor.

3. First-In-First-Out

Under this method, beverages that were manufactured first are also sold first. However, the case may vary in the case of wines.

4. Last-In-First-Out

In this method, beverages that are most recently manufactured are sold first. Unfortunately, this method is unsuitable for most distilleries, especially those that produce wines, because vintage-dated wines are sold first.

Wineries that use LIFO for tax purposes typically use FIFO or SPID for managerial accounting purposes and adjust finance-related data to LIFO for tax and financial reporting purposes.

Most significant cost categories

The Financial Accounting Standards Board (FASB) states that companies should consider material costs and other overhead costs such as labor, depreciation on production equipment, facility costs, and additional business operation costs that support production. Beverage production facilities involve unique processing activities and costs. And each activity consists of at least three types of expenses, namely labor, materials, and overhead. Let’s see them one by one.

1. Labor

Labor is the primary force behind turning raw materials into finished products. It includes various components like wages, salaries, and other costs like payroll taxes and benefits. Calculating the compensation of founders and executives is challenging because they work across multiple departments inside the distillery company. So, the standard method used for estimating their compensation is by figuring out the time they spent across each department and then applying the appropriate percentage of the expense.

2. Materials

Calculating the price for materials is very straightforward. The final cost depends on the amount to acquire the materials, including shipping costs and tax spent on bringing the materials to the production location. Remember that the cost of packaging materials varies according to their use.

3. Overhead

Overhead costs depend on factors like manufacturing facility size, rent of the facility, shared use of the facility for varying purposes, and other customer services.

Other examples of overhead costs include:

- Insurance

- Depreciation of production equipment

- Maintenance & Repairs

- Insurance

- Lab fees

- Cleaning supplies

4. Shared Expenses

A distillery has various departments that have a few shared expenses. Here are a few examples of such shared expenses:

- Utilities: Electricity and other utilities can be divided amongst various departments based on their usage detected through dedicated usage meters. Many countries provide additional tax credits for manufacturing-related activities based on utility studies conducted by third-party vendors that perform tests to determine average usage by manufacturing activities.

- Facilities and equipment: This classification applies to rent or depreciation of shared equipment and facilities, which can be split by the area occupied by the tasting room, administration, production, and marketing. Equipment can be utilized across various functions and assigned on a rational and reasonable basis.

- Wages: Few distilleries assign a small percentage of wages paid to administrative employees for the work they perform to support production activities.

You must understand how much it costs to produce beverages to gauge the profitability and performance of your business. There are two parameters to do that, namely COGP (Cost of Goods Produced) and COGS (Cost of Goods Sold). Since few beverages take about two to four years to become ready-for-sale, it’s essential to calculate the cumulative cost of producing that wine i.e., its COGP — from beginning to end. First, the production cost, which includes labor, raw materials, production equipment, and overhead costs is recorded in the balance sheet as an addition to the cost of beverage inventory. Later, when the finished beverage is sold, the expenses incurred while manufacturing the product, i.e., the COGP is recorded as the COGS for that specific period. Moreover, an equivalent offsetting entry is made to minimize the inventory value in the balance sheet.

You will run a profitable distillery company if you understand the COGS of the business. COGS will give you a complete picture of the direct and indirect costs that you incur during the entire beverage manufacturing process. There are seven essential steps in this process, which are as follows:

1. Appoint the right personnel

The steeping stone to create a highly efficient COGS system is to identify the correct personnel — external and internal — who understand the nitty-gritty of the accounting principles that a specific country follows for accounting COGP and COGS.

Another crucial point for the company’s management is identifying the end-users of the financial statements, including a board of directors, advisors, vendors, investors, lenders, or acquirers. The finance module of the Distillery ERP software allows collecting and updating financial statements quickly and provides access to only relevant stakeholders. So, you don’t have to worry about critical financial data falling into the wrong hands.

2. Set top-notch Reporting standards

The global distillery industry generally follows the GAAP standard. This is especially true for large conglomerates. On the other hand, small organizations can modify reporting standards based on their system limitations and budget constraints.

Moreover, as described in step 1, any user can ask for financial statements based on GAAP standards and may even request scrutiny from an independent CA to check whether the distillery company complies with the GAAP standards.

The best part about Distillery ERP software is that it generates top-notch reports compliant with GAAP standards. These reports provide all the required information to the users that help them derive valuable insights from it.

3. Create a ledger to categorize costs

After taking care of the reporting requirements, you must create a general ledger that records expenses in defined categories and at the appropriate unit of account. It enables easier extraction of costs to be examined from the inventory costing process. Typically, the three major categories of expenditure in a distillery company are as follows:

- Labor

- Materials

- Overhead

Distillery ERP software sets up a general ledger that accounts for all the expenditures in the beverage manufacturing process. The best part is that it records all the expenses automatically. So, you don’t have to assign this duty to any employee. Instead, you can assign them mission-critical tasks that require intelligence and creativity.

