General Ledger Integration with Tax Services

Sage 300cloud allows you to enter tax amounts in G/L Journal entries. This new feature is available in Product update 2 for Sage 300cloud 2020 wherein General Ledger is integrated with Tax Services which allows users to enter tax amounts in G/L.

To pass tax transaction in G/L

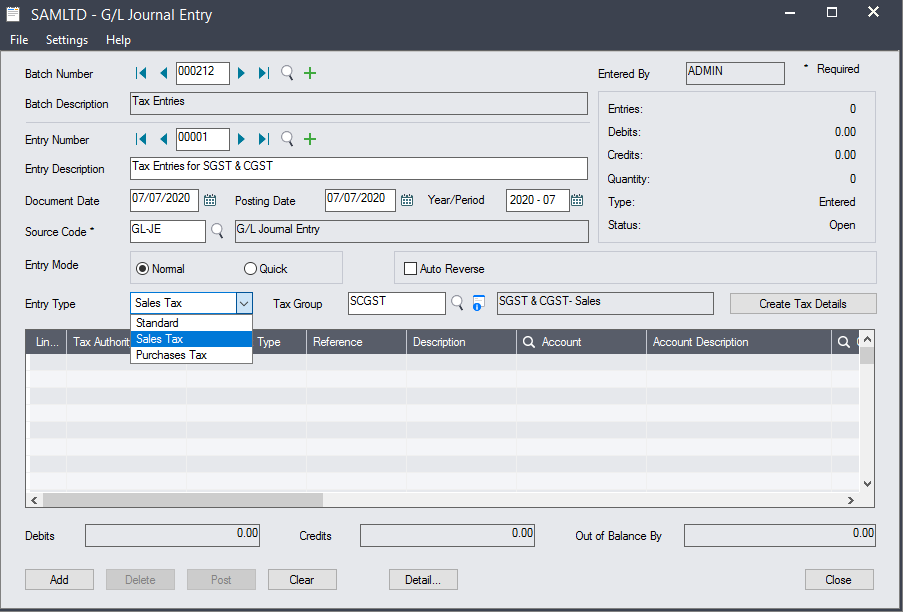

Navigate to General Ledger à G/L Transactions à Journal Entry

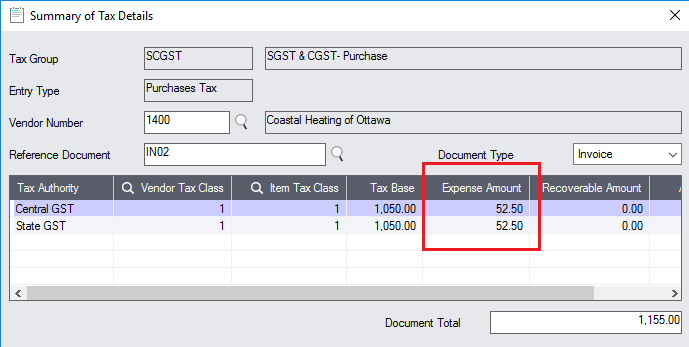

Under Entry Type, we have the option to select the tax amount for either Purchase or Sales. Once the type of tax transaction is selected, we select the Tax Group for doing the entry.

(Please note, only tax groups created in Tax service are available in the finder)

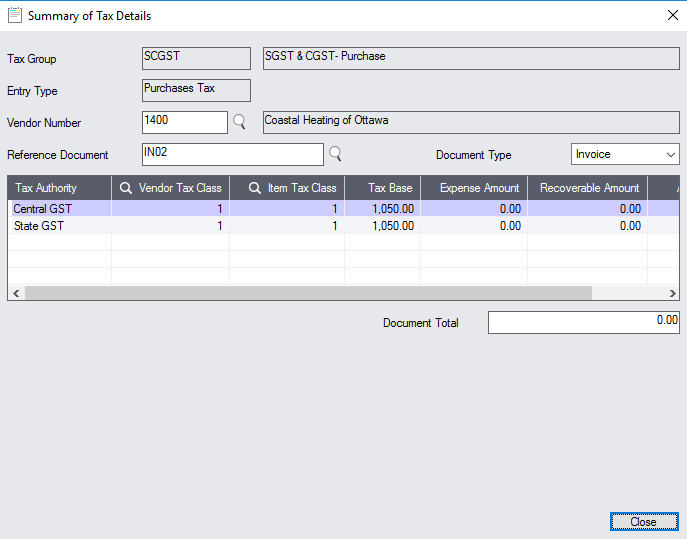

We also have an option to enter the details of the vendor number and reference Document Number for audit purposes. To enter the reference detail, click on (zoom) icon. We need to make sure all the details are manually entered as it is not integrated with any other sub-module.

