ERP for financial services eliminates accounting errors and helps achieve operational excellence through automation of finance workflows, such as AP automation. With its range of industry-specific features, from multi-entity insights to budgeting and planning, Sage Intacct maximizes ROI for finance companies by ensuring the most productive use of time.

Highlights of Sage Intacct ERP for financial services are as follows:

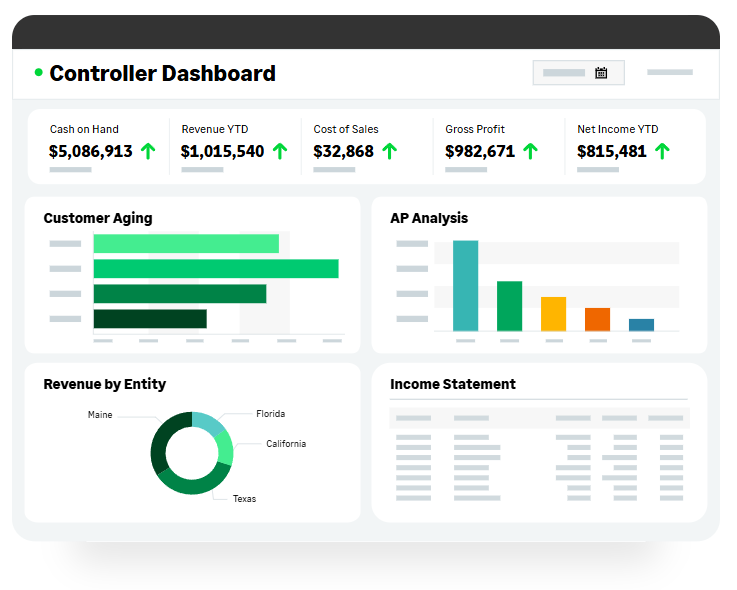

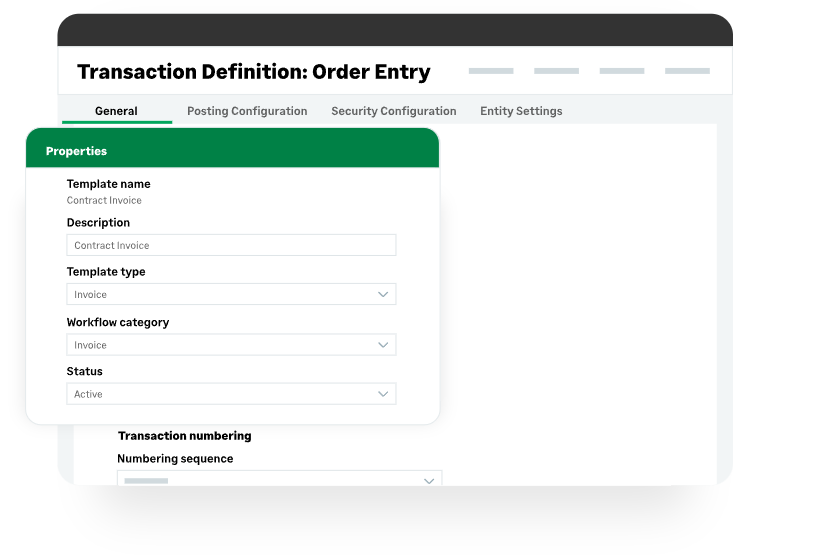

- Robust core accounting: Meet the highest standards of accounting with rich features of Sage Intacct, such as a dimensional general ledger, accounts payable, accounts receivable, cash management, purchasing, order entry, and Sage Intacct Collaborate for real-time team communication.

