We often interchange the words invoice and a bill. They are closely related as they are synonymous with each other but sometimes they cannot be exchanged and only one term will fit in the context.

Let’s learn more about their difference in this blog —

Bills vs Invoice

A bill indicates the total amount owed by the customer to the vendor. Note that both invoice and the bill contain similar information regarding business transactions. A bill contains information such as items, pricing, and the applicable local, state or government taxes. Businesses can create bills if they have initiated any kind of transaction with the customer. They can create a bill for their record and the customer separately.

As soon as the business transaction is completed, a bill is generated. It serves as a form of communication (regarding business transactions) and is used for documentation.

Here is a list of some must-haves for bills :-

- Contact Information– This section applies to both the business and the customer. The details can be extensive or minimal based on the fit and requirements of both parties.

- Billing number – A number is allotted to each bill for future reference purposes.

- Date of service – The date is mandatory in the bill. A date should be mentioned and the separate date of the transaction should be added.

- Totals – The total amount of the goods or services that have been interchanged have to be mentioned in the bill.

An Invoice on the other hand outlines the details of a sale and mostly follows a particular template. It is an accounting document issued by the business to its customers. The content of the invoice contains sold items or services provided, the amount charged for it, the amount due and the due date. It also lists the previous payment which is done in recent times. And invoices must follow a specific template and it serves as a legal document for any accounting disputes.

Invoices can be printed on paper or can be in a digital format such as pdf. It also identifies remittance instructions which can be authenticated using a secure e-signatory system.

Here are some of the necessary components for an invoice —

- Identification details – The invoice should include information such as company details and client information. Information includes name and address, email and contact no. This applies to both parties.

- Amount – Items should be specified with their respective amount in a sequence. All these amounts are totalled to a singular end amount.

- Product or service descriptions – All goods or services rendered to the customer should be explained and elaborated in order to minimise liability.

Uses of Bills and Invoices

Uses of Bills and Invoices

1. Bill –

First, let’s learn about some significant uses of the bill.

- A bill is issued to the customers before the payment is made.

- It is a document for the customers for the goods and services that are purchased.

- It serves as a notice for payments that have to be made.

2. Invoice –

Now, let’s discuss the uses of an invoice.

- It’s a record of all the purchases between a business and a customer. It is a document which can be used for legal purposes.

- It specifies a deadline and the customer has to stick to the payment date.

- The company records the transaction to keep track of sales.

Invoice vs bill: what are the main differences?