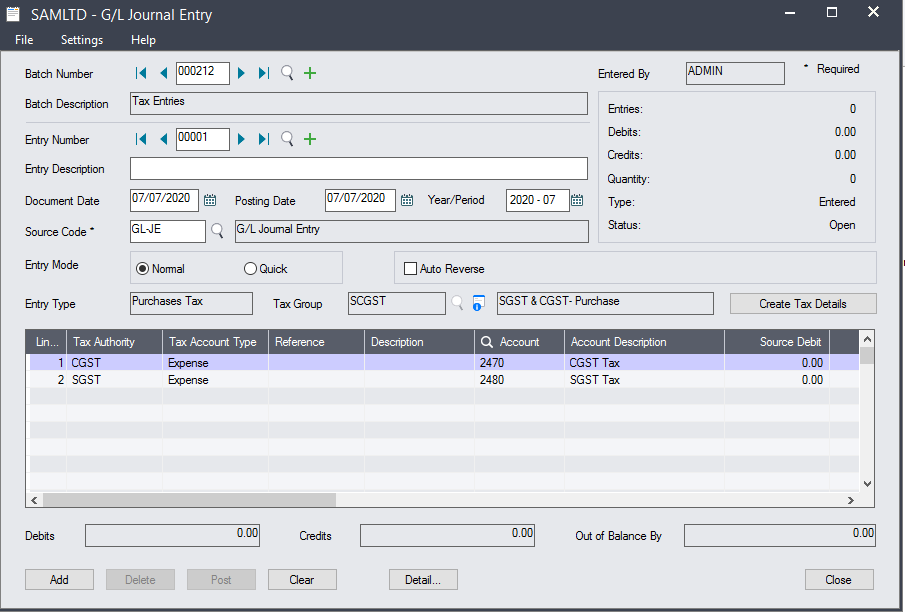

After selecting the Tax Group, click on ‘Create Tax Details’ so that system created the detail lines for the type of transaction i.e. Purchase tax or Sales tax, and each authority defined in the tax group.

For Purchase tax, we can select the Tax Account type from the below options available

- Expense

- Recoverable

- Allocated

whereas for Sale, the Tax Account type is by default ‘Liability’

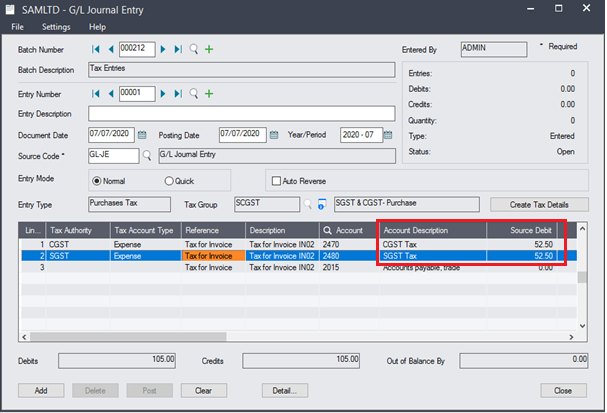

We enter the appropriate details line G/L Account for tax authority, tax amount and other details respectively. Amount entered in G/L Journal detail line against the tax authority will be displayed in the Tax Amount column.