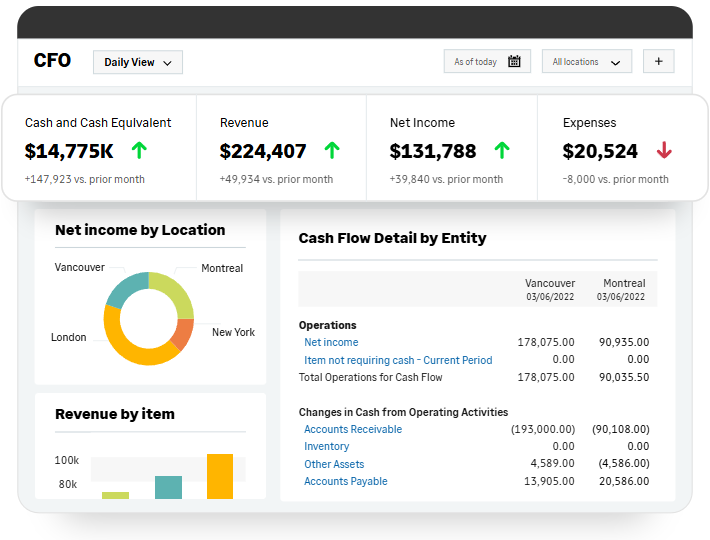

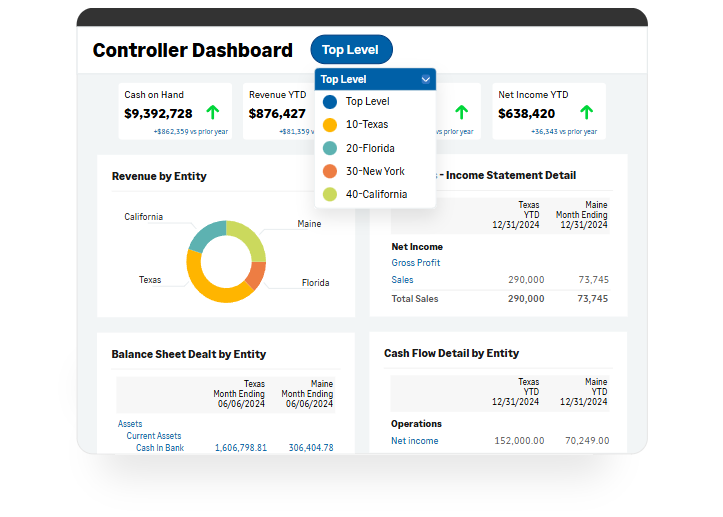

- Multi-entity and global consolidations: Push-button consolidations instantly combine transactions across the organization for a comprehensive view of performance, including inter-entity transactions, decentralized payables, multiple currencies, funds, locations, departments, and more.

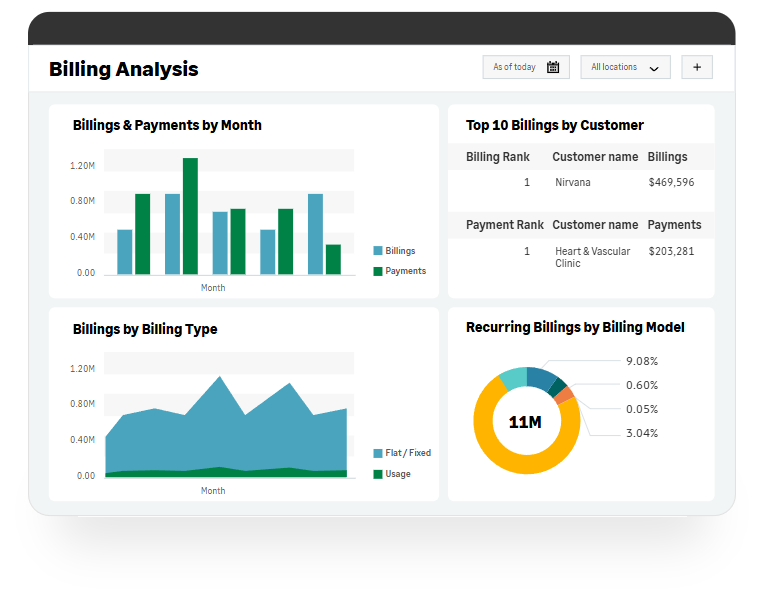

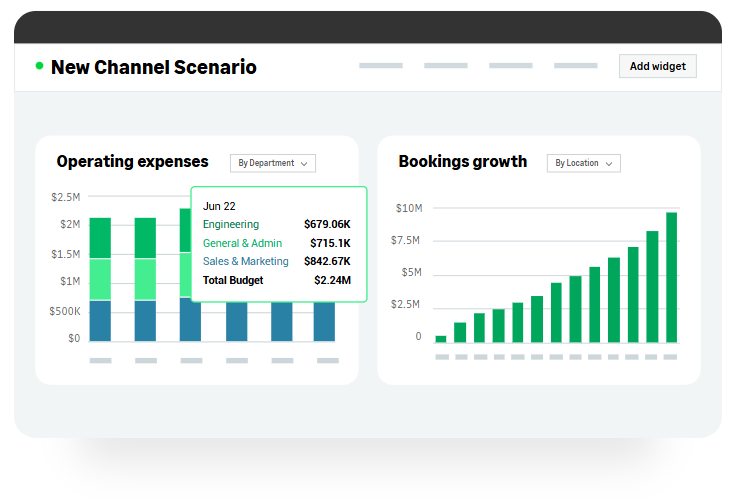

- Reporting and dashboards: Gain real-time access to your company’s financials, from fund performance and AUM to profit and loss, departmental budgets, and employee spending, everything you need to keep your business on the right track.

- GAAP/ Ind AS Compliance & Control: Lower risks and costs with automated workflows, strong internal controls, and easy audit tracking across all departments.

- Real-Time Visibility: Get clear, instant insights by combining financial and operational data, helping you make faster, smarter decisions.

- Cloud Technology with Open API: Easily track key metrics by connecting with systems like payroll, budgeting, CRM (e.g., Salesforce), and others important to your business.