What is Operating Budget?

An operating budget is a financial document that reflects a company’s estimated income and expenses over a specified time and is prepared by factoring in past sales records and current business dynamics to efficiently plan and manage its daily operations.

Put differently, an operating budget helps to maintain a strong working capital, manage resources, and evaluate financial performance. The operating budget defines the financial boundaries within which the firm should operate and is an effective tool to achieve business objectives and prepare for emergencies.

Why is it Important to Have An Operating Budget?

Operating budgets give a solid framework for the company to look up to. As a result, companies are better placed to manage their risks and challenges and formulate growth strategies. They can raise credit, avail bank loans and pay off debts. It’s a means for maintaining a healthy income statement and is commonly used to track the progress of managers.

It is difficult to imagine a growing business without an annual operational budget, as the business can easily lose control over its expenditures or fall into a debt trap. According to the Observer Research Foundation (ORF), 5 to 20% of operational expenses in MSMEs go towards paying electricity bills, highlighting a need for optimizing the use of electricity and opting for sustainable means of energy.

An operating budget is not limited to a specific department in a company. They are used by almost every department to meet its respective goals. The procurement manager uses ERP software to make an operating budget for controlling purchasing costs. Similarly, the production manager for material, labor and overheads and the sales department for planning sales activities.

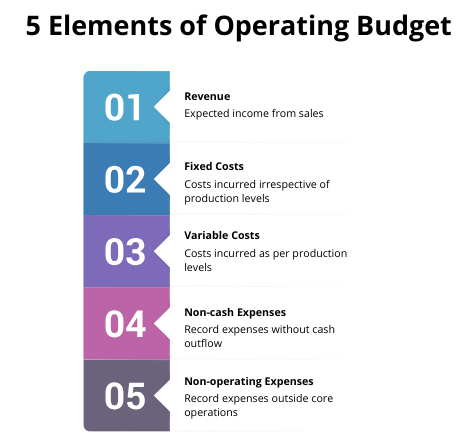

What Are The 5 Elements of Operating Budget?

Here are the various elements included when making an operating budget.

1. Revenue

The operating budget carries all sources of revenue from the sale of products and services. Your manufacturing ERP software aggregates all the income streams from previous years along with the selling price of the product and units sold to help you project revenue for the next year.

2. Fixed Costs

The company has to bear fixed costs irrespective of the production volume. Expenses incurred towards salary, rentals, insurance premiums towards property, equipment and labor safety, and property tax are all part of fixed costs.

3. Variable Costs

All expenses that directly depend on production are included in variable costs, such as wages, cost of goods sold, raw materials, utilities, packaging and freight charges, and equipment maintenance. Also, costs associated with defective products due to quality failure and outdated inventory.

Also Read: What Is Predictive Maintenance?

4. Non-Cash Expenses

Non-cash expenses do not involve upfront payment, yet they have to be included in the operating budget from an accounting perspective. Some examples are equipment depreciation and provisioning for bad debts. Asset write-down for property, plant and equipment or damaged inventory.

5. Non-Operating Expenses

Non-operating expenses are not related to routine production operations, which may include interest payment on property mortgage, and legal costs to be incurred due to disputes with suppliers or clients. Also, maintenance of computer hardware can be added to the non-operating expense account.

What Are The Benefits of Operating Budget?

Let’s look at the most common benefits of making an operating budget.

1. Resource Management

Resource management is crucial to ensure that resources are optimally utilized and adequate funds are allocated for their purchase. An operational budget includes the estimated expenses to be incurred towards sourcing and managing resources, including manpower, machinery and material.

2. Steady Cash Flow

The operating budget helps to maintain visibility into projected cash flow to fulfil working capital requirements and avoid fund shortages. Tools like Accounts receivable automation and accounts payable software track cash inflow and outflow in real time, simplifying cash flow management.

3. Production Cost Management

All costs related to production have to be accounted for ensuring uninterrupted and smooth production operations. Beyond the cost of direct resources used in the production, the operating budget allocates funds for machinery maintenance, quality control and waste management.

4. Performance Review

An operational budget allows the managers to review their performance against the budget and identify scope for improvement within the ERP application. It provides transparent information to stakeholders and investors for profitability analysis.

5. Financial Planning

An operating budget is a crucial tool that helps in long-term financial planning. The projected income, investments, and expenses can all be analyzed with a set of KPIs using business intelligence software for gaining insights and making informed decisions for sustainable growth.

What Are The Challenges In Making Operating Budget?

Operating budgets are not without their share of challenges. Here are some of the common challenges that managers may face in preparing an operating budget.

1. Forecasting Revenue

Forecasting revenue requires careful analysis of past financial records, which can be difficult without ERP implementation. ERP system analyzes historical sales data, including sales volume and selling price, identifying product-wise sales patterns and uses projected selling price and units to forecast revenue.

2. Tracking Expenses

Without an efficient tracking system in place, it may not be possible to get the most accurate operating budget. For example, for a pharmaceutical company, costs related to regulatory compliance, material traceability, research & development may be difficult to track in the absence of pharma ERP software.

3. Allocating Funds

Operating budgets allocate funds to every resource expected to be used. However, it is quite possible to allocate inaccurate funds to a specific resource or a particular activity. ERP system allows you to systematically allocate funds to every resource to help you maintain low per unit production cost.

4. Following Guidelines

An annual operating budget has to be prepared in compliance with the company’s guidelines to avoid going wrong. Budgetary compliance prevents misappropriation of funds and fraud. It also takes into the account long-term financial and strategic goals of the organization.

