Invoice is a term which sounds so simpler, but businesses clearly know its huge significance. It’s a crucial financial document received by businesses and has to be dealt with sooner. Invoice management is a business function that eases the procurement software.

Enterprises keep on progressing in terms of function, and the requirement for more products and services for efficient operation will increase. Office supplies, stationery, housekeeping services, outsourced services etc. are some of the daily requirements for which an invoice is generated.

What is an Invoice Management system?

The invoice management system is a crucial internal business function facilitating the procurement process. It covers the entire function and management of invoicing from suppliers. It is also termed invoice processing.

Invoice management is the function where a business receives invoices from the supplier, determines its legitimacy, pays the vendor and documents it.

It is a known fact to all businesses that effective invoice management and vendor management will impact business revenue. Conventional manual invoice management was complex and confusing for the business.

Modern invoice management process is more advanced and automated and removes all bottlenecks. The major benefit is that it saves time and money as compared to manual invoicing. In addition, this automated invoice management software streamlines the purchase operation and gives visibility into the full invoicing process.

Automation of invoicing will help employees to focus on critical tasks that are more productive and enhances vendor relationships. Plus, assists in staying competitive and will impact the profit margin of the company.

Invoicing is a repetitive task which can be automated so that the employees can focus on more valuable tasks. And it will avoid any room for errors because of automation.

Importance of Invoice Management

A study says that about three million invoices get exchanged worldwide. The functions of invoice management are listed below.

- An invoice is received by the business from a supplier for the product or services offered.

- Determining the validity of the invoice.

- On time, processing the payments.

- Documenting the payment accurately in the company records.

- Invoicing is a part of the purchase-to-pay cycle, and it comes directly under the accounts payable category. Let’s discuss some of the importance of invoice management.

- The main motive of invoice management is to prevent any delays in paying for the product or services. And invoicing serves as a reminder to pay on time.

- Wastage and delays can be prevented with the help of invoice management.

- Inventory regulations can be sorted with invoice management.

- Invoicing data can be leveraged to plan for financials and the performance of the business.

- Invoice management simplifies all taxing activities such as tax documentation, audits, etc.

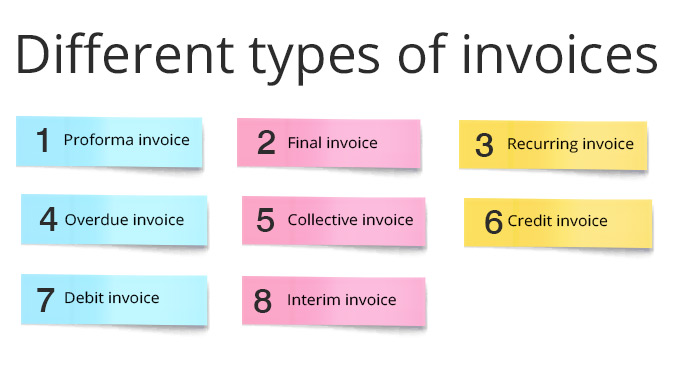

What are the different types of invoices?

Invoices differ based on the client industry, vendor industry and based on diverse industry policies. Let’s discuss some common invoices that businesses commonly receive.

→ Interim invoice

This invoice is sent to the business intermittently. The project begins and goes on for a longer period of time, so the vendor sends an invoice before it ends.

→ Proforma invoice

This invoice is sent to the business even before the service is offered. But it does not indicate that the payment has to be done instantly, its a notification to the business informing the due date and the timeline for the payment.

→ Final invoice

The final invoice will have the details of the services provided, goods purchased and the goods sent. In addition, it includes information on all the transactions and the final balance that the business has to pay vendors.

→ Recurring invoice

This invoice is sent to a business that is dealing with long-drawn projects. The invoice is sent at regular intervals.

→ Debit invoice

Suppose the vendor has underbilled you, these debit invoices serve as minor adjustments to the current bills. It will indicate the real balance due.

→ Credit Invoice

A credit invoice is sent after the vendor sends you an overbilled invoice. It includes the details regarding the amount that has to be refunded back to the business. This invoice is sent if you are mistakenly charged extra or unintentionally paid more which is duplicate payments.

→ Collective invoice

A collective invoice is sent to the business if the vendor is dealing with multiple orders or projects with you. It includes multiple invoices for specific services. It is the total sum of all small invoices.

→ Overdue invoice

If you default on your payment, the vendor will send this invoice. This will be sent to you only if you didn’t make the payment on the expected timeline.