>>>Also Read: General Ledger integration with Tax Services | Sage 300cloud<<<

4. Set up processes for collecting and reporting expenditures.

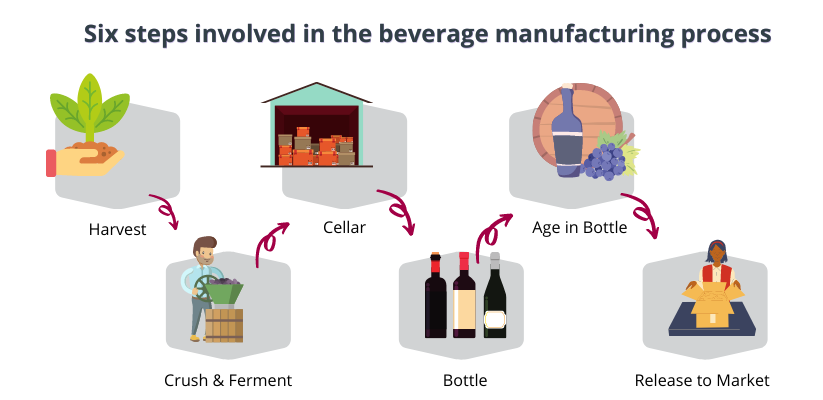

The fourth step is to define internal protocols for appropriately recording COGP and create a process that records costs allocated to separate lots and assigned between various departments. Ideally, it would be best if you created departments that correspond to the natural flow of the beverage manufacturing process.

Distillery ERP software captures the cost of running and operating your facility across the beverage manufacturing process. These costs are then assigned to the stages as mentioned in the schematic above.

Internal protocols

Incorrect input costs can impact the final product cost calculation and generate an erroneous profit margin. Therefore, one of the most significant parts of accurately defined internal reporting protocols is setting up a system that provides data regarding inventory flow and quantities. A free flow of information between the accounting department and the manufacturing staff is essential for accurate COGS calculations and establishing exact inventory values.

Distillery ERP software allows the staff to take care of the following measures to promote the accuracy of the inventory values:

- Records and update the condition and quantity of raw materials and packaging supplies upon finishing the beverage-making activities.

- Institutes average production volumes to establish correct rate allocations and monitor when those values diverge from the predefined baseline.

- Maintains precise information regarding the changes in the beverage volume to make relevant adjustments in the inventory values.

- Communicate the final production counts using a label.

>>>Also Read: ERP for Alcohol & Distilleries Industry<<<

5. Creating costing protocols

Different beverages require varying periods to manufacture, ranging from many months to a few years. Therefore distilleries need to maintain other costing protocols to take into account all these factors.

Distillery ERP software takes input from the manufacturing team, production staff, and all other departments in the company that helps ensure that the costs reflect the level of effort and input necessary for manufacturing different types of beverages. The inventory accounting personnel also plays a crucial role by routinely observing the beverage manufacturing process and noting the changes in the process that influence data collection or accounting costing approach.

You can start by creating a spreadsheet that considers every component in the production cycle, including labor, raw materials, services, overheads.

6. Perform inventory accounts

To properly apply costs, distillery companies must maintain a complete record of inventory quantities across each production stage along with the cost of product information. So, an efficient inventory count system — including manual counting and an automated inventory tracking system — is indispensable for distilleries.

A physical count is done every month or quarter and the results are displayed at the end of every reporting period. Sometimes, owing to contractual or regulatory requirements, the inventory counts are done more than once in an accounting period. Nevertheless, each distillery business must conduct an inventory count at least once at the end of each fiscal year. A distillery ERP software allows companies to automatically perform inventory counts quickly and efficiently.

7. Set up a Point-of-sale (POS) system

A POS system is ideal for distillery companies with a robust online presence, including eCommerce, tasting rooms, and wine clubs. Today, with advancements in distillery ERP software, even small distilleries can use ERP software for accepting credit card payments. However, the most crucial benefit of using distillery ERP software is that it allows beverage manufacturing companies to leverage a POS terminal to minimize the transaction complexities associated with accounting.

POS terminals provide the following three benefits:

- Critically examine credit policies.

- Track and reconcile payment types which are helpful for better accounting and bookkeeping information.

- Record sales of each item that helps analyze the final inventory.

POS terminals also eliminate the risk of internal theft in retail operations. For example, they can verify the amount of cash deposited in the company’s bank account by counting the money collected in the tasting room. Moreover, it also calculates the depleted inventory and the potential losses recorded in the room.

>>>Also Read: Benefits of ERP and POS Integration<<<