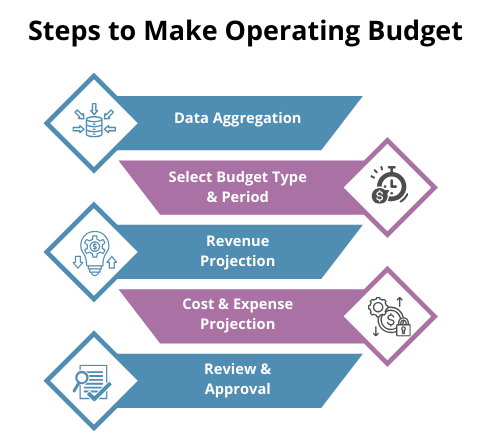

Steps To Make an Operating Budget For Your Company

Follow these steps to easily prepare an operating budget for your organization.

1. Data Aggregation

The first step to making an operating budget is to put all your data together. Your ERP software pulls out all the required data from previous financial years or quarters to help you get started.

2. Select Budget Type & Period

Choose the budgeting method that best fits your requirement for revenue and expense projection. Then select the period for which you want to prepare the budget.

3. Revenue Projection

Eliminate the complexity from your budgeting process by automating data extraction for sales forecast, selling price & production capacity from your ERP system and project future revenue.

4. Cost & Expense Projection

Get complete information on the cost of goods sold, production cost per unit, profit per unit, and inventory on hand and use this data to project expenses for the upcoming period.

5. Review & Approval

After your preliminary budget is ready, review it to ensure all the entries are included and get it approved from the top leadership.

Related: 5 Most Common Budgeting Methods

Operating Budget Example

The following operating budget example for a manufacturing company that makes industrial steam boilers will give you clarity on how the operating budget is prepared.

The company wants to estimate profit for the second quarter (Q2) of this year which is estimated based on Q1 sales of this year and Q2 sales of the previous year. The company sets the boiler price at Rs. 5 lakh per unit and plans to sell at least 200 units in Q2. Accordingly, the revenue for Q2 of this year is estimated to be Rs. 10 crore.

It then calculates the fixed costs which include rents, salaries etc. for Q2, totaling Rs. 1 crore. Similarly, the variable costs including raw material and labour charges based on the expected output of 200 units are estimated to be Rs. 3 crore. Non-cash expenses for equipment depreciation are assumed to be Rs. 5 lakh.

The company has decided to discontinue one old production line in Q2 as it gradually plans to shift to an innovative production system. So, non-operating expenses for closing the old production line are estimated to be Rs. 25 lakh.

Let’s look at all the estimated entries for Q2.

- Revenue Expected: Rs. 10 crore

- Fixed costs: Rs. 1 crore

- Variable costs: Rs. 3 crore

- Non-cash expenses: Rs. 5 lakh

- Non-operating expenses: Rs. 25 lakh

Therefore, Estimated Profit = 10 crore – (1 crore + 3 crore + 5 lakh + 25 lakh) = Rs. 5.70 crore

The company uses these calculations as a benchmark to ensure it is able to match its performance against the projected revenue and costs, and these are visible to all authorized managers via ERP software for manufacturing.

What is the Difference Operating Budget and Capital Budget?

| Operating Budget | Capital Budget | |

| Objective | Efficiently run routine operations | Support long-term growth of the organization |

| Expenses | Covers day-to-day expenses like salary and utility for running operations | Focuses on long-term investments in equipment, vehicle or infrastructure |

| Time Frame | Typically covers a short period, usually a fiscal year | Often spans multiple years, aligning with the life of the asset |

| Source of funds | Funded from sales revenue or short-term financing | Funded from long-term financing or reserved capital |

| Affect on Financial Statements | Affects the income statement through operational costs | Affects the balance sheet through asset purchase and depreciation over time |

| AFlexibility | More flexible and can be adjusted within the fiscal year as needed | Less flexible, as investments are typically planned and funded well in advance |

Sage X3: A Flexible Solution For Financial Planning and Analysis

Operating budgets are a roadmap to measure your financial performance against the projected revenue and expenses. Having a comprehensive view of your cash inflow and outflow no matter how many entries there are, helps maintain sound financial health.

Stay on top of your financial decisions with Sage X3 ERP, which turns budget-making into a strategic advantage, giving you full control over your budgets and enabling you to preview multiple financial scenarios, create budgets for every department, and analyze progress in detail.

FAQs

1. What Is The Main Purpose Of Operating Budget?

Operating budget ensures that your revenue and expenses are in line with the estimates and your financial goals are efficiently met. It serves as a reference document to compare your progress with your expectations and minimize financial uncertainties within the organization.

2. What Is The Duration Of Operating Budget?

As a common practice, operating budgets are usually made for one year. However, it can be made for one month, a quarter or half a year depending on the industry and specific business needs.

3. Who Creates an Operating Budget?

An operating budget is an essential document created through a collaborative process, involving departmental managers, the chief financial officer and the finance team.

4. How To Manage Operating Budget?

Managing an operating budget is a dynamic process that requires reviewing the budget, updating it with new developments and consistently tracking your progress.

5. How To Calculate Operating Budget?

Operating budget is calculated by estimating the yearly income, costs and expenses based on the company’s expectations, production and sales capabilities.

6. What is Operating Budget Called?

Operating budget is also called the annual operating budget or operational budget.