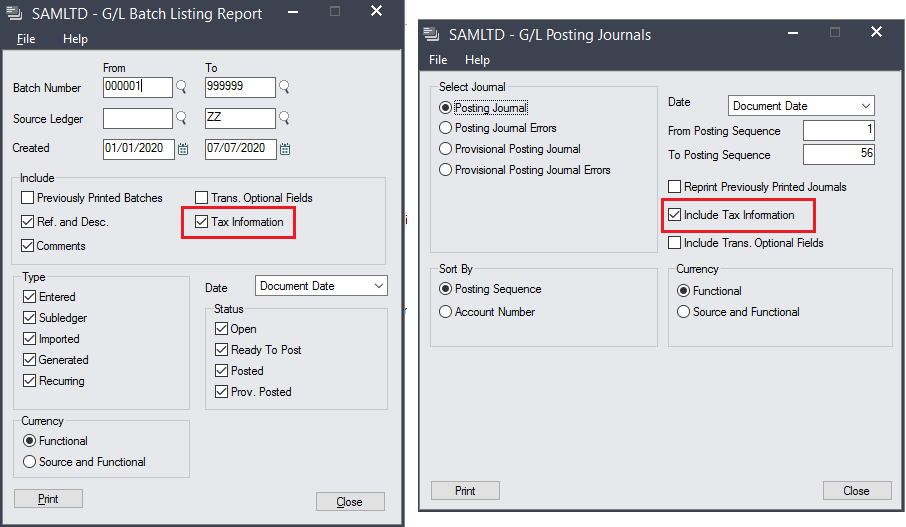

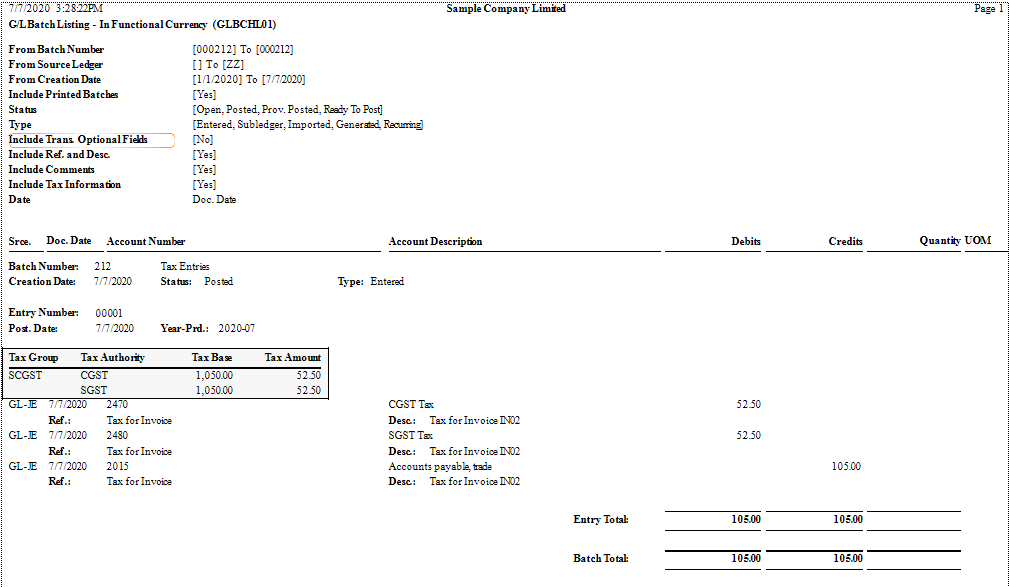

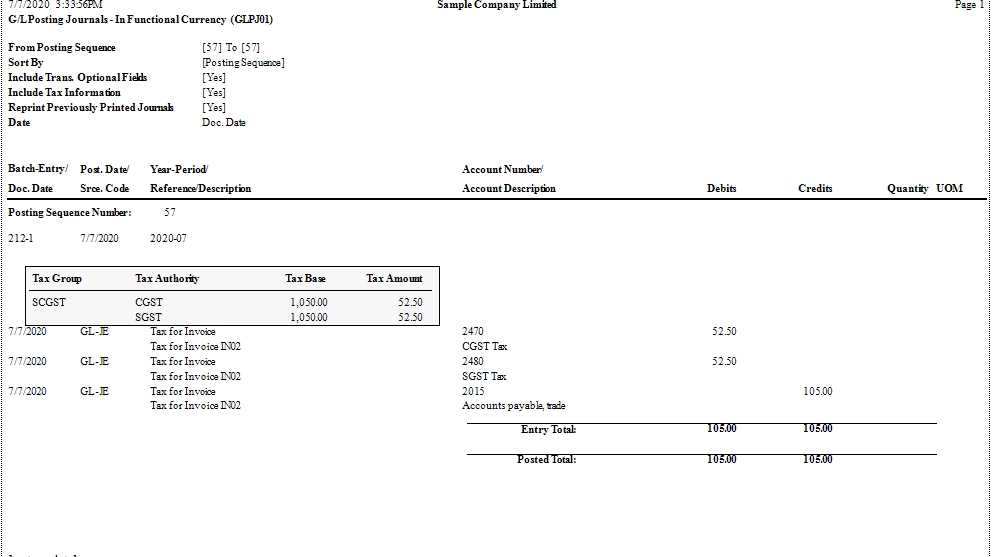

After the transaction is saved, verified and posted we include the tax details in below G/L report

- G/L Batch Listing Report

- G/L Posting Journals Report