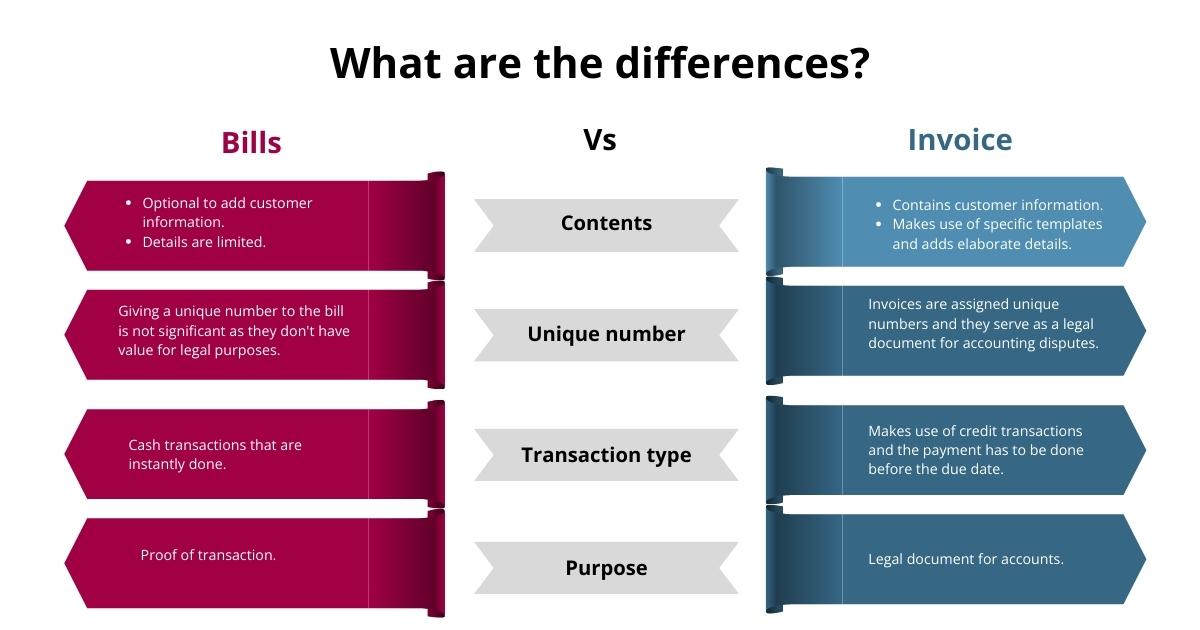

Invoice and bill are used most commonly in a synonymous manner as mentioned earlier. We learned that they are dissimilar. But they are different documents with dissimilar legal purposes and have varied types of transactions.

1. Similar document but has different terms

As repeated earlier, an invoice and bill can mean the same document. It depends on the business and the type of business transactions to differentiate it properly. An invoice consists of details regarding the amount a customer owes to the business. The customer receives this document and records this information as a bill.

Here is an example of how these documents are used in the business. Assume that a private school has provided an invoice to a student for purchasing a language course. The student here will receive this invoice in the form of a bill and pays the stated amount. Furthur the private school sends a receipt as proof of transaction declaring that they received the payment.

2. Different documents with distinct status

So far we have learned that a bill and an invoice are two different documents. Invoices are considered to be official business documents containing details such as unique invoice number, date of issue, due date, business contact information, customer contact details, description of goods or services provided and the total amount due. In addition, invoices add details of VAT or may be industry-specific deductions.

A bill when compared to an invoice, contains less information such as the pricing details and taxation.

For example, imagine a restaurant scenario, a bill is given to the customer. And an important point to note here is that a bill cannot be necessarily taken as a legal document. A bill here will have information regarding the table number, meals or beverages, VAT and the total amount.

3. Differences between an invoice and a bill in business

What is a bill? What is an invoice? We have learned about both concepts and now we need to understand the difference between an invoice and a bill in the business sector. The first question that needs to be addressed is why a bill is less formal as compared to an invoice. The answer to this is that it is issued to the customers for the business transactions completed in one go.

For example, the customer will receive a bill for a single purchase of goods or services.

A clearer example of this is, suppose you get a haircut, and a bill is given to you for the services received. Then you pay for it instantly. On the other hand, suppose you avail the services of a graphic designer to redesign your company’s logo, an invoice will be sent to you stating the transactions which have to be paid on a later date.

But it cannot be said that invoices cannot be used for instant transactions. Invoices are documented for a company’s accounting purposes. Invoices are commonly used for B2B sales, as it eases the complexities of accounting records.

For customer transactions, a bill will be enough to state the purpose of the transactions done in a restaurant. It indicates the payment that is due and which has to be paid immediately.

Automation is the key to using the right template and details accurately for recording and sending an invoice and bill.

Automation with Invoicing software

An Invoice management is a boon for generating accurate invoices for the goods or services rendered. Listed below are the ways software can help the invoicing and billing process.

- Generate professional and customized invoice and bill.

- It enables sending invoices from mobile devices.

- Eases with the payment terms and accepts the payment with credit cards.

- Automatically, payment reminders are notified to the customers.

- Its integration with accounting software will enhance its operations.

Conclusion

You might have understood the major difference between an invoice and a bill. It is synonymously used and causes confusion at times. But keep in mind that bills use limited details and invoices are more elaborate. The difference between a bill and an invoice has to be analysed and correctly used in the right place. But both serve as proof of transaction. Businesses can automate bills and invoices with ERP software which has a built-in invoice processing system. It helps this process to be done accurately and faster.