Excise Stock Register

Trading Excise is an add-on from Sage Software Solutions Pvt Ltd which when seamlessly integrated with Sage 300cloud and provides the users with various reporting options for the required data related to Trading Excise in a single click. In our last post when we had discussed about defacing slip register, we came to know that this add-on is very useful for users to know the location wise details of the excisable goods. But what about the stocks that are placed in the location? One would need reports related to all excisable goods in all of their location also. For computing and generating the report easily, we have an add-on: Excise Stock Register.

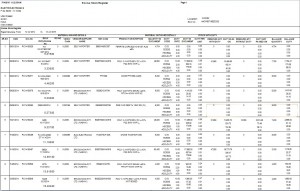

On a normal day, any dealer has to maintain a Stock Register recording on a daily receipt and issue the Excisable goods which comes in handy during the inspection by the officers of the excise department. Excise Stock Register which has reports capable of displaying the details of purchase receipts and sales of excisable goods for a specific period in an item wise report. It clearly comments on the duty (CENVAT) amount passed, duty amount not passed and the balance of duty including Cess amount available during a specified period.

Excise stock register provides the user with various calculated reports for material inward and material outward for quantity and its duty which help the user in tracking balance quantity, balance duty, removed quantity without duty and with duty pass on.

Stock with duty columns and its description:

- Remove quantity with duty: displays the quantity on which duty levied.

- Duty pass on: displays duty which is levied on removed quantity.

- Removed quantity without duty: quantity on which duty not levied.

- Duty not pass on:

- Balance duty: balance duty on balance quantity for that location for particular receipt.

- Balance quantity: balance quantity for that location for particular receipt.

Please refer the screen shot below of Excise Stock Register report which contains sales and Purchase details like, Item code, receipt no., Invoice no. invoice date, Vendor / supplier Name, Item code and description, Quantity in Document and also the ‘as per duty amount passed’, duty amount not passed, Remove quantity without duty, and the balance of duty including Cess amount available.

Go to statutory and Excise >>S/E Report>> Other Excise report

Excise Stock Register is location wise report that prints the data for particular location with the receipt date filter with the help of which, the user can easily get the stock related data with duties.

Sage 300cloud is capable of computing all Indian Taxes like Excise, Octroi, GST in India, easily. To know more about all the report calculation and generation regarding Trading Excise, You can also write to Sage Software Solutions Pvt Ltd at sales@sagesoftware.co.in