Also Read : Accounts Payable Invoice & Payment Voucher

Problems of traditional Invoice management system

The invoicing is monitored and managed by the accounts payable department in almost all companies. This is the manual invoice management process where the invoice is received in the company from the vendor, check for its legitimacy, approve for payment, pay and then document for future reference.

In small companies, one to two employees from the accounts payable team manages the invoicing. Here are some of the tasks associated with the traditional invoice management system. Vendor registration, vendor data validation, vendor record updates, tax form collection, screening of transactions, backing various payment methods, currency conversion, tax reporting and payment reconciliation.

To complicate things more, there are also various types of invoicing such as invoicing in the narrow legal sense and invoicing in the broader legal sense.

In addition to the types, depending on the business type, invoicing documents include standard bills/invoices, credit notes, proforma invoices, interim notes, time sheets etc.

So each company has its kind of invoice management system depending on its functions. As the company expands, it becomes complex for the business to rely on manual invoice processing.

Let’s discuss some disadvantages of manual invoice management.

Expensive and delays

The costs involved in the manual invoicing are huge. The business has to spend money on paper, pen, postage, storage, printer toner and processing costs. Further intangible costs include error correction costs, employee costs and follow-up costs.

Lack of compliance and control

Monitoring and managing physical invoice papers are tough. These papers have to be kept for a certain duration and in the course of this time it is possible to get spoiled by termite attacks, moisture seepage, ink-fading and shredding. To track these invoices and to have internal control of this process is challenging.

Errors and inefficiencies

Every day large volumes of invoices have to be processed by businesses. A study says that manual invoice management caused about 30% of late payments. Manual invoice management causes errors and inefficiencies and this will impact the profit margin of the business.

Automating invoice management

Automation of invoice management is a boon to the company. The main benefit is that its saves time, money and eliminates errors. For automation, invoice management software is required.

Automating invoice management processing workflow will help the accounts payable functions to be paper free and error-free. Enumerated below are some functions that are automated for effective invoice management processes.

Receiving supplier orders and invoices

With automation, invoices are received by the business in various formats such as email attachments, form-filled ones, and paper copies. Here invoice management is the detection of electronically sent invoices in emails, forms etc is the first step of managing invoices. And automation can ease this task.

So if it’s a manual task, an employee has to scan it using OCR software.

Identifying and extracting relevant data from invoices and registering it in ERP

Invoices hold crucial data that are leveraged in decision-making and account resource planning. So the accuracy of the extracted data is vital. These extracted data are transferred to ERP system or analytics platforms for further processing.

Performing a three-way match between invoicing, PO and the receipt

Automation of invoice management enables three-way validation by collating and matching documents. It also helps in making vital decisions such as transactions, flagging errors or raising exceptions.

Making digital payments

Through automation, it is easy to choose the best payment policy and the exact time to pay the vendor. Plus, the entire payment process will be transparent which is a benefit for the business. Some vendors provide early payment discounts or provide adjustments in payment options, add late payment fees etc. Automation helps these functions to work efficiently and avoids jeopardizing vendor relationships.

Benefits of Automating Invoice Management

Automating invoice management has a lot of benefits to managing multiple invoices efficiently.

- Invoice automation will help in continuously processing invoices faster.

- Gives accurate invoice information and prevents data loss and errors.

- It provides efficient internal controls like securing payment information, sending payment reminders, easing the billing process, etc.

- Automation is eco-friendly and saves costs in paper, ink etc.

- Prevents bottlenecks in the supply chain system.

- Transparency in invoice management software enables visibility, control and adherence to regulations.

- Automation helps in preserving documents and managing them without any fear of termites and shredding of papers.

Invoice management software

Automation is the solution to efficiently manage invoice management systems. Invoice management software provides end-to-end visibility of the entire invoicing process. In addition, it eases the tedious process and helps in gaining internal control. Let’s discuss some common benefits of invoice management software.

- Easy integration with the vendor.

- Integrate with accounting system (ap automation).

- Directly send the amount to the vendor with various payment methods.

- Smart and interactive dashboard.

- Effective invoice approval features.

Conclusion

Automation of invoices has many benefits to offer a business. Implementing invoice management software will boost the process by consistently sending the invoice at the right time to businesses. It helps to manage invoices and store them for a longer duration. A manual invoice system is tedious and error prone. So it is best for businesses to switch to an automated system to yield better results.